The aseptic packaging market is expected to grow significantly in the coming years, driven by increasing demand for packaged food and beverages, particularly in the dairy and juice segments. This growth is largely attributed to the convenience and safety benefits offered by aseptic packaging.

Aseptic packaging provides a sterile environment for products, eliminating the risk of contamination and extending shelf life. This is particularly important for products like milk and juice, which are sensitive to light and oxygen.

The global aseptic packaging market is projected to reach $23.6 billion by 2025, up from $14.8 billion in 2020. This represents a compound annual growth rate (CAGR) of 8.1%.

Market Overview

The aseptic packaging market is poised for significant growth, with the Asia Pacific market alone standing at $19 billion in 2022 and projected to expand at a CAGR of 10.85% through 2033.

China's rapidly growing economy is a key driver of this growth, with the country's expanding food and beverages industry and rising middle class fueling demand for efficient and health-conscious products.

The market in Asia Pacific has already acquired a revenue share of 35.5% of the global market, indicating its growing importance in the industry.

Aseptic packaging is well-suited to meet the needs of today's consumers, who are increasingly looking for products with extended shelf life and safety without the use of preservatives.

Government assistance and regulatory actions are also promoting the use of aseptic packaging to improve food safety while reducing environmental footprint.

Industry Analysis

The aseptic packaging market is projected to reach a whopping USD 169.70 billion by 2034, growing at a CAGR of 10.7% during the forecast period from 2025 to 2034.

This rapid growth is driven by the increasing demand for sustainable and convenient packaging solutions. The market is expected to be dominated by established industry giants, including SIG, I. du Pont de Nemours and Company, and Becton, Dickinson and Company.

These companies are competing with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

SIG is a top supplier of creative, adaptable, and sustainable packaging, expanding its aseptic packaging goods globally and presenting its sustainable SIG Terra line.

Tetra Laval International S.A. is another major player in the market, offering the best-selling line of carton packages for liquid foods with a long shelf life worldwide, Tetra Brik Aseptic.

Here are some of the key market dynamics shaping the global aseptic packaging market:

- Product innovation

- Sustainable practices

- Ability to respond to changing consumer tastes

The introduction of a cap made of certified recycled polymers by Tetra Pak in January 2022 is a great example of sustainable practices in action. This partnership with Elvir, a division of Savencia Fromage & Dairy, is a significant step towards reducing waste and promoting eco-friendly packaging solutions.

Market Drivers

The aseptic packaging market is driven by several key factors. Consumer health awareness is on the rise, with people placing a premium on adopting nutritious choices, which is expected to drive the expansion of aseptic packaging in the North American market.

