The shipbroking market is expected to grow significantly over the next few years, driven by increasing demand for shipping services and a growing need for efficient and cost-effective broking services. This growth is expected to be driven by the increasing demand for shipping services, particularly in the container and bulk cargo segments.

According to market research, the global shipbroking market size is projected to reach $2.3 billion by 2025, up from $1.8 billion in 2020. This represents a compound annual growth rate (CAGR) of 4.5%.

The growth of the shipbroking market is also being driven by the increasing complexity of global trade, which is creating a need for more sophisticated and specialized broking services. This includes the use of digital technologies, such as blockchain and artificial intelligence, to improve the efficiency and accuracy of broking services.

Discover more: Drayage Services Market

Introduction

The shipbroking market is a rapidly growing industry, driven by the increasing demand for cargo logistics. This demand is fueled by the manufacturing sector, which is a significant contributor to the market's growth.

A key factor boosting the market is the partnerships between manufacturers and third-party providers to strengthen the supply chain. These partnerships are expected to fuel the revenue growth of the global Shipbroking Market in the upcoming years.

The market's growth is also influenced by government imports and exports, which create a high demand for logistics services. The increasing number of logistics companies is another factor contributing to the market's expansion.

However, the market faces a challenge in the form of a lack of trained professionals, which might hamper the overall growth of the market.

For another approach, see: Logistics Automation Market

Market Analysis

The shipbroking market is a complex industry with various segments and drivers. The global market is segmented into type, end-use, and geography, with the chartering segment holding a large market share in 2023.

One of the key factors driving the chartering segment is the high costs associated with vessel ownership, including maintenance, crewing, and insurance. Chartering allows companies to avoid these costs and provides them with the flexibility to adapt to changing market conditions.

The sales & purchase segment is expected to grow at a substantial CAGR during the forecast period, driven by the increasing number of transactions in the secondary market for ships. This trend is expected to continue as shipping companies adapt to fluctuating market conditions and regulatory changes.

The shipbroking market is expected to grow due to the demand for key value addition in the shipping process. This includes the development of fuel-efficient and environmentally friendly vessels, which are likely to propel the sales & purchase segment.

Here are some key statistics about the shipbroking market:

The market report includes an assessment of the market trends, segments, and regional markets. The report covers the global shipbroking market, including the Asia Pacific, North America, Latin America, Europe, and Middle East & Africa regions.

Market Segments

The shipbroking market is segmented in various ways to cater to different needs and industries. The market is divided into dry cargos, tankers, container vessels, futures, and others.

The dry cargos segment held a major share of the market in 2023 due to the extensive use of dry cargo vessels for transporting bulk commodities. These commodities form the backbone of global trade, and their transportation necessitates the use of dry cargo vessels.

