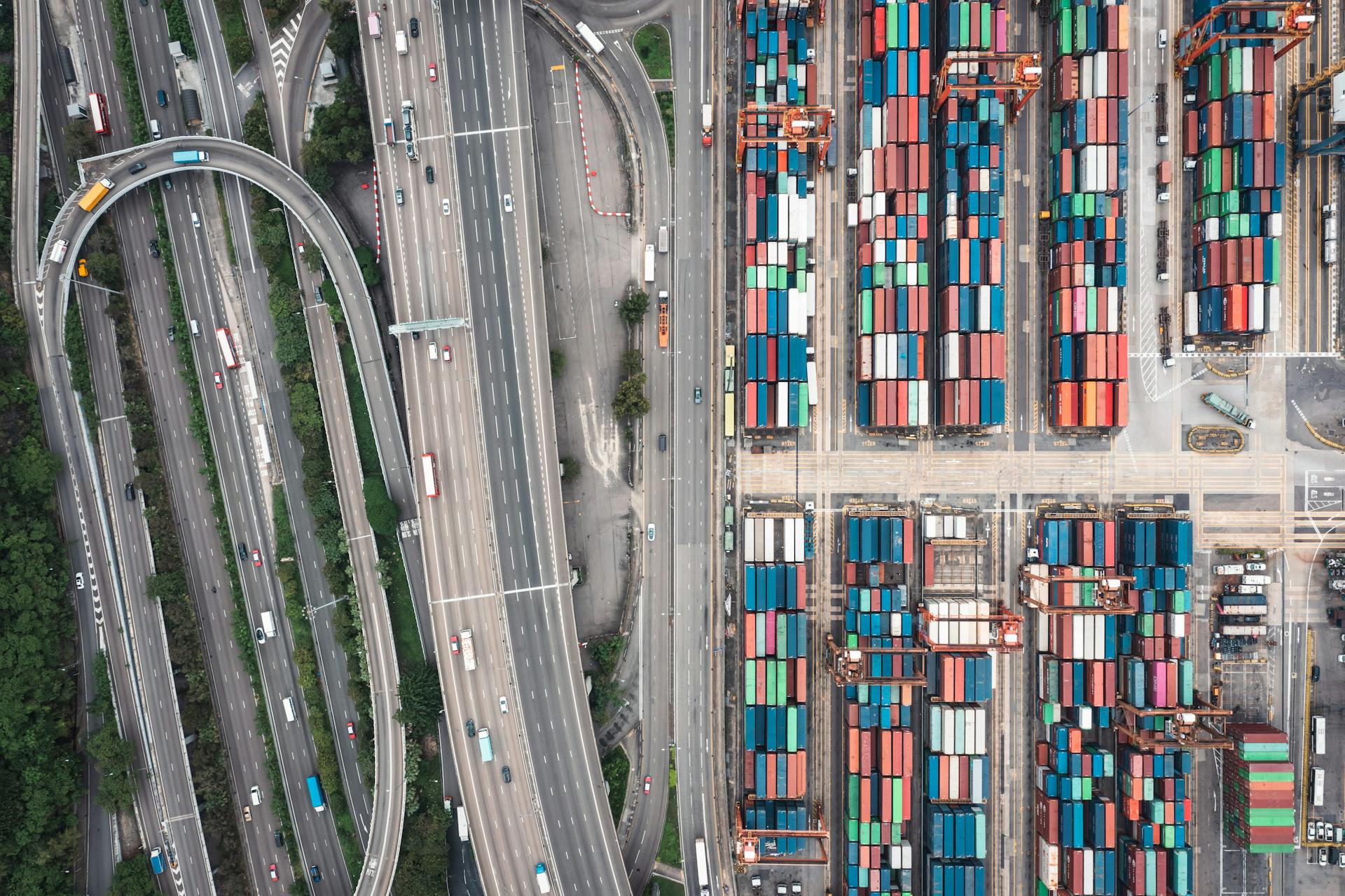

The Brazilian packaging market is a rapidly growing industry, driven by the country's increasing demand for packaged goods.

Brazil's population is projected to reach 223 million by 2030, fueling the need for innovative packaging solutions.

Food and beverage packaging is a significant segment of the market, accounting for 45% of total packaging demand.

The Brazilian government's focus on sustainable development has led to increased regulations on packaging waste, creating opportunities for eco-friendly packaging solutions.

The country's growing e-commerce sector is also driving demand for packaging that can withstand shipping and handling.

Market Overview

The Brazilian packaging market is a rapidly growing industry, with a projected value of $43.6 billion by 2025, driven by the country's increasing demand for packaged goods.

Brazil's large and diverse population is driving the growth of the packaging market, with over 212 million people requiring packaged goods for daily consumption.

The country's economy is expected to continue growing, with a predicted GDP growth rate of 2.5% in 2023, further fueling the demand for packaging solutions.

The packaging market in Brazil is dominated by flexible packaging, accounting for over 60% of the market share, followed by rigid packaging and corrugated packaging.

