The vacuum packaging market is expected to reach a significant size, driven by the increasing demand for packaged food products. This market is expected to grow at a CAGR of 5.5% from 2023 to 2030.

The growth of the vacuum packaging market is attributed to the rising popularity of packaged food products, particularly in the retail sector. The market is also driven by the increasing demand for convenience food products.

The demand for vacuum packaging is expected to be high in the food and beverages industry, particularly in the meat, poultry, and seafood segments. The market is also expected to grow in the pharmaceutical and medical devices sectors.

The key players in the vacuum packaging market are focusing on innovation and product development to meet the growing demand for packaged products.

Industry Analysis

The vacuum packaging market is a rapidly growing industry, driven by increasing demand for sustainable and convenient packaging solutions.

Consumer demand for sustainability is driving the use of eco-friendly and recyclable packaging materials. This trend is particularly evident in the meat and cheese vacuum packaging industry, where companies are adopting eco-friendly packaging materials to meet consumer expectations.

Expand your knowledge: Foam Packaging Materials

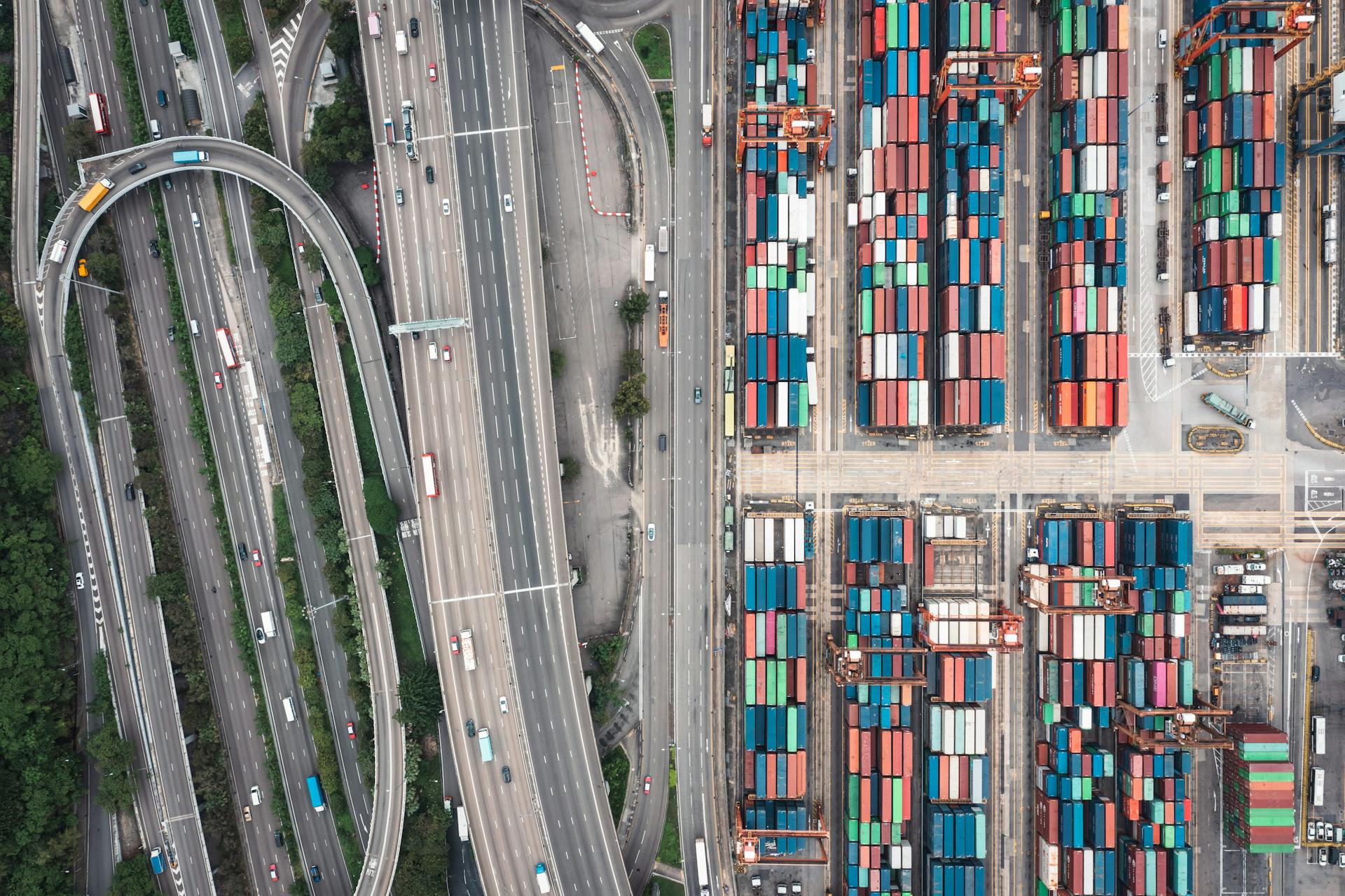

The rise of e-commerce and direct-to-consumer models has also influenced packaging requirements, with vacuum packaging helping to protect products during transportation and ensuring they reach consumers in optimal condition. This is crucial for the e-commerce sector, where timely delivery and product quality are paramount.

Advancements in packaging technology, including vacuum packaging machinery, are helping to improve the efficiency and effectiveness of the packaging process. Automation, intelligent packaging solutions, and innovations in materials are contributing to this trend.

The global vacuum packaging market was valued at USD 29.2 Billion in 2024, and is expected to exhibit a CAGR of 3.43% during 2025-2033. The market can be segmented into various categories, including skin vacuum packaging, shrink vacuum packaging, and others.

Here's a breakdown of the global vacuum packaging market by category:

The demand for extended shelf life is also driving the vacuum packaging market, with consumers and manufacturers alike focused on reducing food waste. Vacuum packaging helps preserve the freshness of food for a longer duration, making it an attractive solution for convenience foods and ready-to-eat meals.

The major players in the global vacuum packaging market include Amcor plc, Coveris Holdings S.A., Dow Inc., Kite Packaging Ltd, and others. These companies are investing heavily in research and development to stay ahead in the market and meet the evolving needs of consumers.

Market Trends

The vacuum packaging market is seeing a significant shift towards eco-friendly solutions, with consumers and companies prioritizing sustainable and recyclable materials. This trend is driven by the growing awareness of environmental impact and the need for biodegradable packaging.