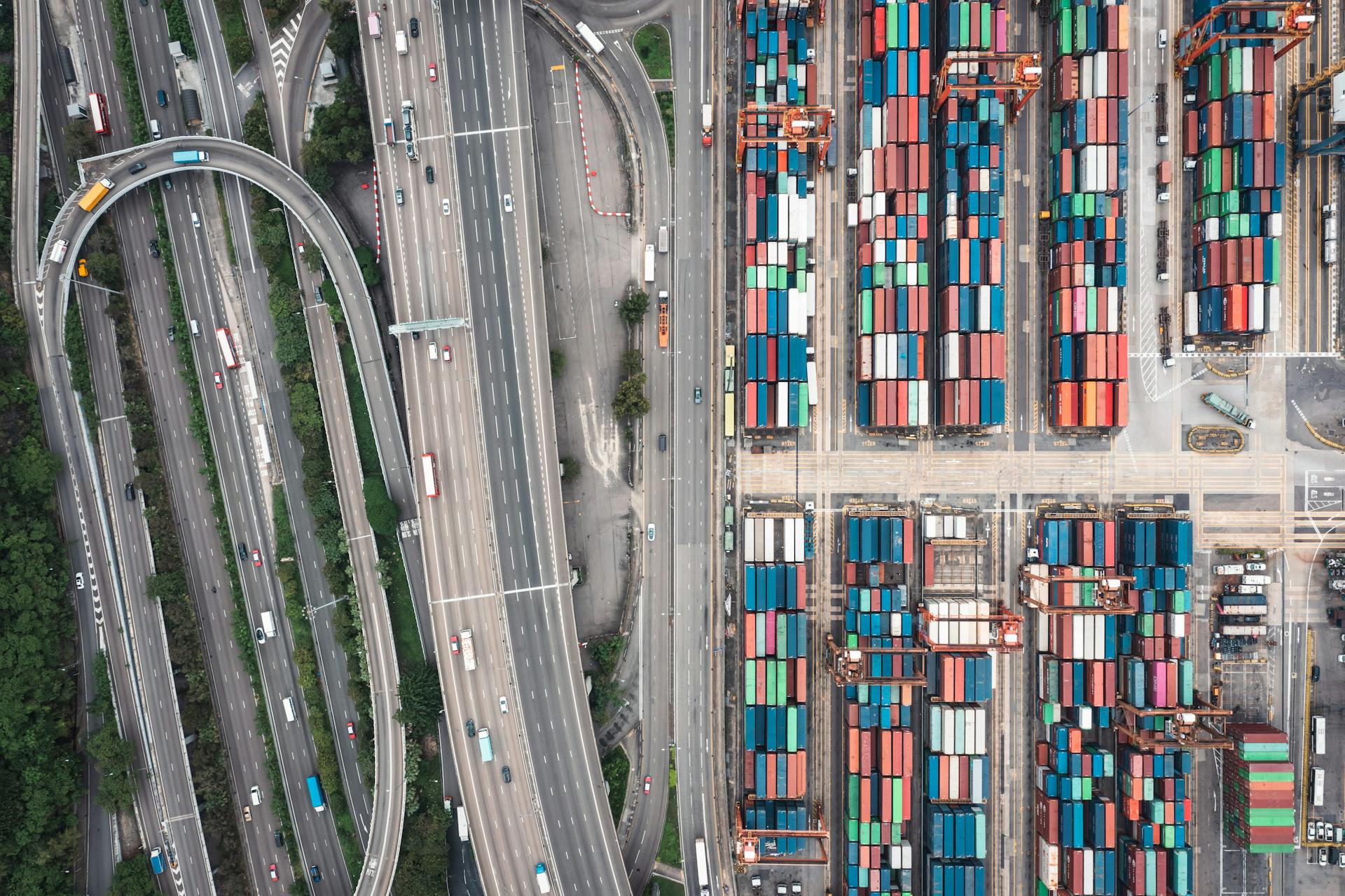

Container vessels are expected to expand at a significant growth rate in the coming years due to the increasing demand for containerized cargo shipping. This versatility, coupled with the growing trend of containerization in global trade, is expected to fuel the segment in the market.

The shipbroking market is also segmented by service, including chartering, sales & purchase, newbuilding, and demolition. The chartering segment held a large market share in 2023 due to the growing preference of shipping companies to charter vessels rather than owning them.

The shipbroking market is further segmented by size, including small, medium, and large vessels. The large segment led the market in terms of revenue in 2023 due to the high demand for large vessels in the shipping industry.

The market is also segmented by geography, including North America, Europe, Asia Pacific, and the Rest of the world. The shipbroking market can be segmented into several categories, primarily based on application, end-user, and geography.

Here are the main segments of the shipbroking market:

- Dry cargos

- Tankers

- Container vessels

- Futures

- Others

Additionally, the market is segmented by service:

- Chartering

- Sales & purchase

- Newbuilding

- Demolition

The shipbroking market is also segmented by size:

- Small vessels

- Medium vessels

- Large vessels

The market is segmented by geography:

- North America

- Europe

- Asia Pacific

- Rest of the world

Regional Outlook

The global shipbroking market is dominated by the Asia Pacific region, which held a major market share in 2023 due to China's robust growth in international trade. China's reliance on shipping for the transportation of goods drove the market, and the presence of numerous shipbuilding yards and shipping companies in the country further contributed to its dominance.

The market in Asia Pacific is projected to grow at a significant pace in the coming years, thanks to the rapid economic development and expansion of its manufacturing and retail sectors. These sectors rely heavily on shipping for the transportation of goods, which is expected to drive the market in India.

India's government initiatives to boost the country's maritime infrastructure and increase its trade volume are expected to fuel the market, and the ongoing liberalization of the Indian shipping industry is attracting foreign investment and fostering competition. This will likely further boost the market in the region.

The global shipbroking market is also driven by factors such as rising demand for cargo logistics, increasing demand from the manufacturing sector, government imports and exports, and a growing number of logistics companies.

Related reading: China International Marine Containers

Competitive Landscape

The competitive landscape of the shipbroking market is dominated by several key players.

Bolloré Logistics, Braemar, Bright Cook & Co, and BRS Shipbrokers are just a few of the many companies competing in this space.

These companies employ various development strategies to expand their global reach.

Mergers, acquisitions, partnerships, collaboration, and product launches are some of the tactics they use to increase their consumer base worldwide.

Top shipbroking market companies include Maersk, Braemar Shipping Services, Clarksons Shipping, Howe Robinson Partners, and Simpson Spence Young.

These major players have a significant market share and are known for their financial stability, product offerings, and market ranking.

The competitive landscape section of the Global Shipbroking Market report provides valuable insights into the market share and ranking of these top players.

