To ensure smooth customs clearance, carriers must receive the right documents from shippers. The Commercial Invoice is a crucial document that provides detailed information about the goods being transported, including their value, weight, and description.

A Bill of Lading is another essential document that serves as a contract between the shipper and the carrier. It outlines the terms of the shipment, including the type of cargo, its weight, and the agreed-upon price.

The Certificate of Origin is a document that confirms the country of origin for the goods being imported. This document is required by many countries to determine the applicable duties and taxes.

Carriers must also receive a Packing List, which details the contents of the shipment, including the number and type of packages.

Worth a look: Shipment Completed Customs Clearance Process.

Customs Clearance Process

The customs clearance process can be complex, but understanding the basic steps can make a big difference.

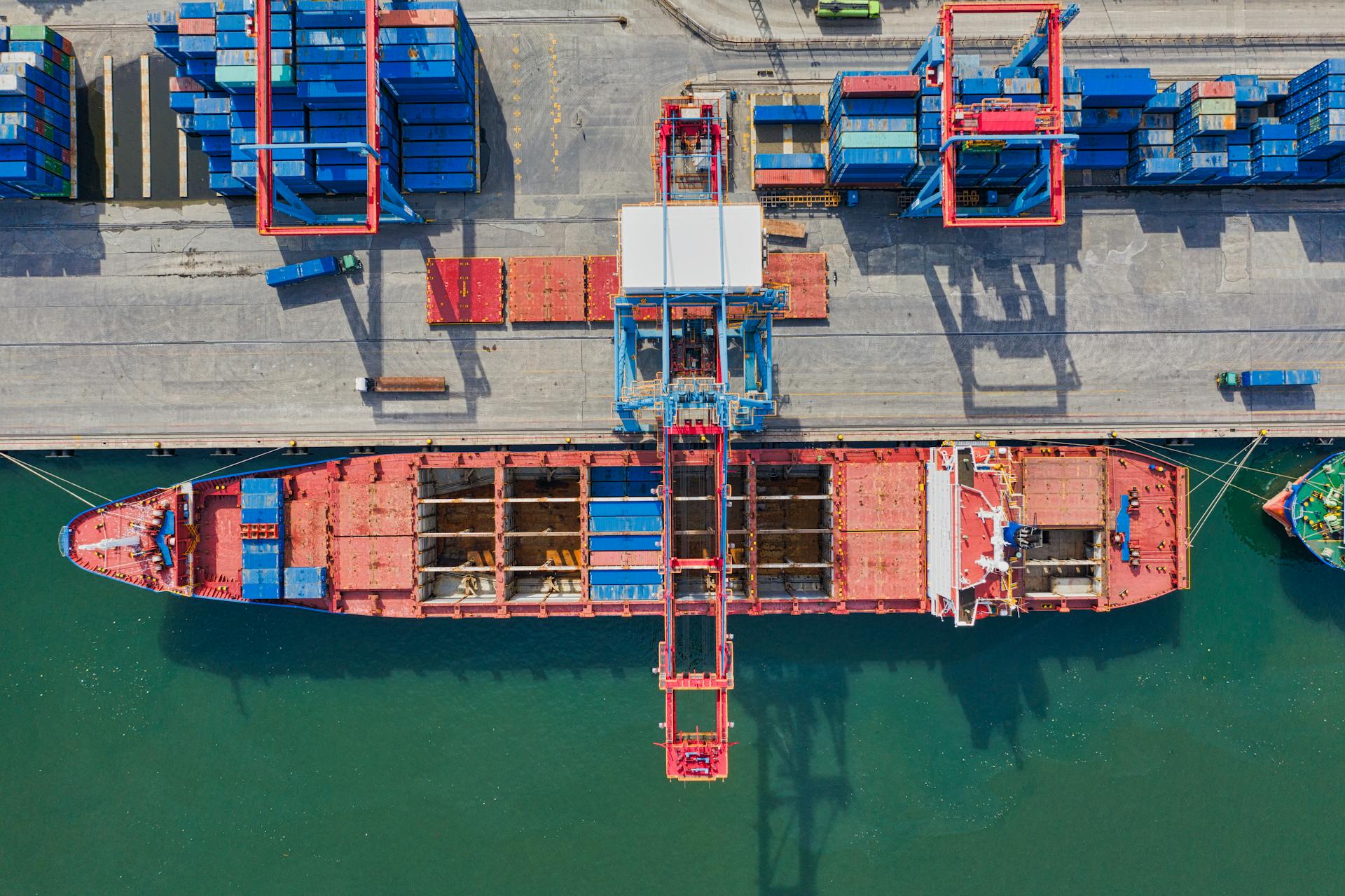

The Import General Manifest (IGM) is the first step, where the carrier electronically files a detailed document listing all the cargo on board the vessel.

