The corrugated packaging market is expected to reach a significant value by 2025, driven by the increasing demand for sustainable packaging solutions. This growth is largely attributed to the rising awareness among consumers and businesses about the environmental benefits of using corrugated packaging.

Corrugated packaging is a popular choice for many industries, including e-commerce, food and beverages, and pharmaceuticals, due to its durability, versatility, and cost-effectiveness. The market is also driven by the increasing use of corrugated packaging in the e-commerce sector, as online shopping continues to grow.

The global corrugated packaging market is expected to grow at a compound annual growth rate (CAGR) of around 4% from 2020 to 2025, driven by the increasing demand for sustainable packaging solutions. This growth is expected to be driven by the adoption of corrugated packaging in emerging markets.

Discover more: Hands-free Power Liftgate Market

Market Trends

The corrugated packaging market is experiencing a surge in growth, driven by emerging markets and innovative technologies.

The demand for corrugated boxes is increasing, particularly in emerging markets, which is expected to drive the growth of the global corrugated boxes market over the forecast period.

Key players in the market are adopting inorganic growth strategies, such as mergers, to expand their manufacturing capacity and drive growth.

Increasing regulatory support is also expected to drive the growth of the market over the forecast period.

The need for secondary corrugated board packaging that protects products and enhances brand image during home delivery has become crucial in the e-commerce industry.

To meet this demand, converters in the packaging industry are adopting advanced technology to deliver high-quality graphic designs as shipping boxes.

Innovative corrugated boxes are being introduced to meet the demands of consumers, which is estimated to drive the growth of the global corrugated boxes market over the forecast period.

Some notable examples of innovative corrugated boxes include:

- DS Smith's recyclable Shop.able Carriers box solution for shipping groceries, which is safe for storing fruits and vegetables and water-resistant.

- Blue Box Packaging's custom printed rigid corrugated boxes for gift packaging purpose, launched in the U.K., U.S., and Australia.

- WestRock's new corrugated box plant in Pleasant Prairie, Wisconsin, U.S., which will feature automation technology for manufacturing and printing corrugated boxes.

Market Analysis

The corrugated packaging market is a vast and complex industry, but let's break it down to its core. The leading regional markets for corrugated packaging products are North America and Asia Pacific.

These two regions are expected to drive the market growth due to increased demand from various industries, including food and beverage, electronics, and personal care. The efficient demand and supply cycle in these regions is a key factor contributing to their growth.

The single wall segment is the largest segment of the market, accounting for over 50% in 2022. This type of packaging is dominant due to its low cost and ease of use.

The double wall segment is the second largest segment, accounting for over 30% in 2022. It's growing due to its increased strength and durability.

Here's a breakdown of the leading regional markets for corrugated packaging products:

The market in Asia Pacific is expected to explode due to increased growth prospects in the region's burgeoning e-commerce industry and fast expanding organized retail sector.

Regional Analysis

The corrugated packaging market is a global phenomenon, with various regions contributing to its growth. Asia Pacific is the leading region, accounting for a significant share of the market.

Consider reading: Boat and Yacht Transportation Market

The region's strong market share can be attributed to the presence of major industries such as food and beverage, electronics, and personal care, particularly in countries like India, Korea, Japan, and China. These industries have efficient demand and supply cycles, which drives the growth of the corrugated boxes market.

The growth of e-commerce is also a significant factor driving the local market in Asia Pacific. In fact, the region's strong market share is also a result of the substantial presence of corrugated box makers in this area.

Here's a breakdown of the regional markets for corrugated packaging products:

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The leading regional markets for corrugated packaging products are North America and Asia Pacific, with the market in Asia Pacific expected to explode due to increased growth prospects in the region's burgeoning e-commerce industry and fast expanding organized retail sector.

APAC & NA

The Asia Pacific (APAC) region is leading the corrugated boxes market in 2024, driven by the food and beverage, electronics, and personal care industries in countries like India, Korea, Japan, and China. The region's strong market share is also due to the growth of e-commerce and the presence of key players who are adopting advanced technology to expand their product portfolio.