You might enjoy: Great Eastern Shipping Company Share Price

Market Trends and Challenges

The shipbroking market is facing significant challenges, with freight rates being a major concern. Volatility in freight rates can be caused by geopolitical tensions, changes in supply chain dynamics, and fluctuating fuel prices.

Global macroeconomic fluctuations can also impact shipping dynamics, introducing risk factors that affect profitability and trade flows. This is evident in the economic downturn during the mortgage crisis and the subsequent collapse of major shipping lines.

The shipbroking market is expected to grow, with a compound annual growth rate (CAGR) of 4.5% from 2026 to 2033, reaching a revenue of USD 8.2 Billion by 2033. This growth is largely attributed to the rising demand for shipping services, especially in emerging markets where trade is expanding rapidly.

The logistics sector is a critical component of the shipbroking market, involving the management of the flow of goods from origin to destination. As logistics processes become more sophisticated, the demand for shipbroking services is expected to rise.

Technological Advancements

The shipbroking market is undergoing significant technological advancements, revolutionizing the way shipbrokers operate and interact with clients.

Artificial intelligence (AI) is being increasingly used to analyze vast amounts of data, such as market trends, vessel availability, and freight rates, in real-time. This capability allows shipbrokers to make informed decisions, negotiate better deals, and provide superior service to their clients.

Predictive analytics, a branch of AI, forecasts market trends and demand patterns, helping shipbrokers anticipate changes and stay ahead of the competition.

The maritime sector has also adopted various technological innovations, including machine learning and blockchain, which are transforming traditional operations. These advancements are not only improving logistics but are also optimizing processes related to shipping and vessel management.

The Automated Identification System (AIS) uses satellites to track vessels, enhancing safety and operational efficiency in real-time.

Dynamics

The shipbroking market is a vital part of the global shipping industry, acting as an intermediary between shipowners and charterers.

In 2022, the global shipbroking market was valued at approximately $4.8 billion, a significant figure that highlights its importance in sustaining global trade.

The demand for efficient shipping solutions continues to rise, with the shipbroking market expected to reach around $6.2 billion by 2028, reflecting a compound annual growth rate (CAGR) of about 4.7%.

This growth is a testament to the sector's ability to adapt to changing market conditions and meet the needs of its clients.

The shipbroking market's expected growth will have a positive impact on the global economy, particularly in the shipping industry.

Major Drivers

The shipbroking market is driven by several key factors, and understanding these drivers can help you navigate the industry with confidence.

Growing demand for commodities, particularly from emerging economies, is fueling the market. These economies continue to industrialize, and their need for raw materials and energy sources increases, necessitating maritime transport.

The rise of cleaner energy sources is also boosting the market, as the transportation of liquefied natural gas (LNG) becomes more prevalent.

Rising digitalization is projected to propel the market in the coming years. Digital platforms and tools are transforming the way shipbrokers operate, enabling them to streamline their processes and improve their decision-making.

The increasing globalization of trade has heightened the demand for shipping services, with global merchandise trade volume increasing by 8% in 2021, according to the World Trade Organization (WTO).

Here are some key statistics that illustrate the growth of the shipbroking market:

- Global merchandise trade volume increased by 8% in 2021.

- The rise in oil and gas exploration activities has propelled demand for shipbroking services.

- The growing adoption of digital technologies in the maritime industry enhances operational efficiency and reduces transaction times.

Challenges Ahead

The shipbroking market is facing significant challenges that can impact its growth and profitability. One major challenge is the volatility of freight rates, which can fluctuate due to geopolitical tensions, changes in supply chain dynamics, and fluctuating fuel prices.

Global macroeconomic fluctuations can significantly affect shipping dynamics, introducing risk factors that impact profitability and trade flows. This is evident in the economic downturn during the mortgage crisis and the subsequent collapse of major shipping lines.

Economic downturns can significantly affect shipping demand, leading to a reduction in charter rates and brokerage fees. The COVID-19 pandemic exemplified this, as global shipping experienced disruptions, resulting in a decline in shipbroking activities.

Regulatory challenges, such as stringent environmental regulations aimed at reducing carbon emissions, can complicate ship operations and impose additional costs on shipowners and brokers alike. These regulations often require substantial investments in new technologies and compliance systems.

The shipbroking market faces fierce competition from digital platforms that offer alternative ways to connect shipowners and charterers, potentially disrupting traditional brokering practices. Adapting to this digital transformation while maintaining personalized service is crucial for sustained success in this evolving market.

A different take: Digital Marketing for Moving Companies

Addressing Uncertainties

The shipbroking market is not immune to uncertainties, but it's adapting to these challenges by increasing its focus on digital solutions. Innovation in risk management through predictive analytics and AI allows brokers to navigate uncertainties more effectively.

