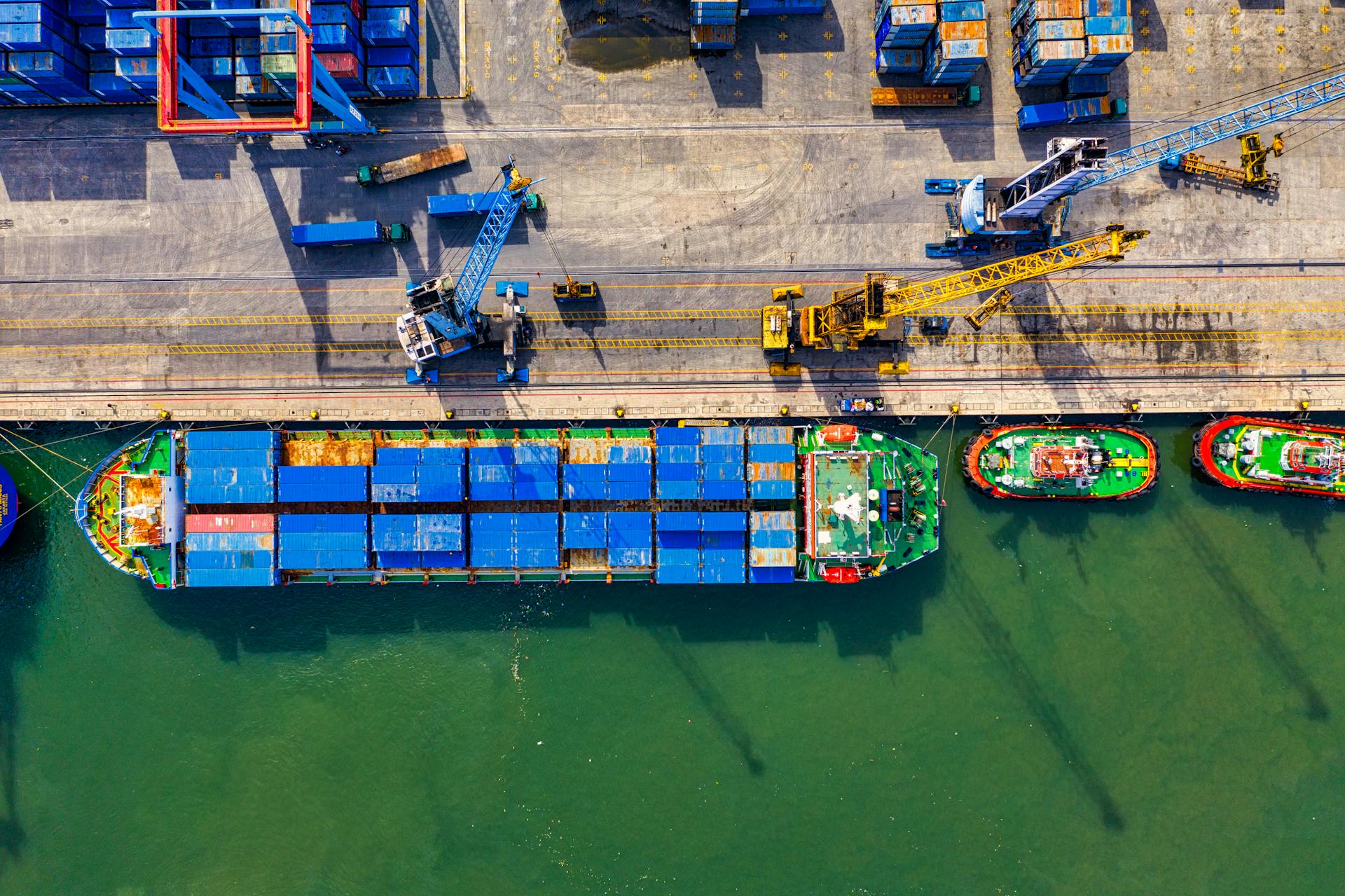

In Florida, cargo insurance is a must-have for freight shipping companies, as it protects against financial losses due to damaged or lost goods.

