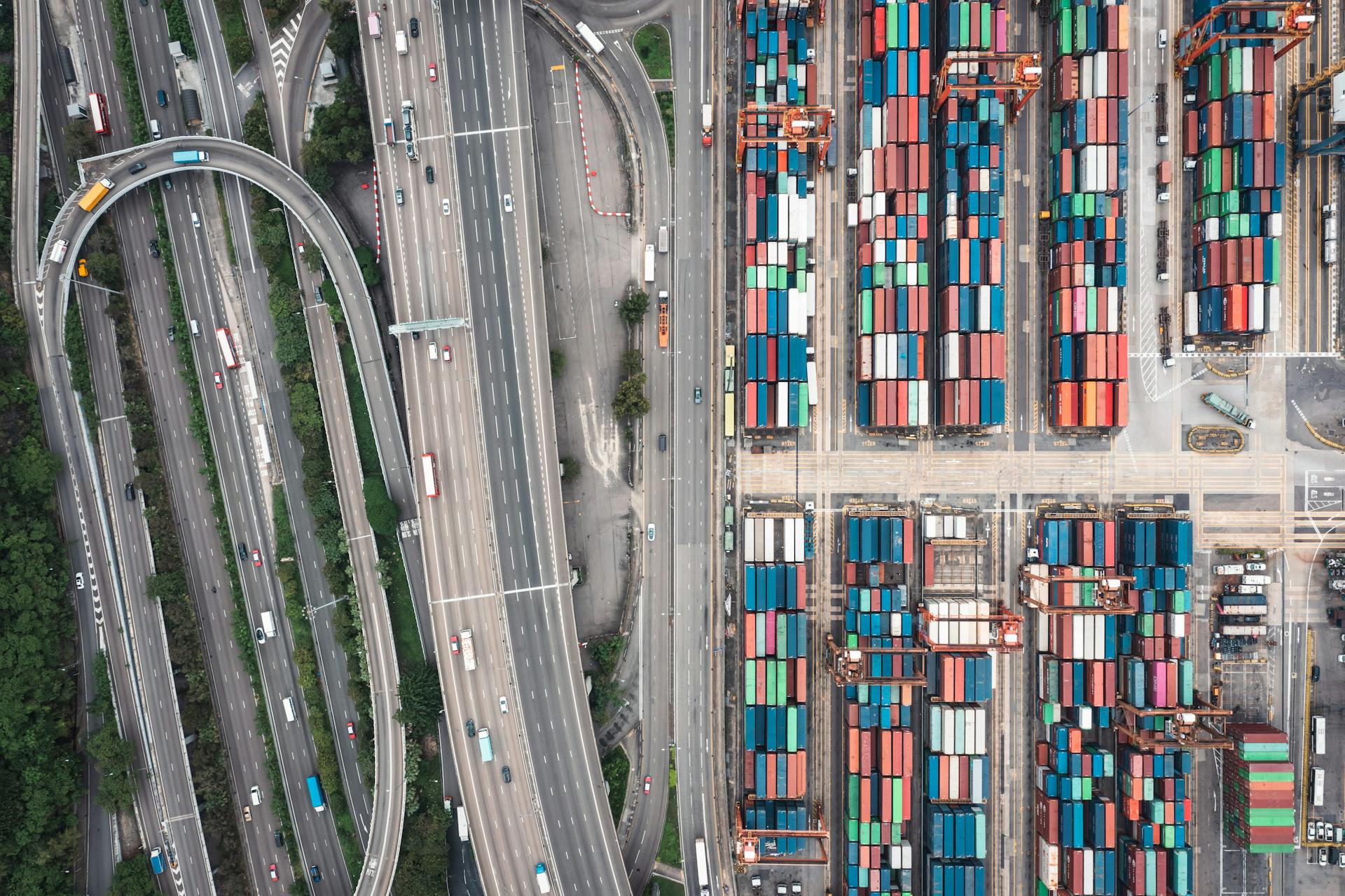

Navigating customs clearance in Turkey can be a daunting task, but understanding the basics can make a huge difference. The Turkish customs authority, TÜIK, is responsible for ensuring that all imports and exports comply with regulations.

Turkey has a complex system of customs clearance, with multiple agencies involved. The Turkish government has implemented a risk management system to identify high-risk shipments and expedite clearance for low-risk ones.

