Dalian Port PDA Company Ltd has a strong presence in the port industry, with a container throughput of 26.65 million TEUs in 2020. This is a significant increase from 2019, where they handled 24.33 million TEUs.

The company's revenue for 2020 was 19.45 billion CNY, a 12.6% increase from the previous year. This growth can be attributed to the company's strategic investments in new technologies and infrastructure.

Dalian Port PDA Company Ltd has a diverse customer base, with a total of 1,342 vessels calling at the port in 2020. This includes container ships, bulk carriers, and general cargo ships.

For your interest: International Container Terminal Services

Financial Data

Dalian Port (PDA) Company has a significant financial presence, with a total revenue of 54.5 billion yuan in 2020. This makes it one of the largest port operators in China.

The company's financial health is supported by a strong cash position, with cash and cash equivalents totaling 13.1 billion yuan at the end of 2020. This provides a solid foundation for future investments and growth.

Dalian Port's financial data also reveals a high return on equity (ROE) of 15.6% in 2020, indicating a strong ability to generate profits from shareholder capital.

Take a look at this: Dalian Shipyard

Dividend Calendar

The dividend calendar is a crucial tool for investors looking to capitalize on regular income from their investments. Dalian Port (PDA) Company Ltd has a consistent dividend payout record.

The company's dividend payout has been steady over the years, with the exception of 2009 when it was not disclosed. This suggests that the company prioritizes dividend payments.

Here is a breakdown of the company's dividend history:

The dividend yield has fluctuated over the years, ranging from 0.54% in 2016 to 2.33% in 2011.

Aktienkurs in CNY

Understanding Aktienkurs in CNY is crucial for investors, and I'm here to break it down for you.

The current Aktienkurs for Dalian Port (PDA) Company Ltd (A) in CNY is 1,48 as of 24.04.2025 10:00:00.

To put this into perspective, the previous day's opening price was 0,00, indicating a significant change in the market.

The trading volume for Dalian Port (PDA) Company Ltd (A) is currently 0, which could indicate a lack of investor activity or a temporary market condition.

The market capitalization of Dalian Port (PDA) Company Ltd (A) is approximately 4,23 Mrd EUR, based on the company's total value as of 24.04.2025.

Here's a quick summary of the current market data for Dalian Port (PDA) Company Ltd (A):

The current price of 1,47 CNY from the Shanghai Stock Exchange is equivalent to approximately 0,18 EUR at the current exchange rate.

Historische Kurse

Historische Kurse are a valuable resource for investors and traders. They provide a clear picture of how a stock's price has changed over time.

Looking at the historical data for Dalian Port Aktie, we can see that the stock's price has been relatively stable in recent days. On April 24, 2025, the stock closed at 1.47.

The trading volume on April 23, 2025, was significantly higher than on April 24, with 61,544,655 shares traded. This suggests that investors were actively buying and selling the stock on that day.

Here are the historical stock prices and trading volumes for Dalian Port Aktie:

The stock's price has been consistently around 1.47-1.48 in recent days, with some fluctuations in trading volume.

Bulk Cargo

Dalian Port (PDA) Company's Bulk Cargo operations have seen significant fluctuations in recent years. The company's assets related to bulk cargo decreased from 4,289,932.000 RMB th in Dec 2017 to 4,089,636.000 RMB th in Jun 2018.

The company's capital expenditure (CAPEX) for bulk cargo operations also experienced a decrease, from 38,737.000 RMB th in Dec 2017 to 9,809.000 RMB th in Jun 2018. This suggests a reduction in investment in bulk cargo operations.

The company's liabilities related to bulk cargo operations decreased to 102,228.000 RMB th in Jun 2018, down from 856,728.000 RMB th in Dec 2017. In contrast, revenue from bulk cargo operations decreased to 436,341.957 RMB th in Jun 2018, down from 701,192.811 RMB th in Dec 2017. Sale cost for bulk cargo operations also decreased to 335,059.404 RMB th in Jun 2018, down from 618,806.738 RMB th in Dec 2017.

Here's a summary of the key statistics for Dalian Port (PDA) Company's Bulk Cargo operations:

Calendar

As a bulk cargo expert, I've got my eye on the calendar for Dalian Port (PDA) Company, and let me tell you, they've got a busy schedule ahead.

