International cargo insurance is a must-have for any business that transports goods across borders. According to statistics, over 80% of businesses that ship internationally have experienced cargo loss or damage.

The cost of cargo loss can be substantial, with some cases involving losses of over $100,000. This is why it's essential to have a reliable insurance policy in place.

The International Chamber of Commerce (ICC) recommends that businesses insure their cargo against risks such as theft, damage, and loss during transit. This is especially crucial for businesses that ship high-value or fragile items.

By investing in international cargo insurance, businesses can mitigate the risks associated with global trade and protect their bottom line.

What Transit Covers

International cargo insurance can protect your goods from damage caused by various risks, including warehouse damage, war and terrorism, piracy, and hijacking. This type of insurance is designed to cover assets in transit or storage.

Warehouse damage is a significant risk, especially during international shipping. Transit insurance can provide coverage for damage caused by warehouse accidents.

International transit insurance can be tailored to fit your business needs. You can choose when coverage begins and ends, and which events are covered, including protection for business interruption in case of delayed shipments.

Coverage options include single or one-off transits, open cargo, warehouse-to-warehouse policies, blanket policies for worldwide shipments, and all modes of conveyance, including land, sea, and air.

Here are some common types of insurance coverage for international shipments:

- Single or one-off transits

- Open cargo: all risks

- Warehouse-to-warehouse policies

- Blanket policies for worldwide shipments

- All modes of conveyance: land, sea, and air

Insurance companies like GCA offer coverage up to the commercial invoice of your goods, as well as domestic and international multi-modal protection against loss or damage.

Need for Insurance

Cargo insurance is a must-have for international shipments, as it protects against events not covered by other insurance policies.

Cargo carriers aren't responsible for losses and events outside their control, which is a significant risk for shippers.

National and international regulations limit liability for sea freight, making it essential to have additional coverage.

Shipping delays have increased in recent years, highlighting the need for business interruption coverage, a product within cargo insurance.

Insurance for international shipments isn't required by law, but it's highly recommended to protect against various dangers and risks.

Having some level of protection is better than none, and insurance coverage can be tailored to meet the specific needs of each company.

Types of Trade Insurance

Cargo insurance coverage is an agreement between two parties: the insured and the cargo insurance company. The insured pays a premium to the insurance company in exchange for the company's agreement to protect the value of the cargo during transport.

There are various types of insurance in international trade, including cargo insurance coverage that protects goods during transport, covering the risks of loss, damage, and theft. Each organization's circumstances are unique, so custom-designed policies can be built to suit their needs.

Some types of cargo insurance coverage include:

- Single or one-off transits

- Open cargo: all risks

- Warehouse-to-warehouse policies

- Blanket policies for worldwide shipments

- All modes of conveyance: land, sea, and air

These types of insurance can be tailored to fit the specific needs of each company.

Clements for Your

Clements Worldwide offers a range of insurance options for international trade, including transit insurance coverage that can be customized to suit each company's needs.

Their transit insurance coverage allows you to choose when coverage begins and ends, and which events are covered, including protection for business interruption in case of delays.

You can choose from single or one-off transits, open cargo coverage for all risks, warehouse-to-warehouse policies, or blanket policies for worldwide shipments.

Their insurance coverage includes all modes of conveyance, such as land, sea, and air, and provides worldwide coverage, including transit through hazardous routes.

Here are some of the key options to consider:

For air cargo, Clements Worldwide offers two main types of insurance: partial coverage and full-risk coverage.

Why Is Trade Protection Important?

Trade protection is crucial for international trade because cargo insurance coverage protects goods during transport, covering the risks of loss, damage, and theft.

Cargo carriers are often not responsible for losses and events outside their control, leaving businesses vulnerable to financial losses. This is why cargo insurance is needed to protect against events not covered by other insurance policies.

National and international regulations limit liability for sea freight, making it essential for businesses to take out insurance to protect their goods. Shipping delays have risen in recent years, increasing the need for business interruption coverage, a product within cargo insurance.

Taking out insurance in international trade is a smart business move because it provides financial protection against unforeseen events, such as loss, damage, or theft of goods during transport.

For your interest: Wholesale Business Insurance

Claims and Processes

If you're dealing with cargo loss or damage, it's essential to act quickly. For package loss or damaged, Global Cargo Alliance will assist you during the process with the carrier and help you get a reasonable result.

When it comes to billing inquiries, it's also crucial to note that Global Cargo Alliance has a process in place to help resolve any discrepancies.

If you're dealing with insurance claims, it's vital to examine the cargo upon reception and notify the insurance provider with pictures and claim amount immediately after the realization of damage. Visible loss or damage requires immediate notification, while non-visible loss or damage must be reported within three days from the delivery date.

