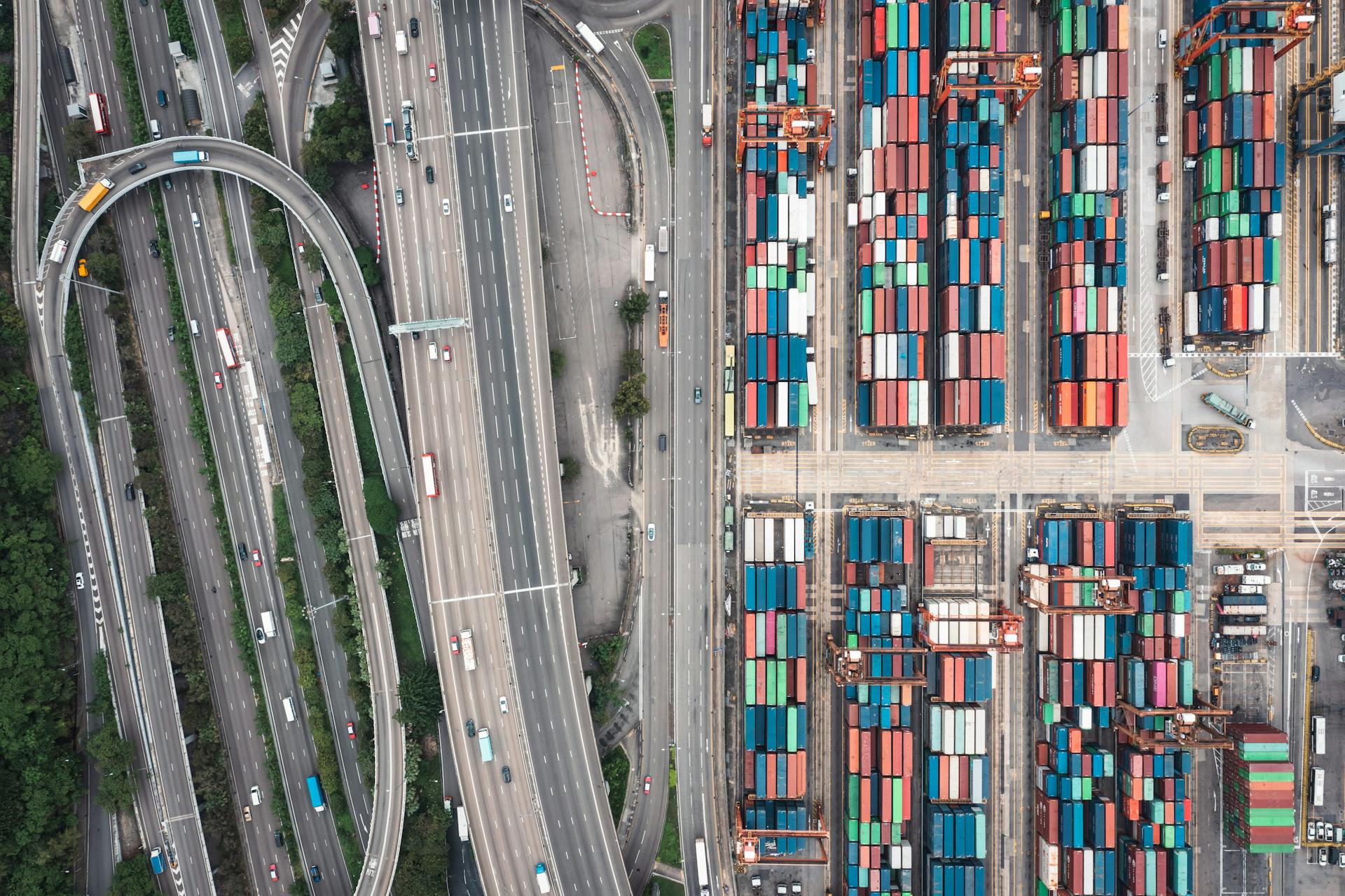

Shanghai International Port Group (SIPG) has a diverse range of services that cater to the needs of various customers.

SIPG offers a wide range of services including container handling, bulk cargo handling, and cruise ship services.

One of its notable services is container handling, with over 30 million TEUs (twenty-foot equivalent units) handled annually.

SIPG has a significant overseas presence with operations in 19 countries and regions.

About

Shanghai International Port Group is a leading port operator in China, with a rich history dating back to 1993. It was established by the Shanghai Municipal Government to manage and operate the city's ports.