Before the vessel arrives, customs reviews the manifest and verifies documents, granting entry and assigning an IGM number.

The vessel's cargo remains in the custody of an approved custodian until customs clearance is complete, and a note must be included in the manifest to unload the goods.

A Bill of Entry is a mandatory document that importers must fill out and sign, submitted along with other paperwork for customs inspection and review.

Customs verifies that the imported items follow all the rules and regulations, and that the goods are properly declared.

Once cleared by customs, importers can apply for tax credits on the goods if they qualify.

The Bill of Entry is a legally binding document that must be filled out and signed by the importer, CHA, or carrier.

After submitting the Bill of Entry and other required paperwork, goods are evaluated and examined by relevant authorities.

Import Documents

A commercial invoice is the primary document for valuation and classification of goods, serving as a receipt and contract for the shipment. It must include detailed descriptions of the items, their origin, and their total value.

The commercial invoice is typically prepared by the seller and submitted by the importer. You'll need to provide a detailed description of the goods, including their material composition, intended use, grades, quality, and part numbers.

A packing list is a critical document that complements the commercial invoice by providing a detailed breakdown of the shipment's contents. It's essential for customs inspections, as it allows agents to verify the items against the invoice.

The packing list should accurately reflect the number of packages, weights, and any special handling instructions. It's also used to generate bills of lading for your shipment.

A bill of lading (BOL) is a legally binding document issued by the carrier to the shipper, detailing the shipment's specifics. It serves multiple purposes: as a receipt, a document of title, and a contract for carriage.

The BOL must be signed by all parties involved in the shipping process. You'll need to ensure that the BOL accurately reflects the shipment's details, including the shipper and consignee information, description of goods, and terms of transportation.

An air waybill (AWB) is similar to the BOL but specifically for air shipments. It allows for tracking and serves as a receipt for the goods.

You'll need to provide the following information on the commercial invoice:

- Exporter/Shipper's Name and Address

- Seller's Name and Address (if different from Exporter/Shipper)

- Consignee's Name and Address

- Buyer's Name and Address (if different from Consignee)

- Invoice Number

- Invoice Date

- Country of Origin

- Detailed Description of Goods

- Quantity of Goods

- Weight and Measurements of Goods

- Value of Goods

- Total Invoice Value

- Currency in Which Transactions are Done

- Terms of Sale (Incoterms)

- HS Code (Harmonized System Code)

- Origin of Shipment and Port of Entry

- All Charges Incurred

Here's a summary of the import documents you'll need:

Remember, each document has specific requirements, so make sure to review the details carefully to avoid any issues during customs clearance.

BoL

A bill of lading, or BoL, is a crucial document for shipping goods to and from the US. It's a negotiable document that contains all essential details of the shipper, receiver, goods, and shipping terms.

A BoL is signed by the carrier, shipper, and receiver or their respective agents. This document is so important that it's considered the single most crucial piece of paper for each exporter.

The BoL is useful in cases of theft, as it provides specifics about the buyer and seller, as well as the product description, amount, and weight. This information helps ensure the products are transported without incident.

To ensure a smooth customs clearance process, exporters must acquire a correct and full bill of lading from the shipping line/freight forwarder and then forward it to the importer.

You might like: 2 Inch Receiver Bike Carrier

Customs Forms and Documents

Customs forms and documents are a crucial part of the customs clearance process. Properly prepared documents can save time, reduce stress, and help avoid costly penalties.

A commercial invoice is the primary document for valuation and classification of goods, and it must include detailed product information and values. It's a mandatory document for all types of imports and is used for customs declaration by the US Customs and Border Protection (CBP).

A packing list provides a detailed account of the shipment's contents, including the number of packages, dimensions, weights, and descriptions of goods. It's essential for all types of imports.

A bill of lading (BOL) is a legally binding contract for ocean freight, while an air waybill (AWB) is a non-negotiable document for air freight. The BOL must be signed by all parties, while the AWB serves as a receipt for air shipments.

The importer security filing (ISF) is required for ocean shipments only and must be filed 24 hours before departure. It includes detailed cargo information.