Take a look at this: Poly Vinyl Chloride Packaging Tape Printing Market

APAC's efficient demand and supply cycles are a major factor in its market share. The region's e-commerce industry is driving growth, with a surge in online shopping and a growing organized retail sector. APAC is also home to a large market with a strong industrial presence.

North America is another leading regional market for corrugated packaging products. The market in North America is expected to continue growing steadily throughout the forecast period. The region's market size is significant, with a projected growth rate that is expected to fuel the growth of the corrugated boxes market.

Here's a breakdown of the regions mentioned:

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The Middle East and Africa region is also expected to grow at a promising rate over the forecast period, driven by factors such as rising consumer goods demand and innovation in the electronics and other sectors.

Country-Wise

The Japanese corrugated packaging market is estimated to grow at nearly 6.7% CAGR during the forecast period. This growth is driven by manufacturers innovating new technologies to improve packaging efficiency.

Rengo Co., Ltd. has launched a new system to improve packaging efficiency, called the "Rengo Gemini Packaging System". This system measures the height of merchandise and custom-makes a package of the right size, eliminating empty space in the package and increasing transportation efficiency.

The U.S. market contributed to about 19.1% of the global corrugated packaging market in 2022. The trend of DIY is rising rapidly in the U.S. corrugated packaging market, with manufacturers producing DIY corrugated pallets for end-use industries.

According to Millwood, Inc., DIY corrugated pallets are easy to assemble, require no extra tools, save storage space, and are lighter in weight than wood or plastic pallets, making them a perfect solution for airfreight shipment.

The Swedish corrugated packaging market contributed about 6% to the global corrugated packaging market in 2022. Manufacturers in Sweden are adopting "Arcwise Technology" for the production of corrugated packaging products, which provides unique packaging technology and offers premium packaging at the point of sale through enhanced print quality.

See what others are reading: Package Out for Post Office Delivery

Market Segments

The corrugated packaging market is segmented into various categories, each with its own unique characteristics and applications. The market is dominated by the food & beverages segment, which accounted for a significant share in 2024.

The key segments covered in the corrugated packaging market include slotted boxes, telescope boxes, folder boxes, and rigid boxes. These types of boxes are widely used in various industries, including food & beverages, industrial, and e-commerce.

The corrugated packaging market is also segmented by region, including North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. The market is expected to grow significantly in the coming years, driven by increasing demand for e-commerce and online shopping.

Here are some of the key segments covered in the corrugated packaging market:

- Box

- Slotted Box

- Folder Box

- Telescope Box

- Die Cut Box

- Crates

- Trays

- Octabin

- Pallet

- Others

The single wall segment is the largest segment of the market, accounting for a share of over 50% in 2022. The single wall segment is dominant due to its low cost and ease of use.