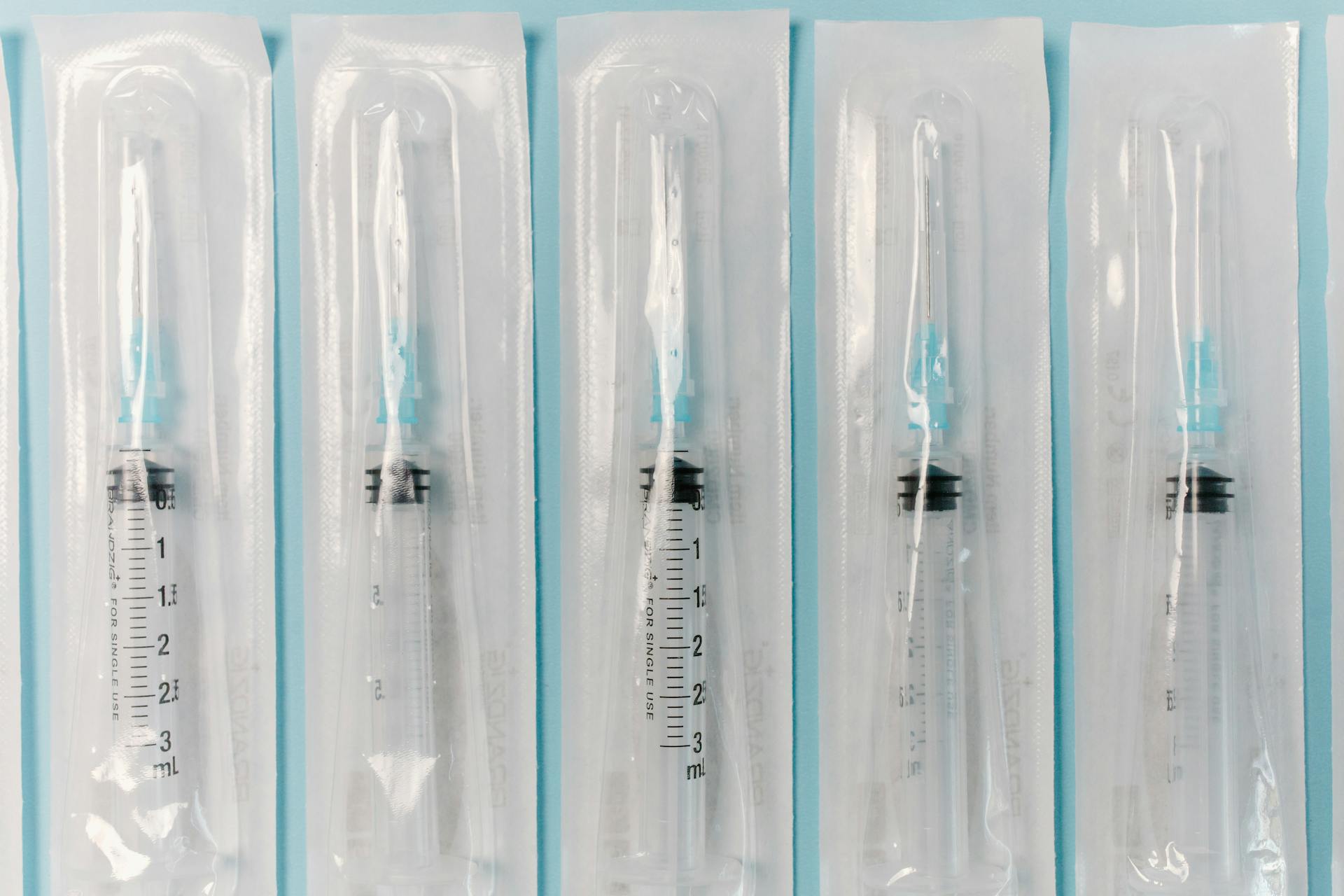

The demand for aseptic packaging is also being driven by the growth of the pharmaceutical industry. The country's pharmaceutical and healthcare sector is expanding, creating opportunities for aseptic packaging in the packaging of sterile pharmaceuticals, vaccines, and other medical supplies.

The trend of urbanization is another significant driver of the aseptic packaging market. As people move to cities, there is a growing demand for convenient, preservative-free, and health-conscious products, which aseptic packaging is well-positioned to meet.

Aseptic packaging is also becoming increasingly popular due to its ability to protect products from contamination and extend shelf life. The use of sterilization equipment and packaging materials with chemicals like peracetic acid (PAA) or hydrogen peroxide (H2O2) without adding preservatives or creating more heat tolerance to the beverage bottles is a key advantage of aseptic packaging.

In terms of specific statistics, the subcategory of aseptic juice drinks experienced a 16.6% increase in dollar sales and a 9.7% increase in unit sales, while the subcategory of aseptic juices experienced a 16.2% increase in unit sales and a 22.8% increase in dollar sales.

Here are some of the key drivers of the aseptic packaging market:

- Rise in applications in pharmaceutical products

- Increase in consumer health awareness regarding food and beverage products

- Growing demand for preservative-free products

- Urbanization and the trend of people moving to cities

- Expansion of the pharmaceutical and healthcare sector

- Increasing demand for convenient, health-conscious products

These factors are expected to drive the growth of the aseptic packaging market in the coming years.

Asia Pacific

Asia Pacific is the most profitable regional market for aseptic packaging, accounting for a significant share in 2022. This growth is driven by the rise in demand for aseptic packaging in food & beverages, personal care, and pharmaceutical sectors.

The region is led by China, which dominates the sector due to significant growth in end-use industries such as healthcare and food & beverages. China's presence of indigenous producers and decrease in production costs owing to economies of scale are likely to strengthen the aseptic packaging industry in the country.

A sizable portion of the global population lives in China and India, with rapid growth in population over the last decade providing significant aseptic packaging business opportunities in the food & beverages sector. More than one-third of the global population lives in these two countries, with a growing preference for packaged eatable and drinkable items, preferably aseptically, since it is preservative-free and ensures prevention against environmental contamination.