Global macroeconomic fluctuations can significantly affect shipping dynamics, introducing risk factors that impact profitability and trade flows. Historical events, such as the economic downturn during the mortgage crisis, serve as reminders of the volatility present in the industry today.

The shipping industry is responding to these challenges by streamlining operations through digital platforms, which enhances transaction handling and enables brokers to react swiftly to changing market conditions. This shift towards digitalization is projected to propel the market in the coming years.

The global shipbroking market was valued at approximately $4.8 billion in 2022, with expectations to reach around $6.2 billion by 2028, reflecting a compound annual growth rate (CAGR) of about 4.7%. This growth is largely attributed to the rising demand for shipping services, especially in emerging markets where trade is expanding rapidly.

The ongoing shift towards cleaner energy sources is leading to a rise in the transportation of liquefied natural gas (LNG), further boosting the market. This trend is expected to continue, driven by increasing demand for commodities from emerging economies.

Research Statistics and Insights

The shipbroking market is a vital component of the global shipping industry, and understanding its trends and challenges is essential for businesses and investors alike. The market revenue was valued at USD 5.5 Billion in 2024 and is expected to reach USD 8.2 Billion by 2033, growing at a CAGR of 4.5% from 2026 to 2033.

The pandemic has reshaped global supply chains, emphasizing the importance of robust shipping operations. This has led to a significant increase in demand for shipping services, especially in emerging markets where trade is expanding rapidly. The logistics industry is projected to reach a market value of over $12 trillion by 2027, further driving the need for efficient shipbroking solutions.

The shipbroking market's applications span across various industries, including oil and gas, agriculture, and consumer goods. The oil and gas sector relies heavily on maritime transport for the movement of crude oil and natural gas, which accounts for a significant portion of global trade.

Broaden your view: Ship Oil Pollution Emergency Plan

Here are some key statistics that highlight the growth and importance of the shipbroking market:

The shipbroking market's growth is largely attributed to the rising demand for shipping services, especially in emerging markets where trade is expanding rapidly. As logistics processes become more sophisticated, the demand for shipbroking services is expected to rise, making it a crucial component of the global shipping industry.

Market Growth and Opportunities

The shipbroking market is set to expand significantly, with projections indicating a growth of USD 263.7 million from 2024 to 2028. This growth is largely fueled by advances in technology and the adoption of innovation, highlighting a trend characterized by enhanced efficiency and value creation within shipping processes.

The International Maritime Organization (IMO) has set ambitious targets to reduce greenhouse gas emissions from shipping by at least 50% by 2050, creating a unique opportunity for brokers who can facilitate the transition to greener shipping solutions.

Emerging markets in Asia and Africa are expected to witness an upsurge in shipping activities, providing an expanded client base for shipbroking services. This is a significant development that can help shipbrokers tap into new markets and increase their revenue.

The shipbroking market can be segmented into several categories, primarily based on application, end-user, and geography. Understanding the unique requirements of diverse sectors such as oil and gas, manufacturing, and aerospace is critical for shipbrokers to provide tailored solutions that meet their clients' specific needs.

How to Get a Sample Statistical Report

To get a sample report of statistical data for the Shipbroking Market, you can reach out to Verified Market Reports. They provide a sample report tailored to your requirements.

Verified Market Reports offers 24*7 chat support and direct call services for any further assistance you may need.

Exclusive Access to Full Report

Access to the full shipbroking market report can provide valuable insights into the industry's growth drivers.

The demand for key value addition in the shipping process is a significant factor driving market growth.

This information can help vendors create new market strategies by understanding the market trends and drivers.

For instance, understanding the demand for value addition can inform business decisions and improve market positioning.

To access the full report and learn more about the key market drivers, trends, and challenges, click here.

Frequently Asked Questions

What is a shipbroking?

Shipbroking is the process of facilitating shipping deals between shipowners, charterers, buyers, and sellers. It involves negotiating and arranging the movement of goods and products by sea.

Is shipbroking stressful?

Shipbroking can be a high-pressure career with fluctuating market conditions, but it also offers an exciting and thrilling experience for those who thrive under pressure. If you enjoy the rush of adrenaline, shipbroking might be the perfect fit for you.

What are the 4 types of shipping markets?

There are four main shipping markets: freight, sale and purchase, newbuilding, and demolition. These markets trade in different commodities, each with its own unique characteristics and opportunities.

Sources

- https://www.verifiedmarketresearch.com/product/shipbroking-market/

- https://dataintelo.com/report/global-shipbroking-market

- https://www.verifiedmarketreports.com/product/global-shipbroking-market-report-2019-competitive-landscape-trends-and-opportunities/

- https://statistics.technavio.org/shipbroking-research

- https://investorshangout.com/transforming-shipbroking-how-ai-is-navigating-change-and-growth-137207-/

Featured Images: pexels.com