To clear customs in Turkey, you'll need to provide detailed documentation, including the commercial invoice, bill of lading, and certificate of origin. This paperwork must be accurate and complete to avoid delays or penalties.

Customs clearance is a crucial step in international trade, and it's not unique to Turkey. Other countries have similar regulations and procedures in place to ensure compliance and revenue collection.

Understanding Customs Clearance in Turkey

Customs clearance in Turkey is a critical process that allows goods to move in and out of the country legally and efficiently.

The Turkish Customs Code (No: 4458) contains 8 main regimes and their related regulations, including Release for free circulation, Transit, Customs warehousing, and more.

To navigate customs clearance properly, it's essential to comply with various customs regulations, document shipments accurately, and pay the necessary duties and taxes.

KANATER Group, a prominent name in the logistics and import-export industry, offers comprehensive customs clearance and transfer services in Turkey, encompassing solutions tailored to meet the unique needs of each client.

Proper documentation is the cornerstone of successful customs clearance, and KANATER Group meticulously prepares all required paperwork, including bills of lading, certificates of origin, and commercial invoices.

Correctly classifying goods under the appropriate tariff codes is essential to determine the applicable duties and taxes, and KANATER Group's experts are well-versed in the Turkish Customs Tariff Schedule.

Here are the 8 main regimes in the Turkish Customs Code:

- Release for free circulation

- Transit

- Customs warehousing

- Inward processing

- Processing under customs control

- Temporary admission

- Outward processing

Efficiency is at the core of KANATER Group's customs clearance and transfer services, with streamlined processes that reduce transit times and ensure your goods reach their destination promptly.

Clearance Procedures

In Turkey, customs clearance involves understanding the main customs procedures outlined in the Turkish Customs Code (No: 4458). There are 8 main regimes and their related regulations to be aware of.

Release for free circulation is one of the main customs procedures in Turkey, allowing goods to enter the country without restriction. Transit is another, which enables goods to pass through Turkey without being processed or stored.

Customs warehousing is a regime that allows goods to be stored in a customs-controlled area for a specific period, while inward processing involves processing goods before they are released into free circulation. Processing under customs control and temporary admission are also important procedures to consider.

Here are the 8 main customs procedures in Turkey:

- Release for free circulation,

- Transit,

- Customs warehousing,

- Inward processing,

- Processing under customs control,

- Temporary admission,

- Outward processing,

The full text of the Turkish Customs Code No: 4458 is available online for further reference.

Main Procedures in Turkey

In Turkey, there are several main customs procedures that you should be aware of. The Turkish Customs Code (No: 4458) outlines 8 main regimes and their related regulations.

The first regime is release for free circulation, which allows imported goods to be released into the market without any restrictions. This is a straightforward process that's often used for goods that meet all the necessary requirements.

You'll also encounter transit, which involves moving goods through Turkey without any changes being made to them. This is a common procedure for goods that are being transported from one country to another.

Customs warehousing is another important regime, which allows businesses to store goods in a customs-controlled warehouse while they're being processed or re-exported. This can be a convenient option for companies that need to store goods temporarily.

Inward processing is a regime that allows businesses to import goods for processing or repair, and then re-export them without paying customs duties. This can be a cost-effective option for companies that need to repair or process goods.

Processing under customs control is a regime that involves processing goods within Turkey, while they're still under customs control. This can be a useful option for businesses that need to make changes to their goods.

Temporary admission is a regime that allows businesses to import goods temporarily into Turkey, without paying customs duties. This can be a good option for companies that need to use goods for a short period of time.

Outward processing is a regime that involves processing goods in Turkey, and then re-exporting them to another country. This can be a useful option for businesses that need to process goods for export.

Here's a summary of the main customs procedures in Turkey:

Clearance and Transfer Services

In Turkey, customs clearance is a significant element of trade, and it's essential to understand the process to avoid delays and fines.

The Turkish customs authority has strict regulations based on the European Union's customs code, which business buyers must pay close attention to.

All goods entering or leaving the country must undergo customs clearance, which involves submitting required documentation, paying duties and taxes, and ensuring compliance with import/export restrictions.

Importers must provide relevant certificates, such as documents of origin, commercial invoices, packing lists, and bills of lading.