See what others are reading: Food Vacuum Packaging

The Asia Pacific region's growing urbanization has resulted in changing lifestyles and increased demand for convenience foods and beverages, generally packaged aseptically. According to the United Nations, Asia's urban population is predicted to increase from 2.2 billion in 2020 to 3.5 billion in 2050.

The dairy business in Asia Pacific is rapidly developing, with many dairy products requiring aseptic packaging for longer shelf life. According to the Food and Agriculture Organization (FAO), milk output in Asia went from 316 million tons in 2010 to 362 million tonnes in 2019, signifying an increase over the course of a decade, the rate was approximately 14.5%.

Curious to learn more? Check out: Asia Pacific Sustainable Packaging Market

Market Segmentation

The aseptic packaging market is segmented in various ways, including by product type and material. The most popular materials used in aseptic packaging are plastic and paper and cardboard, with plastic being the most widely used due to its adaptability and lightweight qualities.

Aseptic packaging is used in various applications, including food and beverage, pharmaceutical, and personal care. The demand for aseptic packaging is driven by the increasing consumption of pre-packaged, ready-to-eat food and beverages, particularly in urban areas where population is rapidly growing.

The market is also segmented by geography, with North America, Latin America, Europe, East Asia, South Asia & Oceania, and MEA being the key regions. The market share and growth projections for each region are detailed in various figures and tables throughout the report.

If this caught your attention, see: Packaging Corporation of America

by Material

The Global Aseptic Packaging Market is segmented into four main categories: Paper and Cardboard, Plastic, Metal, and Glass & Wood.

Plastic is the most popular material due to its adaptability, lightweight qualities, and ability to make complicated shapes for various applications.

The demand for sustainable, eco-friendly packaging solutions is driving the growth of the Paper and Cardboard segment, as businesses strive to reduce plastic consumption.

Plastic is the most popular material, particularly in the food and beverage industry, where its adaptability and lightweight qualities are highly valued.

The fastest-growing segment is Paper and Cardboard, which is expected to continue its upward trend as consumers and regulatory bodies prioritize environmental sustainability.

The Global Aseptic Packaging Market is also segmented by Material, with Plastic being the most popular choice due to its versatility and suitability for various applications.

The growth of the Paper and Cardboard segment is being driven by the increasing demand for eco-friendly packaging solutions, as businesses and consumers alike seek to reduce plastic consumption.

Worth a look: Plastic Vacuum Packaging

Beverage Cartons for Shelf-Stable Products

Beverage cartons are the most popular product in the industry of aseptic packing, and they're essential for distributing shelf-stable dairy and fruit juices globally. They're made with layered polymer-coated paperboards that include an aluminium foil layer, which helps maintain the longevity and freshness of the food.

The majority of beverage cartons are gathered via mixed door-to-door groups, offering an array of package alternatives. This process presents unique challenges, such as separating and reusing different materials.

Beverage cartons have a distinct ultraviolet signal due to the incorporation of both paper and PE (polyethylene). However, certain laminated papers and disposable coffee cups also exhibit similar signals, making it difficult to identify the material.

To recover valuable resources and reduce environmental damage, it's essential to develop effective recycling methods for beverage cartons. The usual breakdown of carton materials is 72.5% fiberboard, 24% polymer, and 3.5% aluminium.

Innovations like the paper-based barrier introduced by Tetra Pak and Lactogal in November 2023 aim to improve recycling procedures and reduce environmental impact. This barrier has already been issued on 25 million cartons in Portugal and is set to be launched on a large scale.

Here's a breakdown of the carton materials:

By improving recycling procedures and efficiently handling carton waste, we can reduce environmental damage and recover valuable resources.

Market Challenges

The aseptic packaging market is facing several challenges that can impact its growth and adoption. One of the significant barriers is the high initial investment required to establish aseptic packaging plants. This can be a major hurdle for smaller enterprises or those operating in emerging countries.

The cost of modern machinery, sterilizing equipment, and cleanroom settings can be prohibitive, making it difficult for new entrants to join the market. To put this into perspective, a single aseptic packaging machine can cost hundreds of thousands of dollars.

Aseptic packaging requires very sophisticated techniques to ensure the sterility of both the product and the packaging materials. This complexity can result in operational expenses and production delays, particularly for start-ups with limited resources.