Optimizing Box Design

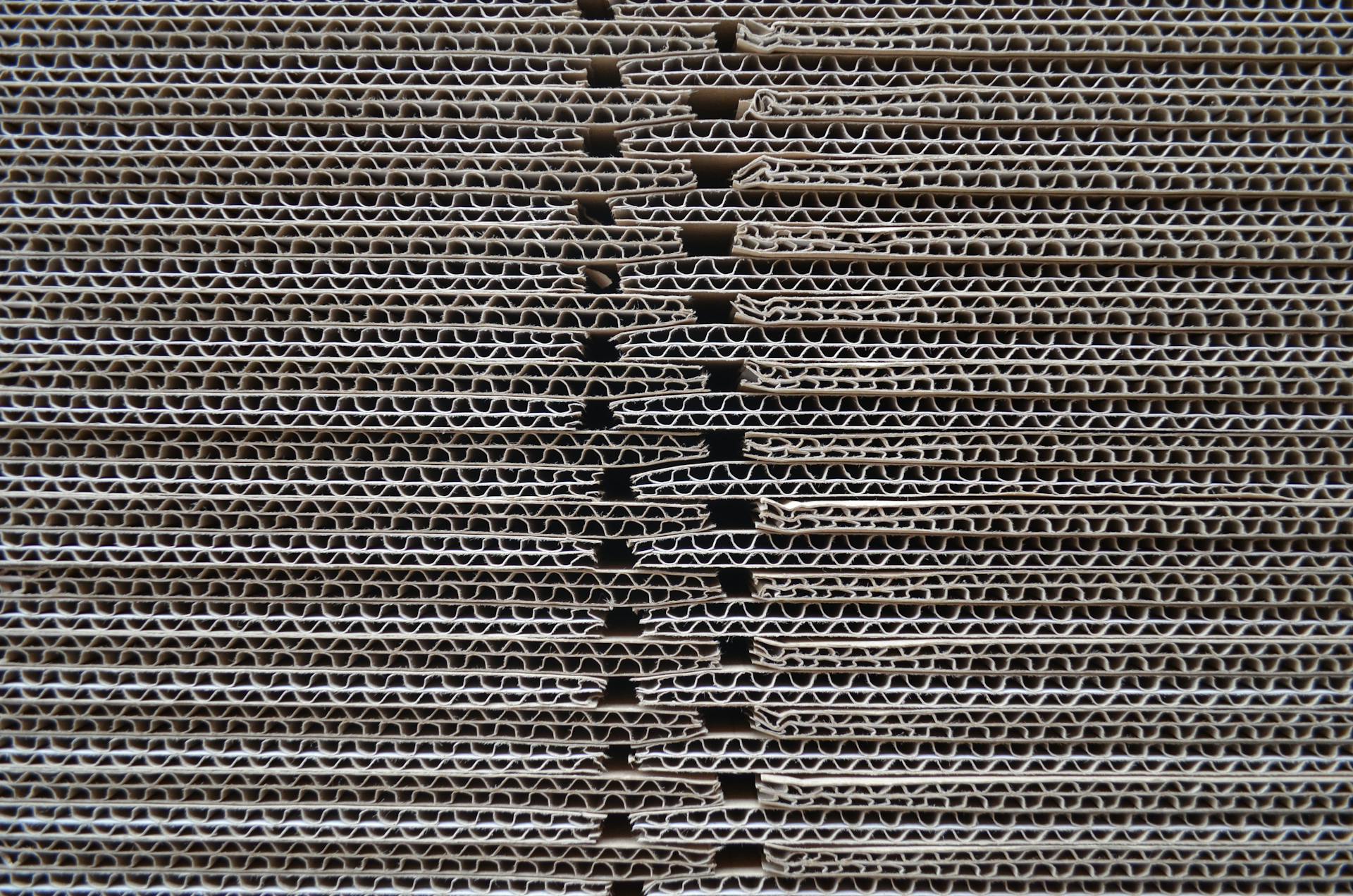

A corrugated box is a disposable container with three layers of material on its sides: an outside layer, an inner layer, and a middle layer.

The intermediate layer, which is fluted, is designed in stiff, wave-shaped arches that act as supports and cushions when weighted materials are placed inside.

To keep overall system costs under control, packaging engineers strive to satisfy a box's performance criteria. This involves aligning corrugated plastic or fiberboard design elements with the functional, processing, and end-use requirements.

In the US, corrugated boxes are used for the shipment of almost 95% of all goods, according to the National Center for Biotechnology Information.

Corrugated boxes vary in their qualities, applications, and strengths. To create corrugated packaging boxes, the corrugated sheets are cut and folded into a variety of sizes and shapes.

Here's a breakdown of the different types of corrugated boxes:

The specific logistics system in use determines a lot of the shipping risks, so it's essential to choose the right type of corrugated box for the job.

Segments in Industry Research

The corrugated packaging market is segmented into various types, including single wall board, single face board, double wall board, and triple wall board. Each type has its own unique characteristics and uses.

The single wall board is made up of one-part fluted paper and two materials glued on both sides to provide strength, making it a popular choice for packaging lightweight items.

The corrugated packaging market is also segmented by packaging type, including box, crates, trays, octabin, and pallet. The box is further divided into slotted box, folder box, telescope box, and cut box.

Here are the key segments covered in the corrugated packaging market:

- Product Type: Single wall board, single face board, double wall board, and triple wall board

- Packaging Type: Box, crates, trays, octabin, and pallet

- End-Use: Food & Beverage, Electrical & electronics, Home care products, Personal care products, E-commerce, Transportation & logistics, Healthcare

- Region: North America, Latin America, Europe, Asia Pacific, Middle East and Africa (MEA)

The corrugated packaging market is also segmented by wall type, including single wall Corrugated, Double wall Corrugated, and Triple-wall Corrugated.