Brazil's geographical location and climate make it an ideal market for packaging solutions that can withstand high temperatures and humidity, such as aseptic packaging.

Raw Materials and Production

Corrugated board and plastics dominate the Brazilian packaging market, accounting for more than 50% of the market share in volume and over 40% in value. In 2014, corrugated board represented 31.6% of the market share in volume, while plastics accounted for 22.6%.

Plastics and flexibles are the most valuable materials, with flexibles representing 22% of the total production value despite only making up 3% of the production size. Glass, on the other hand, contributes only 4% to the total production value despite making up 15% of the market share in volume.

Here's a breakdown of the raw material market shares in 2014:

Raw Materials

Raw materials play a crucial role in the packaging industry, with various materials being used to fabricate packaging. The most common materials used are corrugated board and plastics, which represent more than 50% of the market share in volume and more than 40% in value.

Corrugated board holds a significant 31.6% market share in volume, but its value share is relatively low at 12.7%. In contrast, plastics have a higher value share of 29.5% despite occupying 22.6% of the volume.

A unique perspective: Foam Packaging Materials

Glass is another material used in packaging, but its market share is relatively low, accounting for only 15.1% of the volume and 4.3% of the value.

Here's a breakdown of the raw material market shares in 2014:

The beverage industry is the largest end-use market for packaging raw materials, with plastics and flexibles being the most widely used materials for non-alcoholic beverages.

Worth a look: Plastic Packaging Materials

Stand Up Pouches

Stand Up Pouches are a type of retort pouch that can stand upright due to a bottom gusset, making them ideal for human alimentation products, pet food, and beauty care products. They've been particularly successful in the Brazilian market, where they've shown immense growth (CAGR of 6.1% in volume and 5.8% in value between 2011 and 2014).

Stand Up Pouches are ranked third in terms of CAGR in volume and fourth in terms of CAGR in value among the ten fastest growing flexibles in the Brazilian packaging market. The growth of Stand Up Pouches in Brazil is impressive, but it still lags behind the Chilean and U.S. markets due to a lack of supply of scale of important components like resealable zippers and nylon.

There are two common types of processes for filling Stand Up Pouches: vertical form fill seal (VFFS) and fill-seal (FS). The VFFS process uses rolls of film and complex machines to shape the pouch before filling and sealing it, making it a long-run option for large quantities.

The FS process, on the other hand, uses pre-formed pouches and two separate machines for filling and sealing, making it a more decentralized and low-maintenance option. This makes FS a better choice for short-run or small-batch production.

Some common products that come in Stand Up Pouch packaging include nuts, cereals, dog and cat food, liquid soap, and smaller quantities of laundry detergents.

Curious to learn more? Check out: Security Seal

Bio-Based

Bio-based packaging is an exciting area of development, with companies like Coca-Cola and Tetra Pak leading the way. On June 3, 2015, Coca-Cola presented their 100% recyclable PET bottle, called PlantBottle™, which was the first of its kind.

Coca-Cola's PlantBottle™ relies on sugarcane ethanol instead of fossil-based material. This innovative approach uses polyethylene produced by Braskem, a Brazilian petrochemical and biopolymers company.

Tetra Pak also made a significant announcement, launching a 100% renewable package for their dairy products. This innovative packaging concept won them several awards, including the "Best carton or pouch" and "Best manufacturing or processing innovation" prizes at the World Beverage Innovation Awards 2015.

The Brazilian sugarcane industry is a promising market for bio-based packaging, with 60% of production taking place in the State of São Paulo. Sugarcane ethanol is produced in areas located at least 2000 km away from the Amazon rainforest, in the Northeast coastal regions and the Southeast.

Brazil Packaging

Brazil is a major player in the packaging industry, with a diverse range of raw materials used in its production. The country's packaging market is dominated by corrugated board and plastics, which account for more than 50% of the market share in volume and over 40% in value.

The largest end-use market for packaging raw materials in Brazil is the beverage industry, with plastics and flexibles representing the largest share of used material for non-alcoholic beverages. Metals, particularly aluminum, are also heavily used in the beverage industry, especially for alcoholic beverages.

Broaden your view: Packaging Industry Trade Shows

In 2014, two-thirds of Brazilian raw material consumption took place in the alimentary sector, with the remaining one-third used in the non-alimentary sector. Steel, Kraft, and duplex/triplex are the only materials used to a larger degree for non-food packaging than vice versa.

Brazil is also a leader in the development of bio-based packaging, with companies like Coca-Cola and Tetra Pak introducing sustainable packaging solutions. Coca-Cola's PlantBottle, for example, is a 100% recyclable PET bottle made from polyethylene produced from sugarcane ethanol.

Here are some key statistics on the Brazilian packaging market:

The use of flexibles and aluminum is particularly high in the food sector, with these materials accounting for a significant share of the total value of packaging materials used in the sector.

Intriguing read: China Packing Materials

Regulations and Compliance

Regulations and compliance are crucial aspects of the Brazilian packaging market. Brazil exempted all Food Contact Materials (FCM) from Mercosur's registration requirements except for FCM made from recycled materials in 2000.