Advancements in packaging technology, including automation and intelligent packaging solutions, are also contributing to the growth of the market. These innovations are improving the efficiency and effectiveness of the packaging process.

The demand for extended shelf life is another key trend in the vacuum packaging market. Consumers and manufacturers are focusing on reducing food waste, and vacuum packaging helps preserve the freshness of food for a longer duration. This is particularly important for the e-commerce sector, where products need to be protected during transportation.

Here are some of the key trends shaping the vacuum packaging market:

Size and Growth Trends

The vacuum packaging market is set to experience significant growth over the next decade. The market size is forecast to grow from USD 33.25 billion in 2025 to USD 52.93 billion by 2034.

This growth is driven by a compound annual growth rate (CAGR) of 5.3% from 2025 to 2034, which is a notable increase in the market's value.

Trends Shaping the Market

The vacuum packaging market is experiencing a surge in demand for eco-friendly solutions, with consumers and companies shifting their focus towards sustainable and recyclable materials. This trend is particularly evident in the food and consumer goods sectors, where producers are developing biodegradable and environmentally friendly packaging.

Advancements in multi-layered and high-barrier packaging films are also driving the market forward. These films enhance the preservation of actual goods for longer periods and are favored in the food and pharmaceutical industries for their superior moisture and oxygen resistance.

The rise of e-commerce and direct-to-consumer models has influenced packaging requirements, with vacuum packaging helping to protect products during transportation and ensure they reach consumers in optimal condition.

One of the primary trends for vacuum packaging is the desire to extend the shelf life of products. Consumers and manufacturers alike are increasingly focused on reducing food waste, and vacuum packaging helps preserve the freshness of food for a longer duration.

Here are some key trends shaping the vacuum packaging market:

The market is also driven by the growing demand for convenience foods, including ready-to-eat meals and snacks, which requires packaging solutions that maintain the quality and flavor of these products.

Segments and Products

Vacuum packaging is a versatile technology used in various industries. It's especially crucial for food products that are prone to spoilage, like meat and seafood, which are often vacuum-packed to preserve freshness.

The top three products where vacuum packaging is extensively used are meat and seafood, dairy products, and fresh produce. These products are frequently vacuum-packed to prevent spoilage and extend shelf life.

