An exporter of record and an importer of record are two distinct roles that play a crucial part in international trade. An exporter of record is responsible for managing the export process, including obtaining necessary licenses and permits, and ensuring compliance with regulations.

Their role is vital in ensuring that exported goods meet the required standards and are delivered safely to the buyer. This includes handling customs clearance, documentation, and other logistical tasks.

In contrast, an importer of record is responsible for managing the import process, including obtaining necessary licenses and permits, and ensuring compliance with regulations. This includes handling customs clearance, documentation, and other logistical tasks.

An importer of record is also responsible for communicating with the buyer and the shipper to ensure that the goods are delivered on time and in good condition.

Check this out: Customs Clearance Turkey

What Is Exporter of Record vs Importer of Record?

The Exporter of Record (EOR) and Importer of Record (IOR) are two crucial roles in international trade. The EOR is responsible for shipping goods out of a country and ensuring compliance with export regulations.

The EOR bears the risk of export compliance and any related penalties, and assumes responsibility for managing export customs procedures. They handle export-related documentation and trade paperwork, and manage potential export tariffs, taxes, and compliance-related costs.

Here are the key differences between the EOR and IOR:

What Is Exporter of Record?

The Exporter of Record (EOR) plays a crucial role in ensuring strict adherence to all foreign export laws, regulations, and trade restrictions. This requires careful inspection to make sure that the products being exported comply with the export authorization guidelines and allowed trade restrictions.

The EOR is responsible for accurately filling out the necessary export documentation, and making sure that the information provided is correct and consistent with rules.

What Is Exporter of Record vs Importer of Record?

The exporter of record (EOR) and importer of record (IOR) are two crucial roles in international trade. The EOR ensures that exported goods are successfully moved from the source to the destination country.

The EOR is usually the owner of the exported goods, but a third party can assume this role if the owner can't provide all the necessary services. This third party must be licensed and knowledgeable in providing EOR services.

The EOR is responsible for handling all necessary documentation, paying duties and taxes, and maintaining records that may be required by customs. This is similar to the role of the IOR, which is responsible for ensuring that imported goods comply with the legal requirements of the destination country.

The IOR must navigate the complex web of importation regulations to determine the applicable taxes, duties, and tariffs and ensure their timely and accurate payment. This includes accurately and transparently declaring the nature, quantity, and value of the imported products.

The EOR and IOR play a vital role in preventing trade disruptions and ensuring legal compliance, crucial for smooth business operations. They help businesses avoid costly delays and fines by ensuring all necessary documentation and payments are in order.

In some cases, partnering with an EOR or IOR can be essential for businesses without a local entity in a particular country. This can make importing or exporting goods much easier and less complicated.

Broaden your view: Canadian Import Duties

Roles and Responsibilities

The roles and responsibilities of an Exporter of Record and an Importer of Record are crucial for smooth international trade. The Exporter of Record is responsible for ensuring exports follow home country and international laws.

An Exporter of Record must prepare and submit all necessary documentation to facilitate export compliance. This includes export paperwork, which can be a complex and time-consuming process. In fact, the Exporter of Record prepares and submits all documentation needed for exporting.

The Exporter of Record also secures the goods, complying with export control laws to prevent unauthorized exports. This is a critical responsibility, as non-compliance can result in serious consequences. In addition to documentation, the Exporter of Record takes on risks related to the export process, including potential fines and legal implications of non-compliance.

On the other hand, the Importer of Record is responsible for ensuring that imports comply with the destination country's legal requirements. This includes checking that imports meet all destination country regulations, including customs, safety, and duties. The Importer of Record manages necessary paperwork for customs clearance, like invoices and permits.

Here's a breakdown of the key responsibilities of the Exporter of Record and the Importer of Record:

- Exporter of Re

- Export Documentation and Licensing

- Record Maintenance

- Risk Management

Importer of Record:

- Local Law Compliance

- Documentation

- Duties and Taxes

Compliance and Obligations

As the party responsible for overseeing the exportation process, the EOR assumes legal accountability for the accuracy and compliance of the exported goods. Any export-related infractions, errors, or deviations from regulations could lead to legal repercussions.

The EOR must ensure that the products being exported comply with the export authorization guidelines and allowed trade restrictions. This requires careful inspection to make sure that the products meet the necessary requirements.

In the event of any failed delivery, the EOR must compensate the affected parties by paying the remunerations related to the incurred losses. This is a critical aspect of the EOR's role in ensuring smooth business operations.