The company has grown exponentially since its inception, with a strong focus on innovation and technology. Today, it operates 34 ports across China, including the Shanghai Waigaoqiao Port and the Shanghai Yangshan Deep-Water Port.

Shanghai International Port Group has a significant presence in the global shipping industry, with a strong network of partners and customers worldwide. It handles over 700 million tons of cargo annually, making it one of the busiest ports in the world.

For another approach, see: Ports in Frankfurt Am Main

The company's commitment to sustainability and environmental protection is evident in its efforts to reduce emissions and improve energy efficiency. It has implemented various green initiatives, including the use of liquefied natural gas (LNG) and wind power.

Shanghai International Port Group has received numerous awards and recognition for its outstanding performance and contributions to the shipping industry.

Operations and Services

Shanghai International Port Group offers a range of services, including container business, port logistics business, other business, port service business, unallocated, intersegment elimination, and bulk cargo business.

The company's container business has seen steady growth, with revenues reaching 15.96 billion in 2023, up from 13.54 billion in 2019.

Their port logistics business has experienced fluctuations, with a significant drop in 2020 to 7.21 billion, but has since recovered to 10.93 billion in 2023.

Here is a breakdown of the company's sales by activity for 2023:

The company's revenue from China has been steadily increasing, reaching 37.55 billion in 2023.

Overseas Operations

SIPG has expanded its operations beyond China, with a significant presence in Israel.

In 2015, SIPG won the bid for the concession to operate the port of Haifa's new Bay Terminal in Israel for 25 years starting in 2021.

This marks a significant milestone in SIPG's growth and diversification.

SIPG is now set to manage the Bay Terminal, which is expected to boost the port's capacity and efficiency.

