Cargo insurance is a vital protection for businesses that transport goods, covering losses due to damage, theft, or other unforeseen events during transit. This type of insurance is not mandatory, but it's highly recommended to mitigate financial risks.

The cost of cargo insurance varies depending on the type of goods being transported, their value, and the route taken. For example, shipping fragile electronics may require a more expensive policy than transporting non-perishable goods.

To choose the right policy, consider the type of cargo you're transporting and the level of risk involved. You may also want to consider the reputation and financial stability of the insurance provider.

Researching different insurance providers and comparing their rates and coverage options is essential to find the best policy for your business.

You might like: Marine Cargo Insurance Policy

Types of Cargo Insurance

Cargo insurance comes in two main types: motor truck cargo insurance and marine cargo insurance. Motor truck cargo insurance is designed for goods transported on land via utility vehicles or trucks, covering risks like collision damage or theft.

Check this out: Does Boat Insurance Cover Engine

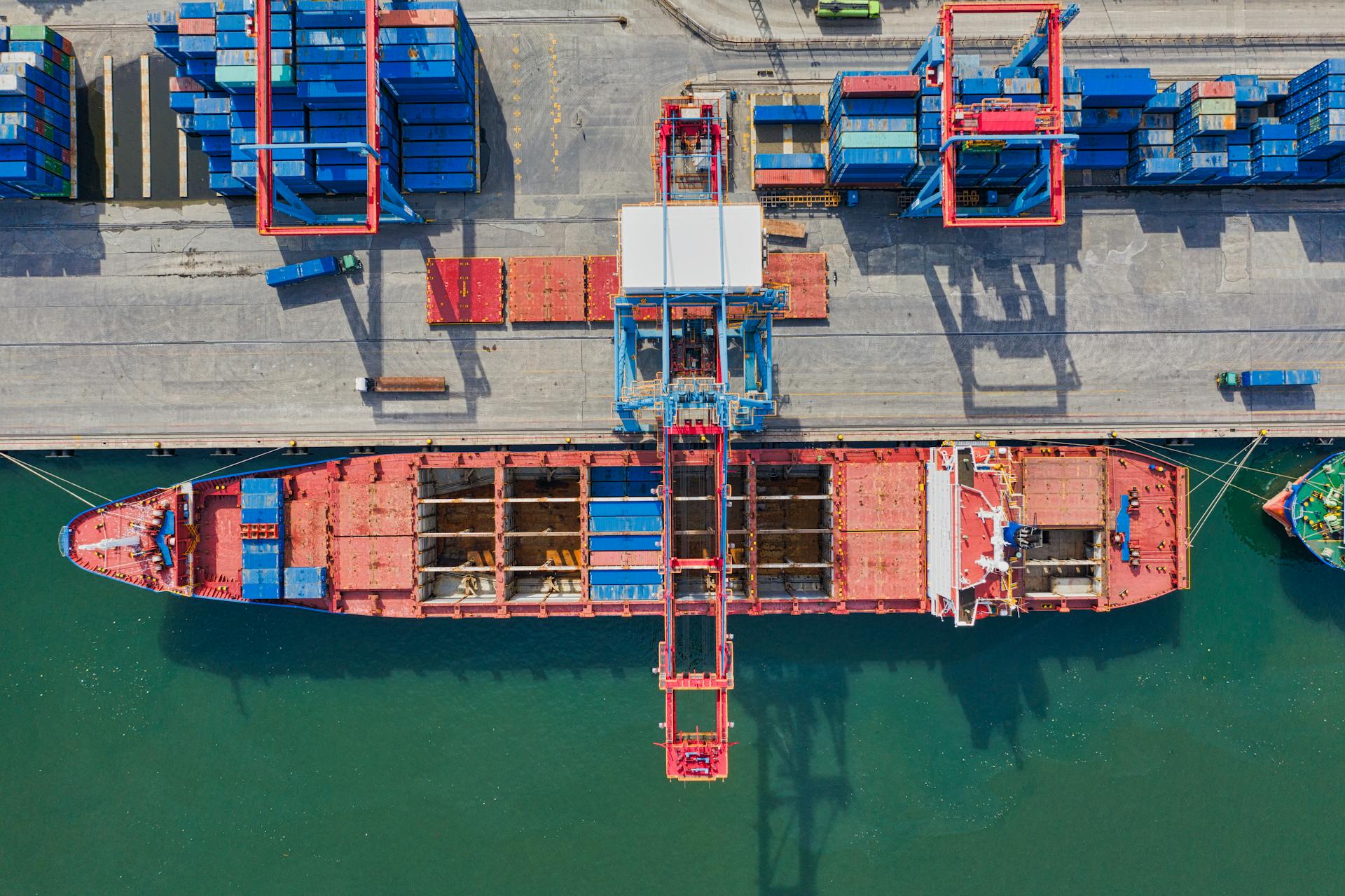

Marine cargo insurance, on the other hand, is perfect for international shipments that travel via ocean and air, covering damage from accidents, weather, loading, and unloading, along with other risks associated with airplanes and ships.