Material Type

The material type in the global corrugated boxes market is a crucial aspect to consider. The linerboard segment held the largest share of the global corrugated boxes market in 2024.

Linerboard is a flat piece of material that makes up a corrugated sheet's upper and lower surfaces, serving as a sandwich for the medium or flutes. It offers a smooth surface for printing graphics, text, and product details on the exterior of corrugated boxes.

A linerboard is derived from the kraft paper making process, using woodfiber that offers strength properties. This makes it a vital component in ensuring the structural integrity and protective qualities of corrugated boxes.

The key players in the market are focused on expanding their manufacturing facilities for linerboard production, which is expected to drive the growth of the segment over the forecast period. For instance, Cascades launched a recycled linerboard production facility at Bear Island paper mill in Hanover County, Virginia, US in January 2024.

The medium segment is expected to progress at the fastest rate over the forecast period. This is because the kraft paper that is put in between the linerboards and shaped into arches, called medium, produces robust columns that can support a great deal of weight when a flat surface board is placed on top of them.

The flute patterns in linerboard vary across factors such as strength, durability, endurance, and thinness. Some common flute patterns include B-flute, C-flute, E-flute, and F-flute.

Here are some key characteristics of each flute type:

- B-flute: smaller flute profile, more flexible structural and graphic performance

- C-flute: bigger flute profile, superior cushioning and vertical compression strength

- E-flute: smaller flute profile, more flexible structural and graphic performance

- F-flute: smaller flute profile, more flexible structural and graphic performance

Market Challenges

The corrugated packaging market faces several challenges that impact its growth and demand. One major challenge is the increasing competition from alternative packaging materials, such as plastic and paperboard.

The rising cost of raw materials, particularly paper and pulp, is another significant challenge that affects the profitability of corrugated packaging manufacturers. This is evident in the increasing prices of corrugated packaging products.

The growing concern about sustainability and environmental impact is also a challenge for the corrugated packaging market. Consumers are increasingly seeking eco-friendly packaging options, which can be a threat to the traditional corrugated packaging market.

Raw Material Cost Competition

The competition from plastic packaging is a significant challenge in the corrugated boxes market.

Flexible plastic packaging is 40% less expensive overall compared to corrugated boxes.

Manufacturers and retailers can save shipping and warehousing costs by reducing the weight of the packaging, requiring a lot less space.

The cost for manufacturing the linerboard, flutes is higher as compared to the flexible plastic packaging.

Flexible plastic packaging results in a 50% decrease in landfill waste and a 62% reduction in greenhouse gas (GHG) emissions.

Challenges to the

Market Challenges can be overwhelming, but understanding the specific hurdles can help you prepare and overcome them.

One major challenge is the rise of new market entrants, which can disrupt established businesses and make it harder for them to stay competitive.

This is evident in the tech industry, where companies like Google and Amazon have revolutionized the way people shop and access information.

The increasing demand for sustainable products and services is another significant challenge, as businesses need to adapt to changing consumer preferences.

According to a recent survey, 75% of consumers are willing to pay more for sustainable products, making it a crucial aspect of business strategy.

The rapid pace of technological change is also a major challenge, requiring businesses to invest in new technologies and train their employees to keep up with the latest developments.

In the article section "The Impact of Technology", we saw how AI and automation are transforming industries and creating new opportunities.

Discover more: Sustainable Wine Packaging

However, not all businesses are equipped to handle the challenges of the digital age, and many struggle to keep up with the latest trends and technologies.

The increasing competition from low-cost producers in emerging markets is another challenge, as businesses need to find ways to compete with companies that can produce goods at a lower cost.

According to the article section "Global Market Trends", the global market is becoming increasingly interconnected, making it harder for businesses to maintain a competitive edge.

The shift towards e-commerce is also a major challenge, as businesses need to adapt to changing consumer behavior and find ways to reach customers online.

In the article section "The Rise of E-commerce", we saw how e-commerce is transforming the way people shop and access products and services.

Market Opportunities

The global corrugated boxes market is expected to hit USD 283.02 billion by 2034, expanding at a CAGR of 5.14% during the forecast period from 2025 to 2034.