Cargo insurance in Florida typically covers goods in transit, including those being transported by truck, train, or ship. The cost of cargo insurance varies depending on the value of the goods, the mode of transportation, and the level of coverage.

For example, if a shipment of electronics valued at $100,000 is damaged in transit, the insurance payout could be up to $100,000, depending on the policy. This can help the shipping company recover from the loss and avoid financial ruin.

Florida law requires shipping companies to have a certain level of liability insurance, but cargo insurance is not mandatory. However, it's highly recommended to protect against unforeseen circumstances.

Check this out: 100 000 Cargo Insurance

Cargo Insurance Basics

Cargo insurance is a type of insurance that protects your business from financial loss if your trucks are involved in a serious collision.

The backbone of our economy relies on moving products from one place to another, and without cargo insurance, your business could be at risk.

To get the job done safely and on time, you're constantly invested in making your business the best it can be, from ensuring loads are packed securely to recruiting safe drivers.

Cargo insurance can help make sure your efforts are protected, and that if something goes wrong, you'll be able to continue operating.

Your business is at risk if any of your trucks is involved in a serious collision, but Allied Insurance Group can help protect you.

Florida Cargo Insurance Requirements

In Florida, cargo insurance is a must-have for truck drivers transporting commodities. It safeguards against potential loss or damage.

Intrastate household goods transporters in Florida have distinct cargo insurance prerequisites set by the state. These requirements vary depending on contracts and broker stipulations.

For interstate commerce, federal guidelines may come into play, especially for specific categories of goods.

Florida Requirements

Florida has its own set of cargo insurance requirements for intrastate household goods transporters. These requirements are distinct from federal guidelines, which may apply to interstate commerce.

The state of Florida mandates auto liability insurance for truck drivers, which protects against potential bodily injury and property damage claims. This insurance is crucial for safeguarding victims of accidents involving trucks and protecting truck drivers and their businesses from financial ruin.

Cargo insurance is a pivotal coverage type for truck drivers in Florida, especially considering the diverse range of goods transported across the state. This insurance protects against potential losses or damages to the freight or commodities that drivers are transporting.

Florida's unique terrain and weather present their own set of challenges and uncertainties for truck drivers. Ensuring that they have comprehensive insurance, including cargo insurance, is paramount.

Here are the key Florida cargo insurance requirements:

- Intrastate household goods transporters must meet distinct cargo insurance prerequisites set by the state.

- Truck drivers are mandated to carry auto liability insurance, which protects against potential bodily injury and property damage claims.

- Cargo insurance is a crucial coverage type for truck drivers in Florida, protecting against potential losses or damages to the freight or commodities.

Having the right cargo insurance in place can give both shippers and truckers peace of mind, knowing that the value of the cargo is safeguarded against potential mishaps.

Unmatched Across Florida

Florida's diverse roadways, from the Panhandle to the Keys, require specialized truck insurance coverage.

The cost of truck insurance in Florida is influenced by factors such as the truck's make and model, cargo type, and driving history.

You can get competitive rates without compromising on coverage by teaming up with premier carriers within Florida.

Our expansive network covers every corner of the Sunshine State, providing localized expertise wherever your routes take you.

Whether you're navigating Miami's bustling streets or transporting goods through historic St. Augustine, we've got you covered.

You can benefit from our unmatched truck insurance across Florida, regardless of your specific route or cargo type.

Explore further: Cargo Insurance for Box Truck

Types of Cargo Insurance

Cargo insurance in Florida is a must-have for truck drivers, and it comes in various forms. One type is Motor Truck Cargo Insurance, which protects goods and property being transported by a motor carrier.

This type of insurance is required for professional trucking companies to ensure their clients' valuable products are safe. You don't know what the road might bring, and cargo insurance will cover products damaged during an accident.

For more insights, see: Motor Cargo

Intrastate household goods transporters in Florida have distinct cargo insurance prerequisites set by the state. Federal guidelines might also become relevant if you engage in interstate commerce from or through the Sunshine State.