Meat and seafood are commonly vacuum-packed to prevent the growth of spoilage bacteria and oxidation, which can lead to discoloration. Dairy products, on the other hand, are vacuum-packed to protect them from mold and spoilage, while fresh produce is vacuum-packed to slow down the ripening and decay process.

You might enjoy: How to Vacuum Pack Meat

Some examples of products that are vacuum-packed include fresh cuts of meat, poultry, fish, shellfish, and processed meats like sausages, as well as cheese blocks, grated cheese, butter, yogurt, and cream. Fresh produce, pre-cut fruits and vegetables, frozen vegetables, and salad mixes are also frequently vacuum-packed.

Here are some examples of industries that use vacuum packaging:

- Food Packaging: Meat and seafood, dairy products, and fresh produce.

- Medical Packaging: Not mentioned in the article section, but implied as part of the overall market.

- Consumer Products Packaging: Not mentioned in the article section.

- Electronics Packaging: Not mentioned in the article section.

Segments

Segments play a crucial role in the vacuum packaging market, and understanding them is key to navigating its various aspects.

The market is segmented by Application, which includes Food Packaging, Medical Packaging, Consumer Products Packaging, and Electronics Packaging. These segments cater to specific industries and products.

Food Packaging is a significant segment, accounting for a substantial portion of the market. It encompasses a wide range of products, from perishable goods to non-perishable items.

The market is also segmented by Type, including Flexible Packaging, Rigid Packaging, Pouches, and Vacuum Bags. Flexible Packaging is a popular choice for many products due to its convenience and cost-effectiveness.

If this caught your attention, see: Flexible Plastic Packaging Market

In terms of Material, the market is segmented into Plastic, Paper, Metal, and Glass. Plastic is the most widely used material in vacuum packaging due to its durability and versatility.

End Use is another critical segment, which includes Food and Beverage, Healthcare, Electronics, and Industrial. Food and Beverage is the largest end-use segment, accounting for a significant share of the market.

The market is also segmented by region, including North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Each region has its unique characteristics and market dynamics.

Check this out: Packaging Corporation of America

Products Driving Demand

Meat and seafood are among the top products driving demand for vacuum packaging. This is because vacuum packaging helps preserve freshness by removing oxygen, which prevents spoilage bacteria and oxidation.

Fresh cuts of meat, poultry, fish, shellfish, and processed meats like sausages are commonly vacuum-packed. Dairy products, such as cheese blocks and grated cheese, are also frequently packaged using this method.

Vacuum packaging is particularly beneficial for frozen items, as it prevents freezer burn and retains moisture content and texture. In fact, supermarkets often sell vacuum-packed steaks and fish fillets, while restaurants use vacuum-sealed portions for sous vide cooking.

Some examples of companies using vacuum packaging include Amul in India, which uses it to ensure their dairy products remain fresh until consumption. Retailers like Walmart and Tesco also sell vacuum-packed salad mixes and frozen vegetables to meet consumer demand for convenience and freshness.

Here are some examples of products where vacuum packaging is extensively used:

Regional Insights

The Asia Pacific region dominates the global vacuum packaging market, driven by a growing population, urbanization, and rising disposable incomes. This has led to a strengthening demand for packaged and processed foods, which has boosted acceptance of vacuum packaging.

China and India are key players in this region, with a relatively greater presence of key players and proper manufacturing costs. As a result, the Asia Pacific region has developed strong regional production capabilities.

The region's market predominance is also due to the rapid industrialization and advancement of packaging technologies. This has enabled shelf-life extension and waste reduction, which are strong regional drivers aligned with vacuum packaging benefits.

See what others are reading: Asia Pacific Sustainable Packaging Market

North America's Leadership Role

The vacuum packaging market in North America is expected to grow at a CAGR of 5.5% during the forecast period (2025-2032).

The region's food and beverage industry is a major driver of this growth, with consumers increasingly seeking longer shelf lives for their food products. The increasing demand for longer food product shelf lives is one of the main factors propelling the vacuum packaging industry.

The use of vacuum packaging in the pharmaceutical industry is also on the rise, as it helps to preserve the integrity and quality of products. Various advantages are essential for preserving the integrity and quality of goods in various sectors.

The global vacuum packaging market has grown as a result of technological developments in packaging materials, making it easier to store and transport packaged goods.

Europe and North America Opportunity

The vacuum packaging market in Europe and North America is expected to grow significantly, driven by increasing demand for sustainable and high-quality food packaging solutions.