This significant growth is largely driven by the increasing trend towards sustainable packaging. The global corrugated boxes market size reached USD 171.45 billion in 2024.

A key factor contributing to this growth is the industry's focus on eco-friendly packaging solutions. The corrugated boxes market is poised to capitalize on the demand for sustainable packaging options.

Market Players

The corrugated packaging market is dominated by a few key players who have established themselves as industry leaders. These companies include DS Smith Packaging Limited, Mondi Group, Georgia-Pacific LLC, Smurfit Kappa Group PLC, Westrock Company, Rengo Co., Ltd., Saica Group, Pratt Industries Inc., Oji Holdings Corporation, and Packaging Corporation of America, International Paper Company.

These market players have implemented various growth strategies to increase their market position, including expansion, new product development, mergers and acquisitions, and collaboration. This has helped them improve their product portfolio and geographical presence to meet the rising demand for corrugated packaging from emerging economies.

Some of the key companies in the market include International Paper, DS Smith, Smurfit Kappa, Rengo Co. Ltd, Mondi, Cascades Inc., and Packaging Corporation of America. This list of companies is not exhaustive, but it gives you an idea of the major players in the market.

Here is a list of some of the key companies in the corrugated packaging market:

- International Paper

- DS Smith

- Smurfit Kappa

- Rengo Co. Ltd

- Mondi

- Cascades Inc.

- Packaging Corporation of America

- Georgia-Pacific, LLC

- WestRock Company

- Nine Dragons Worldwide (China) Investment Group Co., Ltd.

- National Carton Factory (NCF)

- Australian Corrugated Packaging

- Visy

- GB Pack

- TGI Packaging Pvt. Ltd

- Trombini; NBM Pack

- Pretoria Box Manufacturers (Pty) Ltd

- Bohui Group

- Lee & Man Paper Manufacturing Ltd

- Shengli carton Equipment Manufacturing

- Dongguang Ruichang Carton Machinery

- EMBA Machinery

- Associated Industrial

- Mitsubishi Heavy Industries America

- Zemat Technology Group

- SUZHOU KOMAL MACHINERY

- MarquipWardUnited

- DING SHUNG MACHinery

- Zhongke Packaging Machinery

- Serpa Packaging Solutions

- T-ROC EQUIPMENT

- Box On Demand

- Fosber Group

- Shanghai PrintYoung International Industry

- BCS Corrugated

- Packsize International

- Valco Melton

- Acme Machinery

- SUN Automation Group (Langston)

- XINTIAN CARTON MACHINERY MANUFACTURING

- Natraj Industries

Global Opportunities & Competitive Landscape

The global corrugated boxes market is expected to reach USD 283.02 billion by 2034, growing at a CAGR of 5.14% from 2025 to 2034. This significant growth is largely driven by the increasing trend towards sustainable packaging.

Major corporations are investing heavily in portfolio development, R&D, and strategic alliances to increase their market reach. UFP Packaging, a subsidiary of UFP Industries, is a prime example of this strategy, as it acquired corrugated packaging manufacturer Titan Corrugated and its affiliate All Boxed Up in 2022.

To extend their market presence, top organizations are employing various growth strategies, including partnerships and collaborations, agreements, expansions, acquisitions and mergers, and new product launches. These efforts are crucial in a competitive market where companies must constantly adapt to stay ahead.

Here are some key growth strategies employed by major corporations in the corrugated boxes market:

- Portfolio development

- R&D

- Strategic alliances

- Partnerships and collaborations

- Agreements

- Expansions

- Acquisitions and mergers

- New product launches

Strategic Entry into the Global Economy

To gain a foothold in the global economy, market players are employing various strategies to expand their reach and increase their market share.

Major corporations like DS Smith Packaging Limited, Mondi Group, and Georgia-Pacific LLC are using expansion, new product development, mergers and acquisitions, and collaboration as key growth strategies.

These companies are focusing on improving their product portfolio and geographical presence to meet the rising demand for corrugated packaging from emerging economies.

In fact, the global corrugated boxes market size is projected to hit USD 283.02 billion by 2034, expanding at a CAGR of 5.14% during the forecast period.