The IOR assumes legal responsibility for the imported goods, which translates into accountability for any customs violations, discrepancies, or non-compliance issues that may arise during the import process.

Import Compliance

The IOR takes on the responsibility of ensuring strict adherence to all import-related laws, regulations, and requirements. This includes accurately declaring the nature, quantity, and value of the imported products.

The IOR must navigate the complex web of importation regulations to determine the applicable taxes, duties, and tariffs and ensure their timely and accurate payment. This can be a challenging task, especially for businesses outside the EU.

The IOR assumes legal responsibility for the imported goods, which translates into accountability for any customs violations, discrepancies, or non-compliance issues that may arise during the import process.

To mitigate these risks, the IOR must exercise due diligence in verifying the accuracy of information provided, including product classifications and valuation. This is crucial for smooth business operations.

Export Compliance

Export compliance is a top priority for any company involved in international trade. The exporter of record (EOR) plays a central role in ensuring strict adherence to all foreign export laws, regulations, and trade restrictions.

To guarantee compliance, the EOR must carefully inspect products to ensure they meet export authorization guidelines and allowed trade restrictions. This includes accurately filling out export documentation and verifying the information provided is correct and consistent with rules.

The EOR assumes legal accountability for the accuracy and compliance of the exported goods, making it imperative to exercise diligence and caution in overseeing the export process. Any export-related infractions, errors, or deviations from regulations could lead to legal repercussions.

To mitigate potential risks, the EOR must ensure goods being exported are properly classified, valued, and compliant with destination country regulations. This proactive approach helps minimize the chances of customs delays, fines, or shipment disruptions.

A third-party EOR must be licensed and knowledgeable in providing EOR services if the owner cannot offer all the services related to exporting the goods.

For your interest: Botswana Postal Services Workers' Union

Liability and Accountability

As the party responsible for overseeing the importation process, the Importer of Record (IOR) assumes legal responsibility for the imported goods. This translates into accountability for any customs violations, discrepancies, or non-compliance issues that may arise during the import process.

The IOR must exercise due diligence in verifying the accuracy of information provided, including product classifications and valuation. This is crucial to mitigate risks associated with customs delays, fines, or shipment disruptions.

In the event of any failed delivery, the EOR must compensate the affected parties by paying the remunerations related to the incurred losses (if any). This highlights the importance of EOR services in ensuring smooth business operations.

The EOR assumes legal accountability for the accuracy and compliance of the exported goods. Any export-related infractions, errors, or deviations from regulations could lead to legal repercussions.

The EOR is responsible for accurately filling out the necessary export documentation, and making sure that the information provided is correct and consistent with rules. This requires careful inspection to make sure that the products being exported comply with the export authorization guidelines and allowed trade restrictions.

The IOR assumes legal responsibility for the imported goods, which includes accountability for any customs violations, discrepancies, or non-compliance issues that may arise during the import process. This is a critical aspect of compliance and obligations in international trade.

Key Differences: IOR vs EOR

The main distinction between an Importer of Record (IOR) and Exporter of Record (EOR) lies in their focus areas. While the IOR ensures imports comply with destination laws, the EOR handles export regulations.

IORs are responsible for importing goods into a country and complying with customs regulations. They assume liability for customs duties and taxes, and accept the risk of customs compliance and associated penalties.

EORs, on the other hand, are responsible for shipping goods out of a country and ensuring compliance with export regulations. They bear the risk of export compliance and any related penalties.