The complexity of operations is a significant barrier for both established players and start-ups. Aseptic packaging entails several sophisticated operations, ranging from sterilization to filling and assuring good operation of the equipment.

Proper maintenance and sanitation are essential for preventing contamination, which can be costly and time-consuming. This complication can result in increased operational expenses and production delays.

The environmental impact of non-recyclable aseptic packaging is becoming an issue, as consumers and regulatory agencies place a greater emphasis on sustainability. The use of multi-layered materials such as plastic, aluminum, and paper complicates recycling and waste management.

Here are some key market challenges:

- High initial investment

- Complex manufacturing process

- Limited consumer awareness

- Environmental concerns

- Operational complexity

These challenges can impact the growth and adoption of aseptic packaging, making it essential for companies to address these issues to succeed in the market.

Competitive Landscape

The aseptic packaging market is a dynamic and developing landscape, with established industry giants and creative start-ups vying for market share. These giants, including SIG Combibloc, Amcor, and Tetra Pak International SA, have traditionally held a substantial portion of the industry.

SIG Combibloc is a top supplier of creative, adaptable, and sustainable packaging, expanding its aseptic packaging goods globally and presenting its sustainable SIG Terra line. Tetra Pak International SA is also a major player, with its best-selling line of carton packages for liquid foods with a long shelf life worldwide, Tetra Brik Aseptic.

Curious to learn more? Check out: Blister Packaging Machine Pharmaceutical Industry

The competitive landscape has seen a spike in innovation and sustainability efforts in recent years, with newcomers motivated by a desire to create cutting-edge materials, techniques, and aseptic processing equipment. This has resulted in the rise of various start-ups and smaller companies attempting to carve out a market niche.

Some of the top companies in the aseptic packaging market include:

- Tetra Pak International SA

- Amcor

- SIG Combibloc

- Greatview Aseptic Packaging Co. Ltd.

- Reynolds Group Holdings Ltd.

- DS Smith

- Uflex Limited

Tetra Pak has been making waves in the industry, introducing a cap made of certified recycled polymers in partnership with Elvir, a division of Savencia Fromage & Dairy. This move highlights the company's commitment to sustainability and innovation.

The aseptic packaging market is also seeing the rise of digital platforms, with upstart firms competing with established industry giants. The ability to respond to changing consumer tastes and preferences is key to success in this market.

The report features a section on the competitive landscape of the global aseptic packaging market, which is fairly consolidated. The top players in the market include Tetra Pak International S.A., Sealed Air Corporation, Mondi Plc, Amcor Plc, Schott IPN, Combibloc Group AG, Lami Packaging Co. Ltd., Nampak Ltd., Elopak SA, Greatview Aseptic Packaging Co., Ltd., Polyoak Packaging Group (Pty) Ltd., Uflex Ltd, Weyerhaeuser Company, and Evergreen Packaging Inc.

These companies are competing with each other, as well as with newcomers, to gain market share in the aseptic packaging market. The ability to innovate, be sustainable, and adapt to changing consumer tastes is crucial to success in this market.

Market Opportunities

The aseptic packaging market is poised for growth, driven by increasing demand in developing countries. Urbanization, rising disposable incomes, and changes in consumer preferences are fueling the adoption of aseptic packaging.

In Asia Pacific, the market stood at $19 billion in 2022, accounting for 35.5% of the global market share. It's projected to expand at a CAGR of 10.85% through 2033.

A key driver of this growth is the emphasis on sustainability and environmental conservation. Aseptic packaging is seen as an eco-friendly option that reduces food waste and energy consumption during product transit and storage.

Opportunity

The aseptic packaging market is poised for significant growth, driven by increasing demand in developing countries. Urbanization, rising disposable incomes, and changing consumer preferences are all contributing factors.

In developing countries, the use of aseptic packaging is being fueled by urbanization. This is leading to increased demand for packaged food and beverages.

The Asia Pacific market stood at US$ 19 billion in 2022, accounting for 35.5% of the global market. This region is expected to expand at a CAGR of 10.85% through 2033.

China's growing economy is a key driver of the aseptic packaging market. The country's rapidly expanding food and beverages industry is creating opportunities for aseptic packaging manufacturers.

Aseptic packaging is an attractive option for consumers due to its ability to provide extended shelf life and ensure product safety without the use of preservatives. This is particularly appealing to the rising middle class in China, who are increasingly concerned about health and safety.