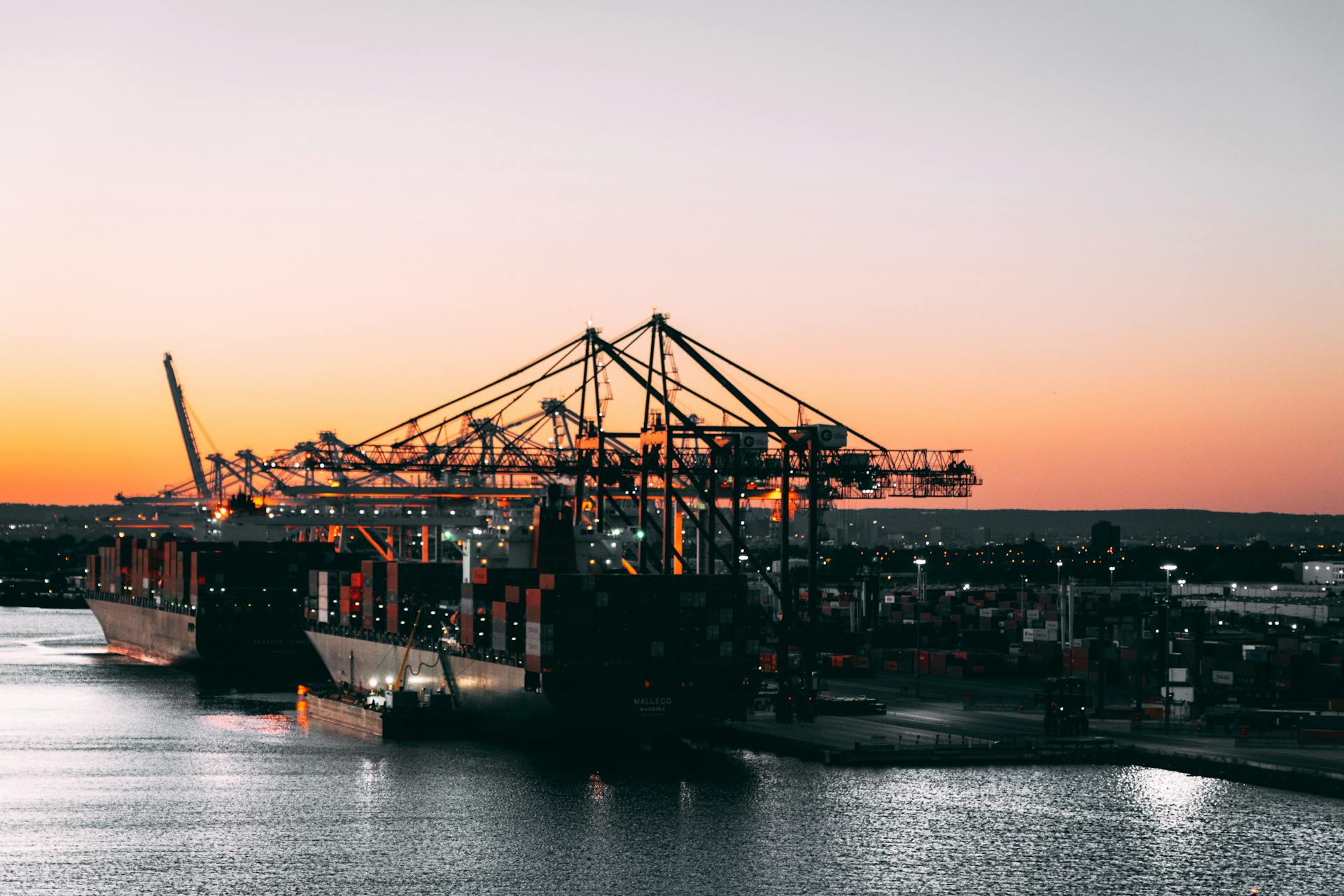

Marine Services

Marine Services play a crucial role in global trade, and Shanghai International Port is a key player in this industry. The company's Q1 net profit was up 5.1% year-over-year.

Shanghai International Port Group reported a 13.3% increase in net profit for 2024. This impressive growth is a testament to the company's strong performance in the marine services sector.

Several marine port services companies have reported changes in their stock prices over the past few days and years. For example, Shanghai International Port (Group) Co., Ltd. saw a 0.36% increase in its stock price over the past 5 days.

A fresh viewpoint: Canada Customs at Pearson International Airport

Here are some key statistics on marine port services companies:

These statistics provide a snapshot of the marine services industry and highlight the performance of key players in this sector.

Sales by Activity:

Sales by Activity provides a clear picture of Shanghai International Port (Group) Co., Ltd.'s revenue streams.

Container Business was the largest contributor to revenue in 2022, generating 16.1 billion yuan.

The company's revenue from Container Business increased by 1.22 billion yuan from 2021 to 2022.

Port Logistics Business saw a significant decline in revenue from 20.13 billion yuan in 2019 to 7.21 billion yuan in 2020.

However, revenue from Port Logistics Business recovered somewhat in 2021, reaching 10.34 billion yuan.

Other Business revenue fluctuated over the years, ranging from 4.97 billion yuan in 2019 to 7.72 billion yuan in 2023.

Port Service Business revenue also experienced some fluctuations, with a high of 3.32 billion yuan in 2023.

Bulk Cargo Business revenue remained relatively stable, ranging from 1.33 billion yuan in 2020 to 1.64 billion yuan in 2023.

China was the largest market for the company, accounting for 37.55 billion yuan in revenue in 2023.

Here's a breakdown of the company's revenue by activity:

Industry Comparison

In the container terminal industry, ESG risk ratings play a significant role in evaluating a company's environmental, social, and governance performance. Adani Ports & Special Economic Zone Ltd. has a low ESG risk rating of 13.7.

Among the companies listed, Adani Ports & Special Economic Zone Ltd. ranks 46 out of 178 in terms of ESG risk.

International Container Terminal Services, Inc. has a slightly higher ESG risk rating of 17.1, placing it 38 spots lower than Adani Ports & Special Economic Zone Ltd. in the industry ranking.

Here's a brief comparison of the companies' ESG risk ratings and industry rankings:

These rankings give us a clear picture of the companies' relative performance in terms of ESG risk.

Financial Information

Shanghai International Port Group has a significant presence in the global container shipping industry, with a market share of around 2.5% in 2020.

The company's revenue reached 43.8 billion yuan in 2020, a 4.3% increase from the previous year.

Shanghai International Port Group operates 35 ports in China and abroad, including the Shanghai Waigaoqiao Port, one of the largest container terminals in the world.

The company's container throughput reached 44.6 million twenty-foot equivalent units (TEUs) in 2020, a 3.5% increase from the previous year.

Shanghai International Port Group has a strong financial foundation, with a net profit of 8.4 billion yuan in 2020.

Investors and Shareholders

Shanghai International Port Group has a diverse group of shareholders, with the largest shareholder being Shanghai State-Owned Assets Supervision & Administration, holding 44.26% of the equities.

The top shareholders also include China Merchants Port Holdings Company Limited, with a 28.13% stake, and Cosco Shipping Holdings Co., Ltd., holding 15.6% of the equities.

Here are the top shareholders, along with their percentage of ownership:

These shareholders have a significant influence on the company's direction and decision-making processes.