If this caught your attention, see: Customs Handling of Import & Export Freight

An arrival notice notifies the consignee that their shipment has arrived, and it's essential for pickup arrangements. A delivery order (D/O) authorizes the release of goods post-clearance and must be presented to the carrier.

Here's a list of essential documents required for customs clearance:

Don't forget that an accurate HS code is a must in the commercial invoice, as it helps customs authorities identify the category of goods and assess duties.

Customs Regulations and Requirements

Customs regulations and requirements can be a daunting task, but understanding the necessary documentation is crucial for ensuring a smooth and efficient process.

The U.S. customs clearance process requires specific documents, such as the Commercial Invoice, which serves as the primary document for valuation and classification of goods, including a description, quantity, value, country of origin, and buyer/seller details.

A Packing List is also required, providing a detailed list of the contents of the shipment, including the number of packages, dimensions, weights, and descriptions of goods.

The Bill of Lading (BOL) is a legal document issued by the carrier, serving as a receipt and contract for the shipment, including shipper and consignee information, description of goods, and terms of transportation.

For air shipments, an Air Waybill (AWB) is required, which includes information about the airline, shipment details, and tracking information.

The Importer Security Filing (ISF) is required for ocean shipments, to screen high-risk cargo, including information about the importer, consignee, goods description, and manufacturer.

Upon arrival, an Arrival Notice is sent to the consignee, notifying them that their shipment has arrived, including details of the shipment's arrival, description of goods, and any fees due for pickup.

The Delivery Order (D/O) is also required, authorizing the release of cargo after customs clearance, which must be presented to the carrier, detailing the shipment and pick-up instructions.

Some countries, like Australia, require a Quarantine Packing Declaration, which is a must for cargo into that country.

Here is a summary of the essential documents required for customs clearance:

Document Differences and Clarifications

A commercial invoice is a critical document that provides Customs and Border Protection (CBP) with necessary information to assess the value and admissibility of imported goods. It must include detailed descriptions of the items, their origin, and their total value.

You'll typically need three copies of commercial invoices for the US import/export process. One copy is for the country you are exporting from, another for the country you are importing to, and the last one is placed inside the package for the recipient.

The commercial invoice serves as the primary document for valuation and classification of goods, making it essential for customs clearance. It must include details such as description, quantity, value, country of origin, and buyer/seller details.

Here are the essential documents required for customs clearance:

Differences in Import Documentation

Differences in import documentation can be confusing, but understanding the various types of documents can make a big difference in the importing process.

A Commercial Invoice is required for all types of imports and must include detailed product information and values.

A Packing List is also used for all types of imports and provides a detailed account of the shipment's contents.

There are different documents for ocean and air freight, the Bill of Lading (BOL) is used for ocean freight and is a legally binding contract that must be signed by all parties.

The Air Waybill (AWB) is used for air freight and is a non-negotiable document that serves as a receipt for air shipments.

Ocean shipments require an Importer Security Filing (ISF) which must be filed 24 hours before departure and includes detailed cargo information.

An Arrival Notice is used for all types of imports and is not a release document but is essential for pickup arrangements.

A Delivery Order (D/O) is also used for all types of imports and authorizes the release of goods post-clearance.

Here's a summary of the different types of import documentation:

Difference Between an Invoice

A commercial invoice is a must-have for all types of imports, and it needs to include detailed product information and values.

You'll typically need three copies of a commercial invoice for the US import/export process: one for the exporting country, one for the importing country, and one for the recipient/consignee.

A commercial invoice is issued before the shipment leaves the consignor, whereas a bill of lading is issued when the freight is loaded onto the vessel before transit.

Here's a quick rundown of the differences between a commercial invoice and a bill of lading:

A ProForma invoice is similar to a purchase order and provides details of the product being sold, but it's essential to generate it before the sales transaction is completed.

In contrast, a commercial invoice does not show ownership or title of the goods sold, which is why a bill of lading is necessary for ocean freight shipments.

Sources

- https://www.customproc.com/carrier-received-documents-required-for-customs-clearance/

- https://www.maersk.com/logistics-explained/shipping-documentation/2023/09/27/shipping-documents-us

- https://cargofromchina.com/shipping-documents/

- https://www.shiprocket.in/blog/documents-required-during-customs-clearance/

- https://www.shipmoto.com/shipping-news/documents-required-for-import-export

Featured Images: pexels.com