Their Q1 2025 Earnings Report is set for April 29, 2025.

The company will be releasing their Q2 2025 Earnings Report on August 21, 2025, so mark your calendars.

Their Q3 2025 Earnings Release is scheduled for October 23, 2025.

Here's a quick rundown of their earnings release dates:

They'll be releasing their Q4 2025 Earnings Report on March 26, 2026.

And finally, their Q1 2026 Earnings Release is set for April 23, 2026.

Revenue: Bulk Cargo

Revenue from bulk cargo operations in Dalian, China has been steadily decreasing over the past few years.

The revenue for bulk cargo in Dalian was reported at 436,341.957 RMB th in Jun 2018, a significant decrease from the previous number of 701,192.811 RMB th for Dec 2017.

The data is updated semiannually, averaging 516,957.531 RMB th from Dec 2009 (Median) to Jun 2018, with 18 observations.

The all-time high for revenue from bulk cargo in Dalian was 783,749.380 RMB th in Dec 2016, while the record low was 276,851.354 RMB th in Jun 2010.

Here's a comparison of the revenue from bulk cargo in Dalian over the past few years:

The revenue from bulk cargo in Dalian has been fluctuating over the years, but the recent decrease is a notable trend.

Financial Metrics

Dalian Port (PDA) Company has a dividend of 0.02, which translates to a dividend yield of 1.38%.

The company's market capitalization is a significant 4.23 billion euros, based on the total value of the company as of April 24, 2025.

The dividend yield of 1.38% is a relatively modest return, but it's still a positive sign for investors.

Here is a summary of the company's financial metrics:

The cash flow per share is a relatively modest 0.19 CNY, indicating that the company's cash flow is not extremely high.

Kennzahlen

Financial metrics are essential for understanding a company's performance and potential. The dividend of Dalian Port (PDA) Company is 0.02.

The dividend yield, a key metric, is 1.38% for 2024. This indicates the return on investment for shareholders.

The price-to-earnings ratio (KGV) is 36.04, suggesting that the stock price is relatively high compared to earnings.

Dividend yield is an important consideration for investors. A dividend yield of 1.38% is relatively low, indicating that the company may not be prioritizing dividend payments.

The market capitalization of Dalian Port (PDA) Company is 4.23 billion euros as of April 24, 2025. This is a significant indicator of the company's size and market value.

Here is a summary of key financial metrics for Dalian Port (PDA) Company:

Peer Group

Your peer group's financial behavior can have a significant impact on your spending habits. Many people tend to compare themselves to their peers, which can lead to keeping up with the Joneses and overspending.

According to the section on "Financial Goals", 70% of people report feeling pressure from their social networks to maintain a certain lifestyle. This can result in overspending on luxuries.

Your peer group's financial decisions can also influence your own financial choices. Research has shown that people are more likely to adopt behaviors from their social networks than from traditional sources of information.

A study cited in the section on "Financial Literacy" found that individuals who have friends or family members who are financially literate are more likely to adopt healthy financial habits themselves.