To achieve this growth, market players are adopting inorganic strategies like partnership and collaboration to develop new paper-based corrugated boxes for food packaging.

For instance, Saica Group signed a collaboration with Mondelez International, Inc. to innovate and introduce new paper-based corrugate boxes targeted to multipacks-products for the biscuits, chocolate, and confectionery markets.

Here's a breakdown of the key players and their strategies:

These strategic moves are crucial for market players to increase their market reach and stay competitive in the global economy.

Players

The corrugated packaging market is dominated by a few key players who are constantly innovating and expanding their reach. These companies include DS Smith Packaging Limited, Mondi Group, and Georgia-Pacific LLC.

DS Smith Packaging Limited is one of the largest players in the market, with a strong presence in Europe. Mondi Group is another major player, known for its sustainable packaging solutions.

The market is highly competitive, with companies like Smurfit Kappa Group PLC and Westrock Company vying for market share. Rengo Co., Ltd. and Saica Group are also prominent players in the industry.

Here's a list of some of the leading manufacturers of corrugated packaging:

- International Paper

- DS Smith

- Smurfit Kappa

- Rengo Co. Ltd

- Mondi

- Cascades Inc.

- Packaging Corporation of America

- Georgia-Pacific, LLC

- WestRock Company

These companies are constantly evolving and expanding their product lines, with a focus on meeting the growing demand for corrugated packaging from emerging economies.

Market Forecast

The corrugated packaging market is expected to grow steadily over the next few years.

The global demand for corrugated packaging is projected to reach 27.6 million tons by 2025, up from 22.1 million tons in 2020. This represents a compound annual growth rate (CAGR) of 4.3% during the forecast period.

E-commerce is a significant driver of the corrugated packaging market, with the online retail industry expected to account for 15% of global sales by 2025.

The use of corrugated cardboard in e-commerce packaging is becoming increasingly popular due to its cost-effectiveness and sustainability.

In terms of geographic regions, the Asia-Pacific market is expected to be the largest contributor to the growth of the corrugated packaging market, driven by the rapid expansion of the e-commerce industry in countries such as China and India.

Market Insights

The corrugated packaging market is expected to reach $67.4 billion by 2025, driven by the growing demand for e-commerce packaging and the increasing use of corrugated packaging in the food and beverage industry.

The average global corrugated packaging production is around 40 million tons per year, with Asia Pacific being the largest producer, accounting for over 30% of the global production.

Corrugated packaging is widely used in the food and beverage industry, with applications in the packaging of snacks, beverages, and ready-to-eat meals.

In 2020, the global corrugated packaging market size was valued at $44.4 billion, with a CAGR of 5.4% from 2015 to 2020.

The use of corrugated packaging in the e-commerce industry is expected to drive growth in the market, with online shopping expected to account for 18% of global retail sales by 2025.

Market Competition

The market competition in the corrugated packaging industry is fierce, and it's not just about corrugated boxes anymore. Flexible plastic packaging is a major competitor, offering significant cost savings and environmental benefits.

Flexible plastic packaging is 40% less expensive overall, resulting in a 50% decrease in landfill waste and a 62% reduction in greenhouse gas (GHG) emissions. This makes it a tough sell for manufacturers and retailers who are looking for sustainable and cost-effective packaging options.

Major corporations are investing heavily in portfolio development, R&D, and strategic alliances to increase their market reach. For example, UFP Packaging acquired corrugated packaging manufacturer Titan Corrugated and its affiliate All Boxed Up in 2022.

Here are some notable market strategies employed by top organizations:

- Portfolio development

- R&D

- Strategic alliances

- Partnerships and collaborations

- Agreements

- Expansions

- Acquisitions and mergers

- New product launches

These strategies are helping top organizations extend their market presence and stay ahead of the competition.

Sources

- https://www.towardspackaging.com/insights/corrugated-boxes-market-sizing

- https://www.persistencemarketresearch.com/market-research/corrugated-packaging-market.asp

- https://exactitudeconsultancy.com/reports/3152/corrugated-packaging-market

- https://cbscompany.com/blog/corrugated-packaging-market-on-track-for-growth/

- https://www.skyquestt.com/report/corrugated-packaging-market

Featured Images: pexels.com