Equity Investments

Shanghai International Port (SIPG) is a major shareholder of the Bank of Shanghai.

SIPG also holds a significant stake in the Postal Savings Bank of China (PSBC), owning 16.87% of all H ordinary shares and 0.17% of A ordinary shares as of December 31, 2019.

This investment is a result of SIPG's partnership with COSCO Shipping to acquire the stake of OOIL, the parent company of OOCL.

SIPG's equity investments are diverse, spanning across various industries and sectors.

Here are some key facts about SIPG's equity investments:

- SIPG owns 16.87% of all H ordinary shares of PSBC.

- SIPG owns 0.17% of A ordinary shares of PSBC.

- SIPG partnered with COSCO Shipping to acquire the stake of OOIL.

Shareholders:

When looking at the shareholders of Shanghai International Port (Group) Co., Ltd., we can see that the company has a diverse group of investors.

Shanghai State-Owned Assets Supervision & Administration holds the largest share of the company, with 44.26% of equities and a valuation of ¥8.217 billion.

The top shareholders of Shanghai International Port (Group) Co., Ltd. are:

Min Zhang is one of the individual shareholders, holding 1.207% of the company's equities and a valuation of ¥671 million.

Other notable individual shareholders include Hai Jian Wang, Zhi Yong Yang, Xiang Ming Ding, and Xin Zhang, each holding a smaller percentage of the company's equities.

Management and Governance

Shanghai International Port Group's management of ESG material risk is rated as Average. This suggests that the company has some work to do in terms of managing its environmental, social, and governance (ESG) issues.

The company's management score assesses the robustness of its ESG programs, practices, and policies. Unfortunately, it seems that Shanghai International Port Group's management of ESG issues falls short in this regard.

Executive Committee

The Executive Committee of Shanghai International Port (Group) Co., Ltd. is responsible for overseeing the company's management and governance.

Jin Shan Gu serves as the President of the company, a position he has held since July 31, 2023.

He is 63 years old.

The General Counsel of the company is Xiang Ming Ding, who has been in the role for an unknown period of time.

Here is a summary of the Executive Committee members:

Board Composition:

The Board Composition of Shanghai International Port (Group) Co., Ltd. is a diverse group of individuals with varying levels of experience and tenure.

Curious to learn more? Check out: Carnival Cruise Group Phone Number

The oldest member of the board is Rui Qing Shao and Jian Wei Zhang, both aged 68, who have been serving since May 30, 2019.

Song Xu, a 53-year-old director, has been a part of the board since an unknown date.

The most recent additions to the board are Shuai Chen, who joined on June 19, 2023, and Xiao Ping Tu, who joined on April 22, 2024.

The age range of the board members is quite wide, spanning from 44 (Ben Liu) to 68 (Rui Qing Shao and Jian Wei Zhang).

Here is a list of the board members, including their age and date of appointment:

Management

Management is a crucial aspect of a company's overall performance, and it's essential to understand how well a company is managing its Environmental, Social, and Governance (ESG) issues.

A company's management score assesses the robustness of its ESG programs, practices, and policies.

Shanghai International Port (Group) Co., Ltd. received an average rating for its management of ESG material risk.

This indicates that the company may need to improve its ESG programs and practices to better manage its material risks.

A company's management of ESG issues can have a significant impact on its long-term sustainability and success.

If this caught your attention, see: Suny Maritime International Transportation Management

Frequently Asked Questions

Who owns Shanghai International Group?

Shanghai International Group is owned by the state of the People's Republic of China. It operates as a large state-owned financial holding group.

Who owns Port of Shanghai?

The Port of Shanghai is owned by Shanghai International Port Company Limited, a public listed company, with the Shanghai Municipal Government holding a significant 44% stake.

Who is the owner of Shanghai Port FC?

Shanghai Port FC is owned by Shanghai International Port Group (SIPG), a Chinese company. The club was founded by former Chinese international footballer Xu Genbao in 2005.

Sources

- https://en.wikipedia.org/wiki/Shanghai_International_Port_Group

- https://www.marketscreener.com/quote/stock/SHANGHAI-INTERNATIONAL-PO-6499267/company/

- https://www.sustainalytics.com/esg-rating/shanghai-international-port-group-co-ltd/1017542484

- https://www.maersk.com/news/articles/2023/03/24/maersk-signs-mou-with-shanghai-international-port-group-on-green-methanol-bunkering

- https://www.cbinsights.com/company/shanghai-international-port

Featured Images: pexels.com