The Brazilian National Health Surveillance Agency (ANVISA) must be informed about any imports of FCM, and FCM imported into the Brazilian market must comply with all technical resolutions and Brazilian legislation incorporating Mercosur resolutions.

Safety and Compliance

Safety and Compliance is a top priority in the world of food contact materials (FCM). Packaging must carry all the necessary information for consumer safety, including preparation instructions, nutritional value, and expiration dates.

The transfer of chemical contaminants from packaging to food is a major health concern. Mathematical modeling and in-depth analysis are used to estimate the degree of this contamination.

Brazil exempted FCM from Mercosur's registration requirements in 2000, except for those made from recycled materials. However, imported FCM must still comply with Brazilian technical resolutions and legislation.

Laws governing FCM are constantly being revised to reflect new scientific insights and technological advancements. This ensures that packaging remains safe and compliant with evolving regulations.

The Brazilian National Health Surveillance Agency (ANVISA) must be informed about any imports of FCM, highlighting the importance of transparency in the industry.

Recycling in Brazil

Brazil has a low total recycling rate, coming in at a mere 2% of created waste. This is largely due to the fact that only 64% of the population has access to regular garbage collection.

The situation is improving, however, with the number of municipalities offering selective waste collection rising from 443 in 2010 to 766 in 2012. This increase is a positive step towards improving recycling rates in the country.

Despite its low overall recycling rate, Brazil is the world leader in recycling aluminum, with a record recycling rate of 98.4% in 2014. This is largely due to the high energy costs associated with producing new aluminum.

Recycling aluminum requires 95% less energy than producing new material, making it a more cost-effective option for manufacturers. This has led to a significant increase in aluminum recycling rates in Brazil.

PET is the second most recycled packaging material in Brazil, with 54% of PET having been recycled in 2014. However, this rate is still much lower than the percentage of recycled aluminum.

If this caught your attention, see: Pet Thermoforming

Research and Insights

Brazilian consumers are becoming increasingly conscious of the environmental impact of packaging materials and practices, with 78% expressing a preference for products with environmentally friendly packaging.

This growing demand for eco-friendly packaging is driving food manufacturers in Brazil to adopt sustainable materials and emphasize their commitment to environmental responsibility in their marketing campaigns.

The Brazil packaging market was valued at 191.7 billion units in 2022 and is expected to register a CAGR of over 2% by 2027, indicating a steady growth in the industry.

New Consumption Patterns

Brazilians are adopting different consumption patterns due to lower purchasing power, such as downgrading pack sizes and preference for homemade meals.

One way people are reducing spending is by opting for bulk purchases, which can be more cost-effective in the long run.

Companies are listening to these new demands by changing their product offerings to include smaller and jumbo package sizes, targeting lower-income and cost-conscious consumers.

Consumer product manufacturers are also adding new products to their mix, known as SKU proliferation, to meet changing consumer demands and strengthen their positions with formal retailers.

Formal retailers are demanding volume, promotional offers, price reductions, and increased margins for most of the product lines that cater to the middle classes.

Curious to learn more? Check out: Amazon Product Packaging

Go Deeper with GlobalData

Brazilian consumers are becoming more environmentally conscious, with 78% expressing a preference for products with eco-friendly packaging.

The demand for sustainable packaging is driving food manufacturers in Brazil to adopt eco-friendly materials and emphasize their commitment to environmental responsibility in marketing campaigns.

The Brazil packaging market is valued at 191.7 billion units in 2022 and is expected to register a CAGR of more than 2% by 2027.

This growth is a clear indication of the increasing importance of sustainability in the food packaging industry in Brazil.

Worth a look: Environmentally Friendly Drink Bottles

General Information

Brazil is the largest market for packaging in Latin America, accounting for approximately 40% of the region's total packaging market.

The country's packaging market is expected to grow at a CAGR of 4.5% from 2020 to 2025, driven by increasing demand for packaged goods and growing middle class.

Brazil's packaging industry is highly competitive, with a large number of local and international players competing for market share.

The country's packaging market is dominated by paper and paperboard, which accounted for 34% of the market share in 2020.

The use of flexible packaging is increasing in Brazil, driven by its convenience and cost-effectiveness.

Brazil's packaging regulations are governed by the National Institute for Space Research (INPE) and the Brazilian Environment Ministry (MMA).

Frequently Asked Questions

What industry has the largest demand for packaging?

The food and beverage industry has the largest demand for packaging, driven by a significant increase in product sales during the COVID-19 pandemic. This industry segment is projected to lead the industrial packaging market.

Sources

- https://en.wikipedia.org/wiki/Brazilian_packaging_market

- https://www.s-ge.com/en/article/spotlight/20193-c6-brazil-packaging-industry

- https://www.en.investe.sp.gov.br/news/post/ireland-s-smurfit-kappa-debuts-in-brazilian-packaging-paper-market/

- https://www.packaging-gateway.com/features/changing-views-on-food-packaging-in-brazil/

- https://www.marketresearch.com/seek/Packaging-Brazil/597/1384/1.html

Featured Images: pexels.com