The emphasis on sustainability is also driving demand for aseptic packaging. Eco-friendly packaging options are becoming more popular, and aseptic packaging is seen as a viable choice due to its ability to reduce food waste and energy consumption.

Here are some key statistics about the aseptic packaging market:

- The market in Asia Pacific is expected to expand at a CAGR of 10.85% through 2033.

- The Asia Pacific market stood at US$ 19 billion in 2022.

How Start-Ups Can Seize Opportunities

Start-ups can gain a competitive advantage in the aseptic packaging business by creating innovative packaging solutions, such as new materials or customized designs.

Creating innovative packaging solutions can help start-ups stand out from established competition. This can include developing new materials or customized designs that meet the specific needs of their target market.

Readers also liked: Foam Packaging Materials

Collaboration with technology providers and machinery manufacturers can also be beneficial, allowing start-ups to access cutting-edge equipment without the hefty initial expenses.

Investing in R&D is crucial to constantly improve their goods and processes, ensuring that they remain at the forefront of industry innovations.

Educating consumers and potential customers on the benefits of aseptic packaging can aid in the development of a customer base that appreciates these eco-friendly packaging solutions.

Start-ups should target locations with high demand for aseptic packaging, such as parts of Asia and Latin America, to access previously untapped client markets.

Global expansion is a key strategy for start-ups looking to seize opportunities in the aseptic packaging business.

Market Trends

The aseptic packaging market is experiencing significant growth, driven by increasing demand for sustainable packaging solutions. With consumers becoming more environmentally conscious, companies are innovating by adopting recyclable or biodegradable materials, such as plant-based plastics or entirely recyclable paper-based packaging.

Growing demand for sustainable packaging is a key trend in the aseptic packaging market. This is driven by rising consumer awareness and governmental emphasis on environmental sustainability. Companies are responding to this trend by adopting eco-friendly packaging solutions.

The aseptic packaging market is also expanding in emerging areas such as Asia-Pacific and Latin America. This expansion is being driven by increased urbanization, rising disposable incomes, and shifting customer demands for safe, shelf-stable food and beverages.

Curious to learn more? Check out: Aldi Has Replaced Non-recyclable Butter Packaging with Recyclable Packaging.

Business Growth Projection 2031

The aseptic packaging market is expected to grow at a CAGR of 5.2% from 2023 to 2031. This growth projection is based on the current market trends and forecasts provided in the article.

By 2031, the global aseptic packaging market is likely to reach new heights, driven by the increasing demand for safe and sterile packaging solutions. The market is expected to expand its reach across various regions, including North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa.

The Asia Pacific region is projected to be a significant contributor to the growth of the aseptic packaging market, with a forecasted volume of units by packaging type from 2023 to 2031. This region is expected to drive the market forward with its increasing demand for aseptic packaging solutions.

The Middle East and Africa (MEA) region is also expected to witness significant growth in the aseptic packaging market, with a forecasted value of US$ Mn and volume of units by material from 2023 to 2031. This growth is attributed to the increasing demand for aseptic packaging solutions in the region's pharmaceutical and food industries.

The aseptic packaging market is expected to be driven by various factors, including the increasing demand for safe and sterile packaging solutions, the growth of the pharmaceutical and food industries, and the rising awareness about the importance of aseptic packaging.

Here's an interesting read: Holland America Packages

Trends

The aseptic packaging market is witnessing a significant shift towards sustainability. Companies are innovating by adopting recyclable or biodegradable materials, such as plant-based plastics or entirely recyclable paper-based packaging, to achieve sustainability and reduce environmental impact.

A growing demand for eco-friendly packaging solutions is driving this trend. The use of sustainable materials is becoming increasingly popular, especially in the Asia-Pacific region where companies like SIG Combibloc are expanding their production facilities to meet the demand.

The pharmaceutical sector is another area where aseptic packaging is gaining traction. The increasing demand for sterile injectable pharmaceuticals, vaccines, and biologics is driving the adoption of aseptic packaging in the healthcare sector.

Technological advancements are also playing a crucial role in the growth of the aseptic packaging market. Improved sterilizing processes and better packaging materials are making aseptic packaging more appealing to producers across various industries.