The statute of limitations for filing a claim with carriers is one year from the delivery date, so it's essential to act promptly. Consider cargo insurance as something as important to your business as car insurance is to yourself.

Here are the key deadlines to keep in mind for insurance claims:

Shipping Risks

Shipping risks are a major concern for anyone sending cargo internationally. Every type of international shipping has its own set of risks.

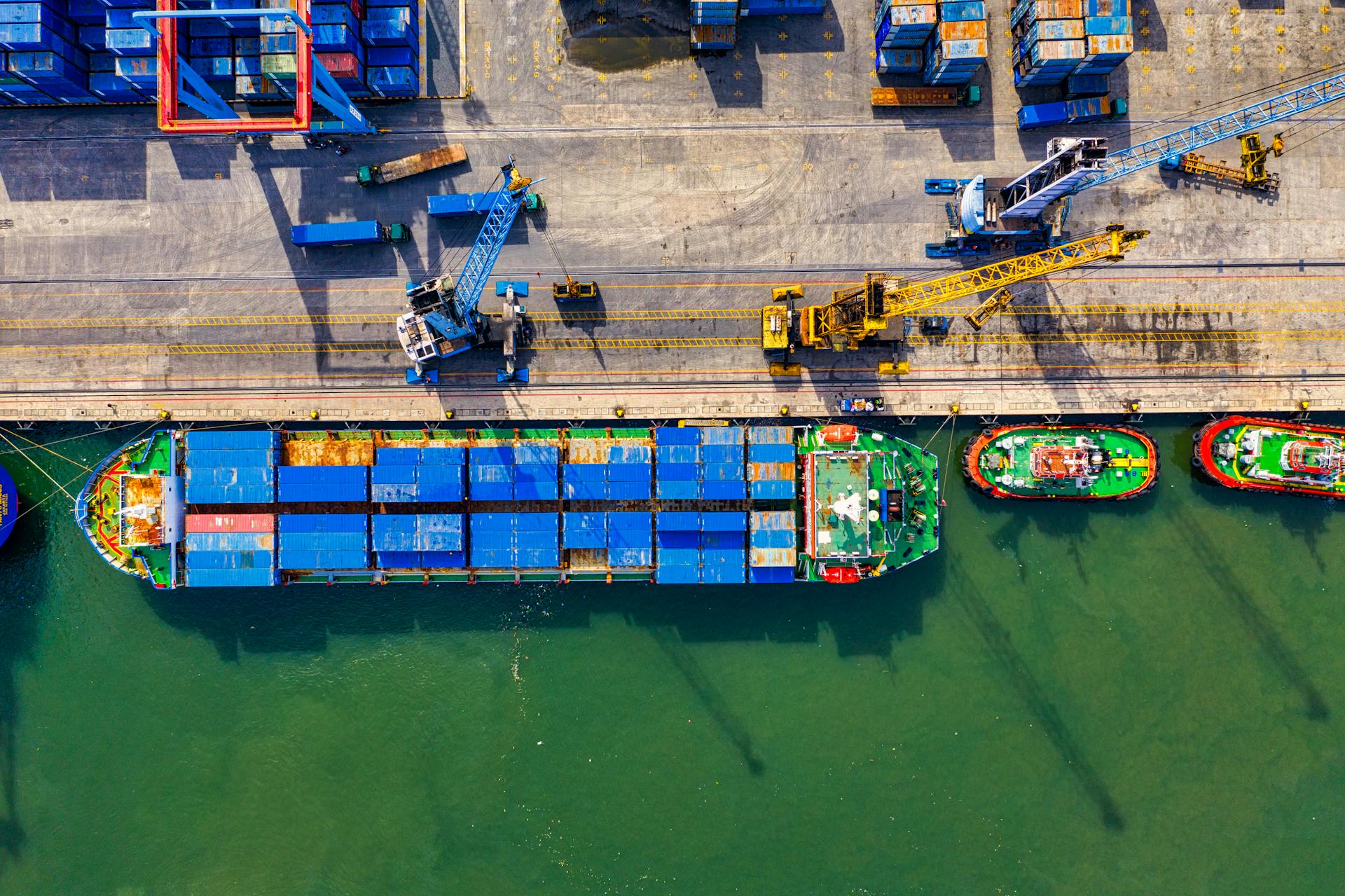

Ocean shipping is the most commonly used method, but it comes with its own set of dangers. Piracy is a significant threat to ocean shipments.

Some of the risks of ocean shipping include piracy, damage, containers falling into the sea, and cranes dropping cargo containers. These risks can result in financial losses for shippers.

Many ocean carriers have special procedures to ensure vessels are sailed safely. However, there is still a risk that freight could suffer damage on its way to the destination.

To minimize risks, shippers should be aware of these potential dangers and choose the right insurance policy.