Here are some common types of marine cargo insurance policies:

- General coverage: This is the standard insurance policy that covers partial losses for policyholders.

- All-risk coverage: This provides protection against significant damage or loss caused by external factors like vermin, theft, or damage by improper handling.

- Warehouse-to-warehouse coverage: This protects against damages or loss caused while the cargo is being transported between warehouses.

Types of

Types of Cargo Insurance can be categorized into two main types: Motor Truck Cargo Insurance and Marine Cargo Insurance.

Motor Truck Cargo Insurance covers risks related to shipping freight on land, such as collision damage or theft. This type of insurance is ideal for clients who need coverage for goods transported on land via utility vehicles or trucks.

Marine Cargo Insurance, on the other hand, covers damage from accidents, weather, loading, and unloading, among other risks associated with airplanes and ships. It's perfect for clients who frequently have international shipments that travel via ocean and air.

Some common types of Marine Cargo Insurance policies include General Coverage, All-Risk Coverage, and Warehouse-to-Warehouse Coverage. General Coverage is the standard insurance policy that covers partial losses for policyholders, while All-Risk Coverage provides protection against significant damage or loss caused by external factors like vermin, theft, or damage by improper handling.

Here are some specific types of Marine Cargo Insurance policies:

- General Coverage: Covers partial losses for policyholders

- All-Risk Coverage: Covers significant damage or loss caused by external factors

- Warehouse-to-Warehouse Coverage: Protects against damages or loss caused while the cargo is being transported between warehouses

These are just a few examples of the various types of Cargo Insurance available. It's essential to understand the specific needs and risks of your business to choose the right type of insurance.

The Differences Between

Cargo insurance and general liability insurance are two types of insurance policies that provide coverage for different risks.

Cargo insurance specifically protects against losses or damages to goods during transit, whereas general liability insurance covers damages to other people or property.

General liability insurance is often required by law for businesses that interact with the public, but cargo insurance is usually a business-to-business agreement between a shipper and an insurance provider.

The key difference between the two is the type of risk they cover: cargo insurance focuses on the goods being transported, while general liability insurance focuses on potential lawsuits or damages to others.

Discover more: Carrier Liability vs Cargo Insurance

Protection and Benefits

Cargo insurance provides financial protection against loss or damage to goods during transit, and policies can be tailored to meet specific business needs considering factors like the value of goods, mode of transportation, destination, and level of risk involved.

Cargo insurance can help mitigate transportation's financial risks, including the risk of delay or disruption to delivery, which can result in extra costs for storage, rerouting, and other expenses.

The benefits of cargo insurance include protecting against loss or damage, mitigating financial risks, and ensuring compliance with legal and regulatory requirements for international shipments.

Cargo insurance is essential for moving freight internationally, ensuring compliance, and allowing goods to be transported easily and efficiently to meet business demands.

Here are some key benefits of offering cargo insurance to commercial transportation operations:

- Lower your clients’ out-of-pocket costs by providing coverage for unexpected damage.

- Get your clients the protection they need to cover costs associated with cargo damages or losses.

- Give your clients peace of mind knowing their cargo is safe and finances are protected.

- Expand your business by offering cargo insurance and partnering with a reputable provider.

Cost and Deductible

The cost of cargo insurance is calculated as a percentage of the value of the goods being insured. This means that the more valuable your goods, the higher your insurance premium will be.

Higher coverage limits and lower deductibles will result in higher premiums, while lower coverage limits and higher deductibles will result in lower premiums. It's essential to consider your specific business needs when choosing your coverage limits and deductibles.

The insurance market also plays a role in determining the premium price of a cargo coverage policy, with a wide range of price differences between cargo insurance companies. Getting multiple quotes for coverage is crucial to find the best deal.

External factors, such as the risks associated with a specific route, origin, or destination, also impact the insurance cost.

Expand your knowledge: Explain Common Carrier Cargo Insurance Coverage

Understanding the Cost

The cost of cargo insurance is typically calculated as a percentage of the value of the goods being insured.

Two significant variables in cargo insurance cost are the coverage limits and deductibles selected by the policyholder, with higher coverage limits and lower deductibles resulting in higher premiums, and lower coverage limits and higher deductibles resulting in lower premiums.

For more insights, see: Transportation Insurance Cost

Getting multiple quotes for coverage is essential due to the wide range of price differences between cargo insurance companies.

The insurance market plays a role in determining the premium price of a cargo coverage policy.

External factors, such as the risks associated with a specific route, origin, or destination, also help determine the insurance cost.