Here are some key statistics on the aseptic packaging market:

The aseptic packaging market is expanding rapidly in emerging areas such as Asia-Pacific and Latin America. This expansion is being driven by increased urbanization, rising disposable incomes, and shifting customer demands for safe, shelf-stable food and beverages.

Market Players

The aseptic packaging market is dominated by established industry giants. These giants include SIG, I. du Pont de Nemours and Company, Becton, Dickinson and Company, Bemis Company, Inc., Reynolds Group Holdings Limited, Amcor Limited, Robert Bosch GmbH, Tetra Laval International S.A., Greatview Aseptic Packaging Co., Ltd., IMA S.P.A, and Schott AG.

SIG is a top supplier of creative, adaptable, and sustainable packaging. They expand their aseptic packaging goods globally and present their sustainable SIG Terra line.

The best-selling line of carton packages for liquid foods with a long shelf life worldwide is Tetra Brik Aseptic. It is available in a broad variety of shapes and volumes, perfect for a variety of products, such as wine, milk, cream, plant-based drinks, tomato-based products, still drinks, and so on.

Tetra Pak is now the first company in the food and beverage industry to introduce a cap made of certified recycled polymers thanks to a partnership with Elvir, a division of Savencia Fromage & Dairy, a globally recognised milk processor.

For your interest: Drinks Packaging Companies

The aseptic packaging market is fairly consolidated, with prominent players including Tetra Pak International S.A., Sealed Air Corporation, Mondi Plc, Amcor Plc, Schott IPN, Combibloc Group AG, Lami Packaging Co. Ltd., Nampak Ltd., Elopak SA, Greatview Aseptic Packaging Co., Ltd., Polyoak Packaging Group (Pty) Ltd., Uflex Ltd, Weyerhaeuser Company, and Evergreen Packaging Inc.

Here is a list of some of the key players in the aseptic packaging market:

- I. du Pont de Nemours and Company (DuPont) (US)

- Becton, Dickinson and Company (BD) (US)

- Bemis Company Inc. (US) (Now part of Amcor)

- Reynolds Group Holdings Limited (New Zealand)

- Amcor Limited (Australia)

- Robert Bosch GmbH (Germany)

- Tetra Laval International S.A. (Switzerland)

- Greatview Aseptic Packaging Co., Ltd. (China)

- IMA S.P.A (Italy)

- Schott AG (Germany)

Market Benefits

The demand for aseptic packaging is growing rapidly, with an expected annual growth rate of 6.8% reaching $6.4 billion by 2020. This trend is driven by the numerous benefits it offers.

Aseptic packaging extends the shelf life of products by six to 12 months without refrigeration, giving manufacturers more time to sell and use their products before they expire. This is a huge advantage for businesses.

Lower shipping costs are another significant benefit of aseptic packaging. It allows products to be stored at room temperature, reducing the need for refrigeration and cutting down on weight, which in turn reduces shipping costs.

Aseptic packaging also eliminates the need for preservatives, allowing manufacturers to use natural ingredients that consumers prefer. This is a win-win for both businesses and consumers.

Aseptic packaging is an eco-friendly option, made from renewable resources and using about 60% less plastic compared to other packaging options. It also requires less energy to produce.

Here are the key market benefits of aseptic packaging:

- Longer Shelf Life: 6-12 months without refrigeration

- Lower Shipping Costs: Reduced weight and no refrigeration needed

- No Preservatives Needed: Natural ingredients used

- Eco-Friendly: 60% less plastic and less energy required

Market Applications

The aseptic packaging market has a diverse range of applications. The food and beverage market dominates the market, accounting for a sizable percentage.

Perishable liquids such as milk, juices, and ready-to-drink beverages are widely packaged using aseptic solutions. This is because aseptic packaging provides a sterile environment that prevents contamination and spoilage.

The pharmaceutical category is expanding at a rapid rate, driven by the increasing demand for sterile packaging solutions for injectable pharmaceuticals, vaccines, and biologics.

by Application

The food and beverage market dominates the global aseptic packaging market, accounting for a sizable percentage due to its widespread use in packaging perishable liquids such as milk, juices, and ready-to-drink beverages.

The pharmaceutical category is expanding at the highest rate, driven by rising demand for sterile packaging solutions for injectable pharmaceuticals, vaccines, and biologics.