Suggestion: Ocean Marine Insurance

Types of Coverage

International cargo insurance offers a range of coverage options to protect your goods during transit. There are several types of insurance policies that can be used to protect freight, but it's essential to understand the differences between them.

All-risk insurance provides the broadest form of coverage, protecting your goods from all potential dangers. This type of insurance is often more expensive than named perils, but it offers greater peace of mind.

Named perils insurance, on the other hand, only provides protection from specific types of risks. This policy allows you to protect your freight from dangers that are more likely to occur, rather than covering all possible risks.

Here are some of the specific risks that international transit and cargo insurance can cover:

- Warehouse damage

- War and terrorism

- Piracy

- Hijacking

These risks can have a significant impact on your business operations, especially with ongoing supply chain disruptions. By choosing the right insurance policy, you can minimize the risks associated with international shipping.

Incoterms and Shipping

Incoterms are a set of globally accepted rules regarding import and export responsibility transfer.

Only two Incoterms specifically address insurance: CIP and CIF. These Incoterms help define when the transfer of risk happens from the seller to the buyer. The seller is responsible for insuring the goods during certain parts of the shipping process.

The two Incoterms that deal with insurance are CIP and CIF. CIP dictates that shippers provide insurance for freight until it reaches the named place of destination, while CIF dictates that shippers provide insurance until the shipment reaches the port of destination.

If CIF is the agreed upon Incoterm, buyers will be able to insure the shipment after it arrives at the port of destination. However, any damage or loss that occurs before the freight arrives at the place of destination in the case of CIP or the port of destination in the case of CIF will have to be covered by the shipper.

Here's a summary of the two Incoterms that deal with insurance:

- CIP: Shippers provide insurance for freight until it reaches the named place of destination.

- CIF: Shippers provide insurance until the shipment reaches the port of destination.

Protecting Shipments

International air shipping comes with its own set of risks, including theft, security threats, damage from hazardous goods, and turbulence damage. These risks can be mitigated with proper protection.

Theft can occur even when shipping via air, and security threats can cause damage to freight. The International Air Transport Association (IATA) has regulations in place to prevent the transportation of hazardous materials.

To protect your shipments, consider purchasing freight insurance coverage, which can provide a layer of protection against loss, damage, and other risks. This type of insurance can be especially useful for container owners or logistics companies.

Here are some common risks associated with international air shipping:

- Theft

- Security threats

- Damage from hazardous goods

- Turbulence damage

Container

Container shipping is a common method of international transport, but it comes with its own set of risks. Piracy is one of the dangers of ocean shipping.

Shipping containers are loaded carefully to prevent freight from shifting during transit, but accidents can still happen. Containers falling into the sea is a risk that can cause financial loss for shippers.

Check this out: Broker for International Shipping

Container insurance is a policy that protects the container as a single unit, covering loss, damage, and other risks during transport. It's useful for container owners or logistics companies.

Container insurance covers accidents, theft, damage due to mishandling or adverse weather conditions, and other risks. It ensures the continuity of the supply chain.

Transporting goods across borders exposes businesses to various risks, from property damage to financial loss. Having adequate insurance allows companies to protect their investments and maintain financial and operational stability.

Here are some common risks covered by container insurance:

- Accidents during loading and unloading

- Theft

- Damage due to mishandling

- Damage due to adverse weather conditions

Shield Your Shipments

Cargo insurance coverage protects goods during transport, covering the risks of loss, damage, and theft.

Having insurance is an agreement between two parties: the insured and the cargo insurance company. The insured pays a premium to the insurance company in exchange for the company's agreement to protect the value of the cargo during transport.

Ocean shipping is the most commonly used method of international transport, but it has plenty of dangers that could cause a financial loss for a shipper. Some of the risks of ocean shipping include piracy, damage, containers falling into the sea, and cranes dropping cargo containers.

Freight insurance coverage provides a supreme amount of protection to your goods. Our quote forms factor in the cost of insurance, giving you a more accurate total cost of the shipment.

Here are some common risks associated with international shipping:

- Piracy

- Damage

- Containers falling into the sea

- Cranes dropping cargo containers

Frequently Asked Questions

What is not covered in cargo insurance?

Cargo insurance typically excludes losses caused by intentional misconduct, wear and tear, and ordinary leakage or loss in weight or volume. Review the policy details to understand what specific risks are excluded.

Sources

- https://www.clements.com/business/international-cargo-transit-insurance/

- https://www.sparxlogistics.com/post/freight-insurance-international-trade-container-insurance

- https://www.gcargo.com/services/cargo-insurance/

- https://ascentlogistics.com/blog/insuring-overseas-international-cargo-insurance/

- https://freightinsurancecoverage.com/process/international-cargo-insurance/

Featured Images: pexels.com