KANATER Group, a prominent name in the logistics and import-export industry, offers efficient customs clearance and transfer services in Turkey.

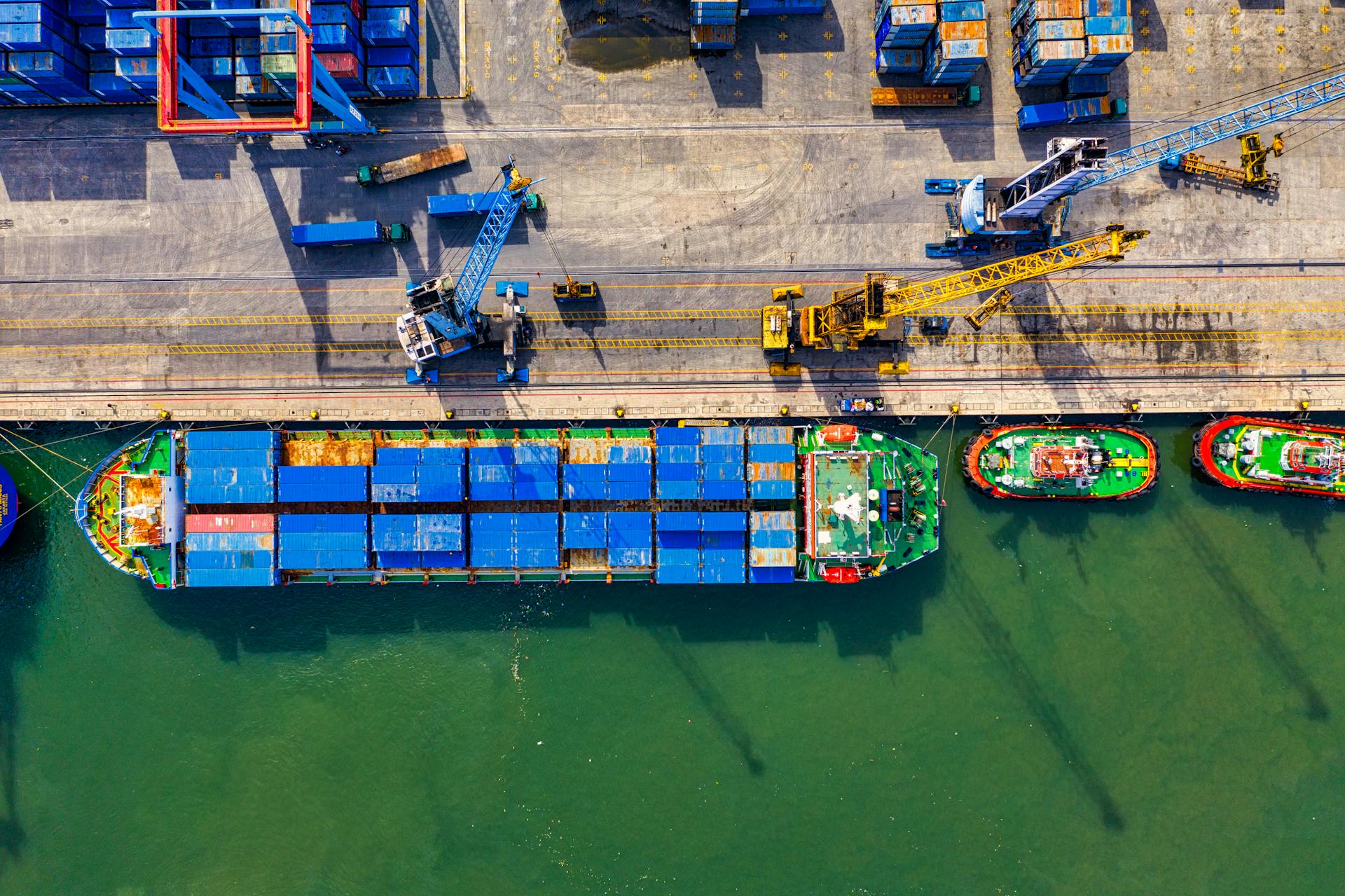

Their transfer services within Turkey are reliable and cost-effective, whether it's moving goods from port to warehouse or from one city to another.

In fact, their transportation solutions can help companies avoid costly delays and ensure smooth operations in the globalized business landscape.