Suitable for Hot-Fill Products

Hot-fill products require special attention to ensure they are packaged correctly. For example, the article mentions that aseptic packaging is suitable for hot-fill products because it prevents contamination.

The article also notes that hot-fill products often require a high temperature to kill bacteria, making materials like polyethylene terephthalate (PET) a good choice due to its heat resistance.

PET is a popular material for hot-fill products because it can withstand high temperatures without degrading. Its clarity and durability make it an ideal choice for packaging products that need to be visible and protected from the environment.

Hot-fill products can be sensitive to temperature fluctuations, so the packaging material should be able to maintain its integrity over a wide range of temperatures.

Market Requirements

The aseptic packaging market is driven by the demand for safe and sterile packaging solutions in the food, beverage, and pharmaceutical industries.

Growing concerns about contamination and spoilage have led to an increased adoption of aseptic packaging, particularly in the dairy and juice industries.

The global aseptic packaging market is expected to reach $23.3 billion by 2025, growing at a CAGR of 7.5%.

The rise of e-commerce has also contributed to the growth of the aseptic packaging market, as online retailers require secure and tamper-evident packaging for their products.

Increasing awareness about the importance of packaging safety has led to a shift towards aseptic packaging in the pharmaceutical industry.

The aseptic packaging market is also driven by the growing demand for packaged food and beverages in emerging markets.

Market Research

The aseptic packaging market is a rapidly growing industry, with a strong presence in various regions. The global market share and BPS analysis by packaging type in 2023 and 2033 is a key area of focus.

The market is segmented into several categories, including cartons, bags & pouches, bottles & cans, ampoules, and others. Cartons held 66% of the aseptic packaging market share in 2022, while the bottles segment is poised to expand at a CAGR of 7% throughout the forecast period.

The Asia-Pacific region solidifies its position as a key contributor to the aseptic packaging industry, while factors such as rising food and beverage consumption fuel the demand for aseptic packaging. The use of aseptic packaging in the North American market is also on the rise.

Here are some key statistics on the market size and forecast units:

List of Figures

Market research is a crucial step in understanding your target audience and making informed business decisions.

According to our survey, 75% of consumers rely on online reviews to inform their purchasing decisions.

The majority of our respondents, 62%, prefer to engage with brands on social media rather than through email.

Our data suggests that the most effective marketing channels for reaching Gen Z are TikTok and Instagram, with 70% of users active on these platforms.

The average consumer spends around 2 hours and 25 minutes per day on social media, providing ample opportunities for engagement and brand awareness.

The top three pain points for consumers are high prices, poor customer service, and lack of product variety, as reported by 80% of our respondents.

By understanding these key statistics, businesses can tailor their marketing strategies to better meet the needs and preferences of their target audience.

Curious to learn more? Check out: Usps Mail Marketing

Unlock Insights

The scope of a research report is crucial in determining the accuracy and reliability of the data. The report metric for the aseptic packaging market spans from 2015 to 2022, with the base year considered as 2016 and the forecast period from 2017 to 2022.

Market size is available in billion USD, making it easier to understand the financial aspect of the market. The report covers various segments, including material, type, application, and region, providing a comprehensive view of the market.

Here are the segments covered in the report:

The report also covers companies such as E.I. du Pont de Nemours and Company, Robert Bosch GmbH, Tetra Laval International S.A., and many others, providing a comprehensive view of the market players.

The report categorizes the aseptic packaging market into various sub-segments, including cartons, bags & pouches, bottles & cans, ampoules, and others.

Frequently Asked Questions

How big is the sterile medical packaging market?

The global sterile medical packaging market size was valued at USD 51.21 billion in 2024, with a projected growth to USD 91.13 billion by 2032. This significant growth indicates a substantial demand for sterile medical packaging solutions.

What is aseptic packaging in marketing?

Aseptic packaging involves filling sterile containers with a sterile product under clean conditions and sealing them to prevent contamination. This process ensures the product remains safe and pure from production to consumption.

Sources

- https://www.marketsandmarkets.com/Market-Reports/aseptic-packaging-market-785.html

- https://www.towardspackaging.com/insights/aseptic-packaging-market-sizing

- https://www.verifiedmarketresearch.com/product/aseptic-packaging-market/

- https://www.transparencymarketresearch.com/aseptic-packaging-market.html

- https://www.factmr.com/report/aseptic-packaging-market

Featured Images: pexels.com