Our Includes Payments

The cost of cargo insurance can be a significant expense for businesses, but there are ways to manage it. The cost is typically calculated as a percentage of the value of the goods being insured.

Two of the most significant variables in cargo insurance cost are the coverage limits and deductibles selected by the policyholder. Higher coverage limits and lower deductibles will typically result in higher premiums, while lower coverage limits and higher deductibles will result in lower premiums.

Cargo insurance companies consider external factors to determine the insurance cost, including the risks associated with a specific route, origin or destination.

Our cargo coverage includes payments for unrecoverable freight charges after a loss, loss-recovery expenses in addition to the limit, and clean-up and pollution-removal expenses up to $10,000 in addition to the limit.

Having a single deductible for a single-unit loss involving covered cargo, a tractor, and a trailer can save you substantial out-of-pocket costs.

Freight Forwarders and Carriers

Freight forwarders are companies that specialize in arranging the transportation of goods and often offer cargo insurance as part of their services.

They can recommend the best type of coverage for the goods being transported and help clients get quotes from insurance providers. This is a great resource for businesses that want to ensure their goods are properly insured during transit.

Freight forwarders and carriers may also offer cargo insurance as an optional service for their customers, which can be included in the shipping fees or provided as an additional service for an extra fee.

Freight Forwarders

Freight forwarders are companies that specialize in arranging the transportation of goods.

They often offer cargo insurance as part of their services, which can provide peace of mind for shippers.

These companies can recommend the best type of coverage for the goods being transported.

They can also help clients get quotes from insurance providers.

It's essential to carefully review the terms and conditions of the policy and ensure the coverage and cost meet your budget and business goals.

Hired Auto

Hired Auto coverage is a crucial aspect of freight forwarding and carrier operations. It extends your Cargo protection to loads for which you are responsible under a bill of lading.

You might need this type of coverage when you borrow or rent an additional unit, which can be a common practice, especially during peak seasons. This ensures that your goods are adequately insured, even when they're being transported in a different vehicle.

Allowing another motor carrier to "trip lease" to haul freight under your authority is another situation that requires Hired Auto coverage. This can be a cost-effective way to increase your capacity, but it's essential to have the right insurance in place.

Take a look at this: Hitch Trailer Cargo Carrier

Here are some examples of situations that require Hired Auto coverage:

- You borrow or rent an additional unit.

- You ask another truck professional who has limited, if any, Cargo insurance to haul a portion of your goods.

- You allow another motor carrier to “trip lease” to haul freight under your authority.

By having Hired Auto coverage, you can ensure that your cargo is protected, even when it's being transported by someone else. This provides peace of mind and helps you avoid potential financial losses.

Where Do You Get Help?

Getting help with cargo insurance is easier than you think. You can turn to insurance brokers who specialize in cargo insurance, freight forwarders who often offer insurance services, or carriers who can provide you with a policy that fits your needs.

Insurance brokers can help you navigate the complex world of cargo insurance and find a policy that suits your budget.

Freight forwarders are a great option if you're looking for a one-stop-shop solution, as they can handle all aspects of shipping, including insurance.

You might enjoy: Marine Cargo Insurance Brokers

Commercial Transportation Operations

Cargo insurance is a must-have for businesses with international supply chains, as it helps mitigate financial risks associated with transportation.

Cargo insurance can help cover costs related to delay or disruption to the delivery of goods, such as extra storage or rerouting expenses.

Protecting against loss or damage is just one of the key benefits of cargo insurance.

Cargo insurance is essential for international freight movement, ensuring compliance with legal and regulatory requirements.

Here are some key reasons why cargo insurance is a must for commercial transportation operations:

- Moving your freight internationally.

- Ensuring compliance.

- Allowing goods to be transported easily and efficiently to meet your business’s market demands.

Things to Consider

The value and nature of the goods being shipped are crucial factors to consider when arranging cargo insurance. This is because the type of goods can affect the level of risk involved in transportation.

The mode of transportation should also be taken into account, as different modes come with varying levels of risk. For example, shipping by sea is generally considered safer than shipping by air.

If your seller offers to arrange insurance coverage, you should ask about the policy's coverage of different kinds of losses. This includes damage to the goods during transit, theft, and other potential risks.

You should also know the policy limits, which determine the maximum amount that can be claimed in the event of a loss. It's essential to understand these limits to avoid any surprises.

The insurance company underwriting the policy is also important to research. You should look for a reputable company with a good track record of paying claims.

Explore further: Transportation Network Company Insurance

Benefits of Offering to Commercial Transportation Operations

Offering cargo insurance to commercial transportation operations can be a game-changer for your clients. It can help reduce their out-of-pocket costs in case of unexpected damage or loss.

Cargo insurance can give your clients the protection they need, providing coverage for unexpected damage or loss. This can help them avoid financial burdens that can be devastating to their business.