North America is the fastest-growing region in the global vacuum packaging market due to its booming food industry and increasing preference for ready-to-eat meals and frozen foods.

In Europe, the focus on food safety and hygiene has led to a growing demand for vacuum-packaged products, which helps to reduce the risk of foodborne diseases.

The Asia Pacific region dominates the global vacuum packaging market, but Europe and North America are expected to be close behind in terms of growth.

The vacuum packaging market size is forecast to grow from USD 33.25 billion in 2025 to USD 52.93 billion by 2034, driven by a CAGR of 5.3% from 2025 to 2034, which will have a significant impact on the market in Europe and North America.

A major factor driving the growth of the vacuum packaging market in Europe and North America is the increasing demand for longer food product shelf lives, which can be achieved through vacuum packaging's ability to eliminate oxygen from the container.

As people become more concerned about food safety and hygiene, they are increasingly choosing vacuum-packaged products, which has led to a significant increase in demand for vacuum packaging in these regions.

Recommended read: Holland America Packages

Industry Research

The vacuum packaging market is a growing industry with a projected CAGR of 3.43% during 2025-2033. This growth is driven by the increasing demand for Ready-to-Eat (RTE) food products and the need for efficient delivery of items.

The global vacuum packaging market was valued at USD 29.2 Billion in 2024, with Asia-Pacific dominating the market share. The market is segmented into various categories, including skin vacuum packaging, shrink vacuum packaging, and others.

Currently, skin vacuum packaging holds the majority of the total market share, followed by shrink vacuum packaging. The market is also divided into polyethylene, polyamide, ethylene vinyl alcohol, and others, with polyethylene exhibiting a clear dominance.

Thermoformers account for the majority of the global market share in terms of machinery, followed by external vacuum sealers and tray-sealing machines. Flexible packaging currently holds the largest market share in terms of pack type, followed by semi-rigid packaging and rigid packaging.

A unique perspective: Shrink Film Packaging Machine

The food industry is the largest application segment of the vacuum packaging market, accounting for a clear majority of the market share. The market is also growing in the pharmaceuticals, industrial goods, and other industries.

Here's a snapshot of the major players in the global vacuum packaging market:

- Amcor plc

- Coveris Holdings S.A.

- Dow Inc.

- Kite Packaging Ltd

- Klöckner Pentaplast

- Nemco Machinery A/S

- Plastopil Hazorea Company Ltd.

- Sealed Air Corporation

- Sealer Sales Inc.

- U.S. Packaging & Wrapping LLC

- ULMA Packaging

- Wells Can Company Ltd

- Winpak Ltd

Market Players

The vacuum packaging market is home to a diverse range of companies, each with their own unique strengths and offerings. Some of the top players in the market include Amcor plc, Berry Global Group, and Sealed Air Corporation.

These companies are not only market leaders, but they are also actively involved in shaping the future of the industry through innovative products and services. For instance, Amcor plc is focusing on sustainable solutions for vacuum packaging, aiming to make all its packaging recyclable or reusable by 2025.

Berry Global is innovating in vacuum packaging with high-barrier films to improve food preservation while reducing material use. This is just one example of how companies in the market are pushing the boundaries of what is possible with vacuum packaging.

Sealed Air, on the other hand, is integrating automation technologies in its vacuum packaging systems to address labor shortages and increase efficiency in production lines. This is a great example of how companies are adapting to changing market conditions and customer needs.

Here are some of the key players in the vacuum packaging market:

- Amcor plc

- Berry Global Group

- Sealed Air Corporation

- Coveris Holdings S.A.

- Winpak Ltd.

- Mondi Group

- DS Smith plc

- Flair Flexible Packaging Corporation

- ULMA Packaging

- Multivac

- Toyo Seikan Group Holdings, Ltd.

- Orved S.p.A.

- Koch Equipment LLC

- Ishida Co., Ltd.

- Leybold GmbH

- GEA Group AG

- Weber Maschinenbau GmbH

- Henkel AG & Co. KGaA

- Plastipak Holdings, Inc.

Market Dynamics

The vacuum packaging market is expected to grow significantly, with a forecasted CAGR of 5.3% from 2025 to 2034, reaching a size of USD 52.93 billion by 2034.

This growth is driven by increasing consumer demand for extended shelf life in perishable goods, which makes vacuum packaging indispensable in food industries.

The trend is also influenced by the rapidly expanding frozen food and convenience food segments worldwide.