Transit Regime

The Transit Regime is one of the main customs procedures in Turkey, as stated in the Turkish Customs Code (No: 4458). It involves the movement of goods through Turkey without undergoing customs clearance or payment of duties and taxes.

If you're planning to transport goods through Turkey, you'll need to understand the Transit Regime. This regime is governed by the Turkish Customs Code (No: 4458) and allows for the temporary passage of goods through the country.

Here are the key aspects of the Transit Regime:

- Goods must be in free circulation in the country of origin or be accompanied by a commercial invoice and other required documents.

- The goods must be transported through Turkey to another country within a specified time frame.

- No duties or taxes are payable on the goods during transit.

As mentioned in the Turkish Customs Code (No: 4458), the Transit Regime is one of the 8 main regimes governing customs procedures in Turkey.

Import and Export Regulations

Import and export regulations in Turkey are based on the European Union's customs code, which is the fundamental framework for customs operations within the EU member states.

All goods entering or leaving the country must undergo customs clearance, which involves submitting the required documentation, paying the applicable duties and taxes, and ensuring compliance with import/export restrictions.

The Turkish customs authority has several import regulations that all business buyers must pay close attention to, including regulations based on product safety, quality standards, and environmental protection and health.

These regulations are mainly to protect consumers and ensure that imported goods meet specific requirements, such as having a clear understanding of the regulations to avoid any delays, fines, or confiscation of goods.

Here are the 8 main regimes and their related regulations as per the Turkish Customs Code (No: 4458):

- Release for free circulation,

- Transit,

- Customs warehousing,

- Inward processing,

- Processing under customs control,

- Temporary admission,

- Outward processing,

Regulations and Compliance in Turkey

Turkey's customs regulations are based on the European Union's customs code, which is the fundamental framework for customs operations within the EU member states.

Compliance with customs regulations is non-negotiable in Turkey, and all goods entering or leaving the country must undergo customs clearance.

Business buyers must pay close attention to the Turkish customs authority's import regulations, which are strict and aimed at ensuring compliance with international trade laws.

These regulations are mainly to protect consumers and ensure that imported goods meet specific requirements, such as product safety, quality standards, and environmental protection and health.

Importers are required to provide relevant certificates, such as documents of origin, commercial invoices, packing lists, and bills of lading.

The Turkish Customs Code (No: 4458) contains 8 main regimes and their related regulations, which are:

- Release for free circulation,

- Transit,

- Customs warehousing,

- Inward processing,

- Processing under customs control,

- Temporary admission,

- Outward processing,

Understanding these regulations is crucial to avoid any delays, fines, or confiscation of goods.

Exemption Regular Regime

If you're importing goods into Turkey, you might be eligible for a temporary import option that exempts you from customs duties and VAT for a specified period. This option is available to business buyers who meet specific conditions.

To take advantage of this option, you'll need to understand the customs regulations in Turkey, which are based on the European Union's customs code. This means that all goods entering or leaving the country must undergo customs clearance, which involves submitting required documentation and paying applicable duties and taxes.

Business buyers must pay close attention to the Turkish customs authority's import regulations, which are strict and aim to ensure compliance with international trade laws. These regulations are in place to protect consumers and ensure that imported goods meet specific requirements.

In order to comply with these regulations, importers must provide relevant certificates, such as documents of origin, commercial invoices, packing lists, and bills of lading. This is crucial to avoid any delays, fines, or confiscation of goods.

To obtain an exemption certificate, you'll need to follow a specific procedure. Here's a step-by-step guide:

The Turkish MOFA address and contacts are: Dr. Sadık Ahmet Cad. No:8 Balgat / ANKARA - Türkiye 06100 Phone: +90 (312) 292 10 00. AFAD address and contacts are: Üniversiteler Mah. Dumlupınar Bulvarı No: 159 ( Eskişehir Yolu 9. Km ) Çankaya/ Ankara Mail: [email protected] Pbx: 0 (312) 258 23 23 Fax: 0 (312) 258 2082.

Calculating Duties and Options

Calculating duties in Turkey is a straightforward process, based on the customs value of the imported goods, which includes the cost of the goods, insurance, and freight.

To determine the customs value, you'll need to consider the cost of the goods, which is the price you paid for them, plus any additional charges such as insurance and freight.