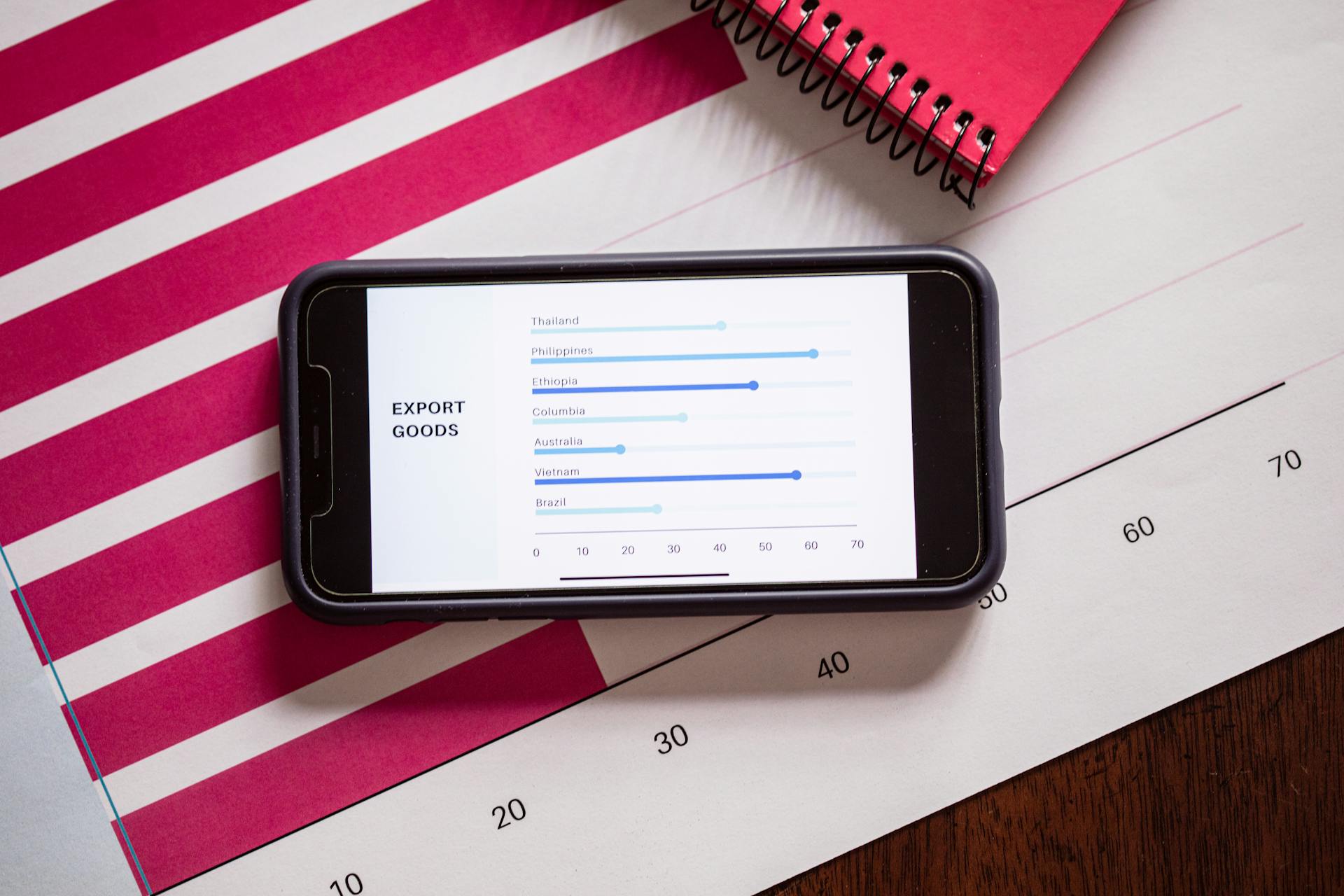

Here's a summary of the key differences between IORs and EORs:

In summary, while both IORs and EORs play crucial roles in international trade, their functions operate at opposite ends of the trade process, and their responsibilities and liabilities differ accordingly.

Services and Benefits

IOR and EOR services bring specialized knowledge of international trade regulations, ensuring that all legal requirements are met efficiently. This expertise helps businesses avoid costly mistakes and fines.

IOR and EOR services can save businesses significant costs by avoiding fines, penalties, and shipment delays. They often have established relationships with customs authorities, potentially reducing duty rates and expediting clearance processes.

By outsourcing import and export processes to IOR and EOR services, businesses can free up valuable time to focus on growth and other strategic initiatives. This time efficiency is crucial for companies looking to scale and expand into new markets.

Here's a comparison of the benefits of IOR and EOR services:

What Are Services?

When working with international trade, you'll often come across two critical roles: the Importer of Record (IOR) and the Exporter of Record (EOR). The IOR holds the legal obligation for the accuracy of import documentation, payment of duties and taxes, and adherence to customs procedures.

The IOR is essential to global trade because it ensures that all necessary import paperwork is accurately completed, expediting the import procedure. This is crucial for businesses that rely on timely imports to operate.

In contrast, the EOR plays a vital role in export facilitation, ensuring that all required export paperwork is accurately completed, which expedites the export procedure.

Here are the key benefits of having an EOR:

Benefits of IOR Services

IOR services can be a game-changer for businesses looking to simplify their international trade processes. By outsourcing these tasks, you can tap into the expertise and knowledge of IORs, ensuring that all legal requirements are met efficiently.