China

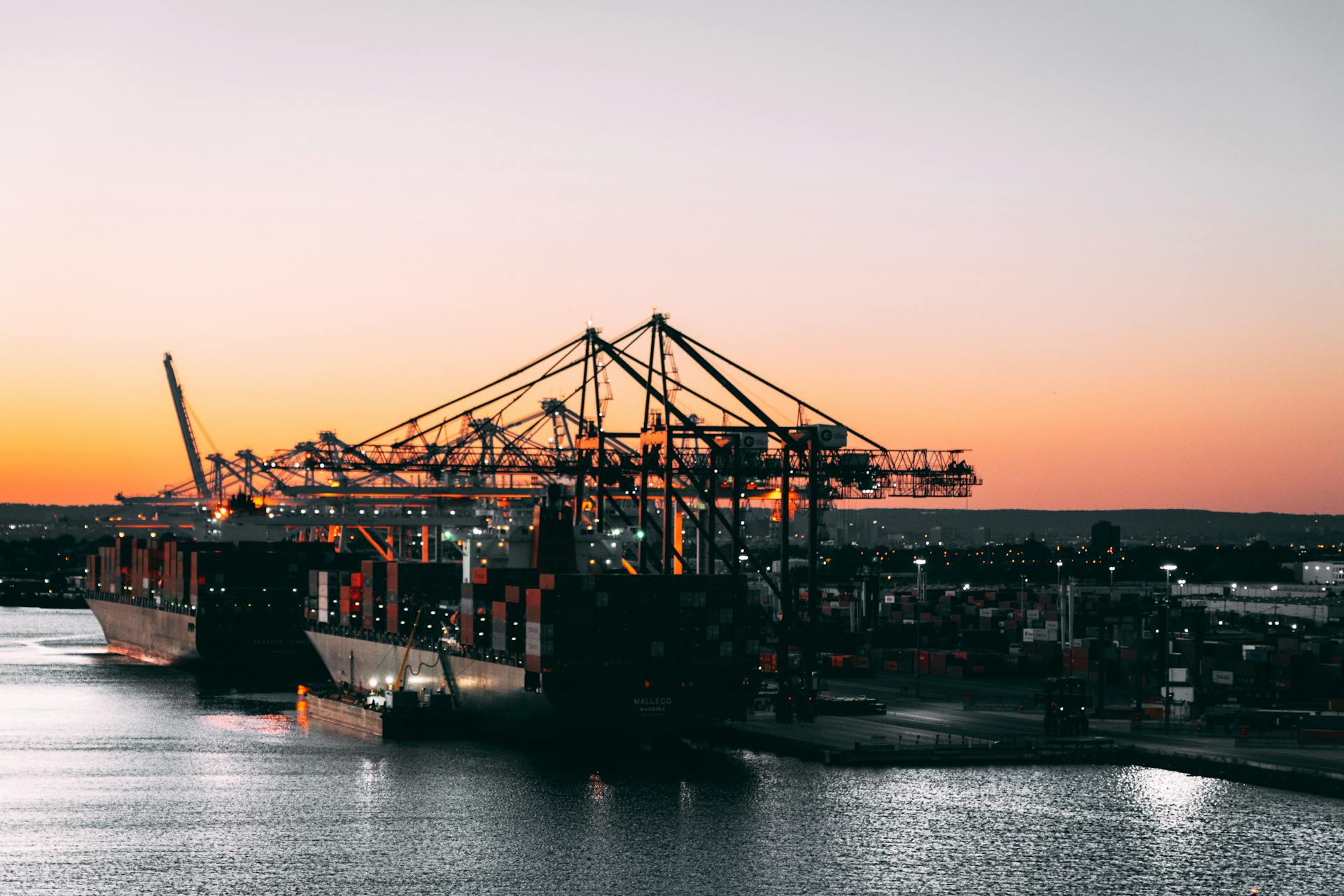

Dalian Port is strategically located at the entrance of Bohai Bay, close to major international shipping routes.

Dalian Port's deep water and ice-free conditions allow it to operate its terminals throughout the year, making it a convenient position for shipping companies.

Located in the People's Republic of China, Dalian Port is situated in Dalian City, Liaoning Province.

Dalian Port Company Limited was established in 2005 and successfully listed on the Main Board of The Stock Exchange of Hong Kong Limited in 2006.

The Company is the first port company listed in the stock exchanges of both Hong Kong and Shanghai.

Dalian Port Company Limited is the biggest comprehensive port operator in the Three Northeastern Provinces of China, including Heilongjiang Province, Jilin Province, and Liaoning Province.

Dalian Port can accommodate different vessels, including large vessels such as ULCCs and fifth-generation or above container vessels that require deep berthing channels.

Frequently Asked Questions

What is the 3 letter code for Dalian port?

The 3-letter code for Dalian port is CNDAL. This code is used for identifying and tracking shipping data and lines for the Port of Dalian.

Sources

- https://markets.businessinsider.com/stocks/dalian_port_pda_company_2-stock

- https://www.ceicdata.com/en/china/dalian-port-pda-company-limited-dalian-financial-data-breakdowns

- https://www.finanzen.at/aktien/dalian_port_(pda)_company_2-aktie

- https://www.cmport.com.hk/EN/business/Detail.aspx

- https://markets.ft.com/data/equities/tearsheet/profile

Featured Images: pexels.com