One of the greatest benefits of offering cargo insurance is the peace of mind it brings to your clients. They can rest assured that their cargo is safe and their finances are protected.

Here are some benefits of offering cargo insurance to commercial transportation operations:

- Lower your clients' out-of-pocket costs: Cargo insurance can help reduce the financial burden of unexpected damage or loss.

- Get your clients the protection they need: Cargo insurance provides coverage for unexpected damage or loss, giving your clients peace of mind.

- Give your clients peace of mind: Cargo insurance can help your clients rest assured that their cargo is safe and their finances are protected.

- Expand your business: Offering cargo insurance can help you expand your business by providing a valuable service to your clients.

By offering cargo insurance, you can help your clients navigate the complexities of commercial transportation operations and ensure that their cargo is protected.

Types of Transport Operations

Commercial transportation operations can be diverse and complex, involving various types of vehicles and routes. Long-haul trucking is one such operation, covering extended trips across long distances.

Short-haul trucking, on the other hand, involves local routes and typically shorter trips. Dump trucks are another type of vehicle used in transportation operations, often carrying heavy loads.

Auto fleets and tow trucks are also common in commercial transportation operations, providing a range of services to clients. Cement mixers and delivery trucks are used in specific industries, such as construction and retail.

Cargo vans and garbage trucks are also used in transportation operations, often in urban areas. Dually pickups and box trucks are versatile vehicles used in various contexts.

Recommended read: Self Insured Trucking Companies

Car haulers and tractors are specialized vehicles used in the transportation of vehicles. Flatbeds are another type of vehicle used in commercial transportation operations, often carrying oversized or heavy loads.

Here are some examples of transportation operations:

- Long-haul trucking

- Short-haul trucking

- Dump trucks

- Auto fleets

- Tow trucks

- Cement mixers

- Delivery trucks

- Cargo vans

- Garbage trucks

- Dually pickups

- Box trucks

- Car haulers

- Tractors

- Flatbeds

Highlights of Motor Trucks

Motor trucks play a vital role in commercial transportation operations, and understanding their key features can help businesses navigate the complexities of this industry.

At Prime, they offer cargo insurance coverage solutions that can support all types of businesses, including new or experienced businesses, businesses with growing fleets, and businesses with claims history issues.

Their flexible underwriting allows them to cater to various business needs, and their customized solutions are designed to serve the best interests of policyholders.

Risk management services are also available to help clients reduce their odds of filing a claims.

Prime's team of in-house claims professionals is dedicated to achieving the best possible outcomes for each policyholder, even if it requires extensive litigation.

Here are some key types of motor trucks that are commonly used in commercial transportation operations:

- delivery trucks

- trucking

Partner Selection

When selecting a partner for your cargo insurance needs, there are several key factors to consider. A qualified team is essential, as they will guide you and your policyholders through the purchasing and claims process.

A great cargo insurance partner knows how to navigate complex regulations and rules to resolve claims quickly. This expertise is crucial in ensuring smooth operations and minimal downtime.

Look for a partner that offers flexible insurance policies based on your clients' needs. Low deductibles are a key consideration, as they can help reduce financial burdens in the event of a claim.

The right provider should offer all-risk coverage for standard commodities against physical loss, damage, or financial exposure while goods are in transit. This comprehensive coverage is essential in protecting your business and your clients' interests.

Here are some key qualities to look for in a cargo insurance partner:

- Qualified team: A team of insurance experts who can guide you and your policyholders through the processes of purchasing and making claims.

- Flexible insurance policies: Policies that can be tailored to meet the specific needs of your clients.

- All-risk coverage: Coverage for all standard commodities against physical loss, damage, or financial exposure while goods are in transit.

Frequently Asked Questions

What is meant by cargo insurance?

Cargo insurance protects goods from loss, damage, or theft during transportation by various modes, including air, sea, rail, and road. It provides financial coverage for goods in transit, giving businesses peace of mind and financial security.

Is cargo insurance necessary?

Yes, cargo insurance is necessary to protect businesses from various transportation risks and disruptions. It safeguards against unforeseen events that can impact your supply chain and bottom line.

What cargo insurance gives cover for?

Cargo insurance covers loss or damage due to accidents during transit, including collisions, overturning, and other mishaps on land, air, or sea.

Sources

- https://www.flexport.com/blog/what-is-cargo-insurance-and-how-does-it-work/

- https://falveyinsurancegroup.com/blog/marine-cargo-insurance/understanding-three-kinds-of-cargo-insurance/

- https://schneider.com/resources/research-and-reports/cargo-insurance-101-protect-business-bottom-line

- https://gwccnet.com/products-services/cargo-coverage

- https://www.primeis.com/education-center/articles/what-is-cargo-insurance/

Featured Images: pexels.com