Cargo insurance will cover stolen goods, and although modern trucks have excellent security systems, commercial truck drivers are bound to make human mistakes.

Understanding Coverage

Cargo insurance in Florida typically covers most cargo shipped under a proper bill of lading, but there are some exclusions you should be aware of.

Major exclusions include alcohol, tobacco, some medicines, and illegal drugs. Currency and valuables, especially art, jewelry, coins, and cash, are also excluded. Dangerous items like acids, explosives, and radioactive materials are not covered either. Living creatures and company-owned items are also excluded from standard cargo insurance.

If you plan to ship any of these excluded items, you may want to consider alternative insurance policies.

Liability Coverage

Liability coverage is a must for any trucking operation in Florida. The required coverage varies depending on the type of cargo being transported.

Readers also liked: Explain Common Carrier Cargo Insurance Coverage

For household goods, the required liability insurance is $300,000. This is a significant amount, and it's essential to ensure you have adequate coverage to protect yourself and your business.

General freight requires a higher liability coverage of $500,000. Oil transport necessitates an even higher coverage of $1,000,000, while hazardous materials demand a significantly higher coverage of $5,000,000.

Different types of trucks have unique insurance requirements. Here's a breakdown of the liability coverage needed for various types of trucks:

Intrastate household goods movers and interstate contract carriers have a cargo insurance requirement of $5,000 per vehicle and $10,000 per catastrophic event.

Discover more: Per Load Cargo Insurance

Freight Shipping Coverage

Freight shipping coverage is a crucial aspect of any hauling company's defense against losses. There were over 400,000 collisions involving large trucks in 2014, which translates to over 1100 collisions every single day.

Collisions are a major risk, and it's not just the trucks that are at fault - in many cases, it's not the driver's fault either. The majority of incidents occur due to circumstances beyond the driver's control.

Theft is another significant problem in the industry, with average losses approaching a quarter-million dollars per incident. This highlights the importance of having adequate insurance coverage to mitigate such losses.

Larger trucking companies often require more insurance to cover multiple vehicles, such as thefts from multiple trucks parked in one place. Even smaller companies are at risk, making cargo insurance and freight insurance essential for their protection.

Covered and Excluded

Understanding what's covered and excluded from cargo insurance is crucial to ensure you're protected against potential losses. Most cargo shipped under a proper bill of lading will be covered by your cargo insurance.

You'll want to know that major exclusions include alcohol, tobacco, some medicines, and any illegal drugs. Currency and valuables, especially art, jewelry, coins, and cash, are also excluded.

Living creatures are not covered by cargo insurance, and anything owned by your company is also excluded. This means you'll need to explore alternative policies or coverage options if you plan to ship these types of items.

Here are some specific exclusions to keep in mind:

- Alcohol, Tobacco, some medicines, and any illegal drugs

- Currency and Valuables (especially art, jewelry, coins, and cash)

- Items considered dangerous (acids, explosives, or radioactive items, including some fireworks and other celebratory products)

- Living creatures

- Anything owned by your company

Frequently Asked Questions

How much is $100,000 cargo insurance?

$100,000 Motor Truck Cargo insurance costs between $500 and $4,000 per year, depending on cargo and freight specifics

Is cargo insurance worth it?

Yes, cargo insurance is a valuable investment for businesses, protecting against unforeseen risks and disruptions that can impact operations and profitability. It provides peace of mind and financial security for companies that rely on transportation and logistics.

What is not covered in cargo insurance?

Cargo insurance typically excludes losses caused by intentional misconduct, wear and tear, ordinary leakage, and market-related issues. Review your policy to understand what's specifically excluded from coverage.

Sources

- https://alliedinsgroup.net/business-insurance/industries/cargo-insurance-and-freight-insurance/

- https://www.tjocargo.com/services.html

- https://simplexgroup.net/florida/commercial-trucking-insurance/

- https://insurancehub.com/transportation-insurance/commercial-truck-insurance-florida-2/

- https://alliedinsgroup.net/business-insurance/cargo-insurance/

Featured Images: pexels.com