One of the key drivers of the global vacuum packaging market is the growing demand for extended shelf life. The use of vacuum packaging helps to maintain quality, minimize wastage, and extend shelf life in perishable goods.

Here are some of the key drivers of the vacuum packaging market:

- Increasing consumer demand for extended shelf life in perishable goods

- Sustainability initiatives driving the adoption of eco-friendly packaging solutions

Sustainability initiatives are also playing a significant role in driving the adoption of vacuum packaging. The lightweight use of vacuum packaging minimizes material use and waste, making it an attractive option for industries seeking eco-friendly packaging solutions.

Dynamics

The vacuum packaging market is growing rapidly, with a forecasted CAGR of 5.3% from 2025 to 2034. This growth is driven by increasing consumer demand for extended shelf life in perishable goods.

Consumer behavior is a major factor in this trend. People are seeking convenience and freshness, which is why retailers like Walmart and Tesco sell vacuum-packed salad mixes and frozen vegetables. This demand is driving the adoption of vacuum packaging in various industries.

The trend of sustainability is also playing a significant role in the growth of the vacuum packaging market. Industries are seeking eco-friendly packaging solutions, and vacuum packaging is a key player in this area. By minimizing material use and waste, vacuum packaging is becoming a preferred choice for companies looking to reduce their environmental footprint.

Here are some key statistics on the vacuum packaging market:

The vacuum packaging market is driven by the increasing demand for extended shelf life in perishable goods, such as meat and seafood, dairy products, and fresh produce.

Restraints

The vacuum packaging market faces some significant restraints that might hinder its growth. One major challenge is the developing environmental awareness about plastic waste, which is putting pressure on manufacturers to find sustainable alternatives.

Growing government regulations and market requirements from consumers are adding to the challenge, pushing manufacturers to invest in research and development of eco-friendly packaging solutions.

The limitations of vacuum packaging itself are also a restraint. For instance, it's not suitable for highly porous or soft-textured products, which can lose their structural integrity or appearance when vacuum sealed.

This limitation restricts the application scope of vacuum packaging and reduces its attractiveness in niche markets with specific packaging requirements.

Report Information

The global vacuum packaging market was valued at USD 29.2 Billion in 2024. This gives us a clear idea of the market's size and scope.

The market is expected to exhibit a CAGR of 3.43% during 2025-2033, indicating a steady growth rate.

The market can be segmented into skin vacuum packaging, shrink vacuum packaging, and others, with skin vacuum packaging holding the majority of the total market share.

The most dominant material in the market is polyethylene, followed by polyamide, ethylene vinyl alcohol, and others.

Here's a breakdown of the market by machinery: thermoformers account for the majority of the global market share, followed by external vacuum sealers, tray-sealing machines, and others.

The market can also be categorized by pack type, with flexible packaging holding the largest market share, followed by semi-rigid packaging and rigid packaging.

Food is the dominant application in the market, followed by pharmaceuticals, industrial goods, and others.

On a regional level, the market is dominated by Asia-Pacific, followed by North America, Europe, Latin America, and the Middle East and Africa.

Recent Developments

In April 2023, U.L.M.A. packaging participated in global trade seafood 2023, highlighting its extensive range of packaging solutions that enabled it to distinguish itself as one of the world's top suppliers.

U.L.M.A. had a significant presence in the market compared to the previous year, showcasing its commitment to the industry.

Stora Enso's novel board material, Trayforma BarrPeel, made packing fresh food on recyclable paperboard trays possible in April 2023. This innovative material helped brand owners achieve their environmental goals by using less than 10% plastic on the tray.

Sealed Air Corporation redefined its business further in June 2023 by formally changing its corporate brand to SEE.

In August 2022, Amcor plc increased its European footprint by purchasing a state-of-the-art flexible packaging facility in the Czech Republic.

The vacuum packaging market is a global industry, with major regions including North America, Asia Pacific, Europe, and LAMEA.

Here are some key developments in the vacuum packaging market:

Sources

- https://www.towardspackaging.com/insights/vacuum-packaging-market-size

- https://www.imarcgroup.com/vacuum-packaging-market

- https://www.linkedin.com/pulse/vacuum-packaging-market-set-thrive-sustainability-convenience-maya-agqhf

- https://www.skyquestt.com/report/vacuum-packaging-market

- https://www.pristinemarketinsights.com/meat-and-cheese-vacuum-packaging-market-report

Featured Images: pexels.com