IORs have specialized knowledge of international trade regulations, which can be a major advantage for businesses. This expertise can help you avoid costly fines and penalties, not to mention the time and resources wasted on dealing with shipment delays.

Outsourcing import and export processes to IOR services can also save you a significant amount of time. By freeing up your team from these tasks, you can focus on growth and other strategic initiatives that drive your business forward.

IOR services can scale to meet your growing demands, providing flexible support without the need for extensive internal resources. This makes them an ideal solution for businesses looking to expand into new markets.

See what others are reading: Customs Inspection Processing Services

Here are some key benefits of IOR services:

- Expertise and Knowledge: IORs ensure that all legal requirements are met efficiently.

- Cost Savings: IOR services help avoid fines, penalties, and shipment delays.

- Time Efficiency: Outsourcing import and export processes saves you time to focus on growth.

- Scalability: IOR services can easily scale to meet increasing demands.

International Trade Roles

In international trade, several key roles come into play to ensure smooth transactions. A consignor is the person or company sending exported goods, while a consignee is the receiver (importer) of those goods.

The consignor remains the legal owner of the exported items until the consignee fully pays for them. This is a crucial distinction, as it affects the transfer of ownership and liability.

Customs brokers play a vital role in navigating the complexities of international trade. They are licensed by a country's customs authority to represent the importer during customs clearance, handling responsibilities such as signing documents, classifying goods, and calculating duties and fees.

Here's a summary of the key roles in international trade:

Licensed Customs Broker

A licensed customs broker is a crucial player in international trade. They're licensed by a country's customs authority to represent importers during customs clearance.

Their responsibilities are quite extensive, including signing and submitting documents, classifying goods, and calculating and paying duties and fees. They also handle import permits and prepare certificates.

Customs requirements can be complex and vary from country to country. To stay on top of these changes, businesses and governments employ customs brokers to keep them updated on paperwork requirements, tax rates, and import legislation.

Here are some key responsibilities of a licensed customs broker:

- Sign and submit documents

- Classify goods

- Calculate and pay duties and fees

- Import permits

- Prepare and issue certificates

Consignee

The consignee is the entity that receives the goods from the carrier or freight forwarder. They are usually the importer or buyer of the goods.

A consignee is often responsible for clearing customs and paying duties on the imported goods. This can be a complex process, involving a lot of paperwork and regulations.

The consignee's role is crucial in international trade, as they ensure that the goods are delivered to the right person and that all necessary documentation is completed.

A fresh viewpoint: Consignor Consignee

Trade Roles: Shipper, Consignor

International trade involves a lot of moving parts, and understanding the different roles can be confusing. Let's break down the key roles of shipper and consignor.

A shipper is responsible for getting the goods to the destination, but their role ends there. The exporter, not the shipper, assumes compliance risks and is responsible for ensuring the goods meet all legal requirements.

The consignor, on the other hand, is the person or company sending exported goods in a consignment. They remain the legal owner of the exported items until the consignee fully pays for them.

Here's a key difference between the two roles:

By understanding these roles, you can avoid costly mistakes and ensure a smooth international trade process.

Definitions and Terminology

Exporter of record (EOR) and importer of record (IOR) are terms that are often used interchangeably, but they have distinct meanings.

An EOR is the party responsible for managing the export compliance of a shipment, which includes obtaining the necessary licenses and permits.

IORs, on the other hand, are responsible for managing the import compliance of a shipment, including obtaining the necessary licenses and permits.

In some cases, a single entity may act as both EOR and IOR, but this is not always the case.

Exporters often rely on third-party logistics providers (3PLs) to act as their EOR, as they have the necessary expertise and resources to manage export compliance.

IORs, however, are typically appointed by importers to manage import compliance on their behalf.

The EOR is responsible for ensuring that the shipment complies with all relevant export regulations, including those related to customs, taxes, and security.

Sources

- https://blackthorneit.com/blog/exporter-of-record-eor-vs-importer-of-record-ior-understanding-the-differences/

- https://siam-shipping.com/shipping-tips/importer-of-record-exporter-of-record/

- https://www.uproottechnologies.com/blog/importer-of-record-ior-vs-exporter-of-record-eor

- https://www.linkedin.com/pulse/importer-record-ior-exporter-eor-essential-guides-global-ashraf-1tuue

- https://blog.trademining.com/key-roles-of-import-of-record-ior-and-exporter-of-record-eor/

Featured Images: pexels.com