Business buyers in Turkey have a temporary import option that can save them money on customs duties and VAT. This option is available if the imported goods meet specific conditions.

To qualify for temporary import, you'll need to meet the requirements set by the Turkish customs authorities.

A fresh viewpoint: Custom Clearance and Freight Forwarding Course

Benefits and Timeframe

Clearing customs in Turkey can take a few days or a week on average, so be sure to plan ahead of time and expect potential delays.

Business buyers in Turkey have a temporary import option that can be a game-changer for their operations. This option exempts imported goods from customs duties and VAT for a specified period if they meet specific conditions.

If you're planning to import goods into Turkey, it's essential to know that basic customs clearance may take a few days or a week on average.

Shipping Arrangements

Shipping Arrangements can be a bit tricky, but don't worry, I've got the basics covered.

To ensure the safe delivery of your goods to Turkey, you can choose from air freight, sea freight, or land transport - the right method depends on the size, weight, and urgency of the goods.

Seaports like Istanbul Port, Izmir, and Mersin, and airports like Atatürk and Sabiha Gökçen are the main shipping transit points in Turkey.

Selecting the right shipping method helps manage customs clearance time more efficiently.

Business buyers can take advantage of special arrangements, such as exemptions from import duties and value-added tax, for goods imported temporarily for processing or manufacturing purposes.

This arrangement is ideal for business buyers who want to import raw materials or machinery for use in manufacturing in Turkey.

Companies operating in Export Processing Zones (EPZ) can import goods and materials without paying customs duties under the EPZ program.

Disputes and Compliance

Turkey's customs regulations are quite strict and aim to ensure compliance with international trade laws. They are based on the EU's customs code, which is the fundamental framework for customs operations within the EU member states.

Consider reading: Import Duty from Eu to Uk

Importers must provide relevant certificates, such as documents of origin, commercial invoices, packing lists, and bills of lading, to avoid any delays or fines. Business buyers need to have a clear understanding of these regulations to ensure smooth customs clearance.

Failure to comply with customs regulations can result in delays, fines, or confiscation of goods.

Benefits of Compliance

Compliance is key to avoiding unnecessary delays and fines. By adhering to customs regulations, businesses can experience faster clearance times, resulting in timely delivery to customers and better inventory management.

Adhering to customs regulations can also help reduce import/export costs. This is achieved by applying for exemptions or reductions and avoiding fines and penalties.

Businesses that comply with customs regulations can gain wider market opportunities. Turkey has several surveillance and inspection fees on goods to meet quality standards, which can be avoided by businesses that comply with regulations.

Compliance helps businesses build a good reputation with customers, suppliers, and partners. It creates trust and reliability in the business, making it easier to operate smoothly.

Compliance can also protect businesses from legal actions and disputes. By ensuring that imported goods comply with customs regulations, businesses can avoid restrictions on dealing with those goods.

Here are the benefits of compliance in a nutshell:

- Avoid Delays and Fines

- Lower Costs

- Market Access

- Improved Business Reputation

- Legal Protection

Types of Legal Disputes

Jurisdiction is a major concern for every single customs dispute, as it can be complicated to determine which court has the authority to handle a case.

Customs administration has the capacity to take official acts with legal effects on persons, which can lead to disputes.

The nature of customs acts is key in determining which court has jurisdiction over a case.

If the complained decision is related to the payment of import or export duties, tax courts are authorized to handle the dispute.

Frequently Asked Questions

What is not allowed to bring into Turkey?

Prohibited items to bring into Turkey include antiques, radioactive and psychotropic substances, meat, dairy products, and certain electronic devices like drones and quadcopters. Check with Turkish customs for a comprehensive list of restricted and prohibited items

Do I have to pay customs from Turkey to USA?

Yes, you will need to pay customs and value-added tax when importing products from Turkey to the USA. Learn more about the customs process and tax requirements to ensure a smooth import experience.

Sources

- https://www.pilc.law/customs-clearances-in-turkey/

- https://www.kanatergroup.com/customs-clearance-and-transfer-services-in-turkey-by-kanater-group.html

- https://www.alibaba.com/showroom/turkey-customs-clearance.html

- https://lca.logcluster.org/turkiye-13-custom-information

- https://olimpialogistics.com.tr/en/transportation/general-turkish-customs-regulations-2/

Featured Images: pexels.com