Brazil's last mile delivery market is a rapidly growing industry, driven by the country's e-commerce boom. The market is expected to reach $4.3 billion by 2025, growing at a CAGR of 17.5%.

The rise of e-commerce in Brazil is largely due to the increasing use of digital payment methods, with 70% of online transactions now made using credit or debit cards. Online shopping is particularly popular among Brazil's younger population, with 80% of internet users aged 18-24 making online purchases.

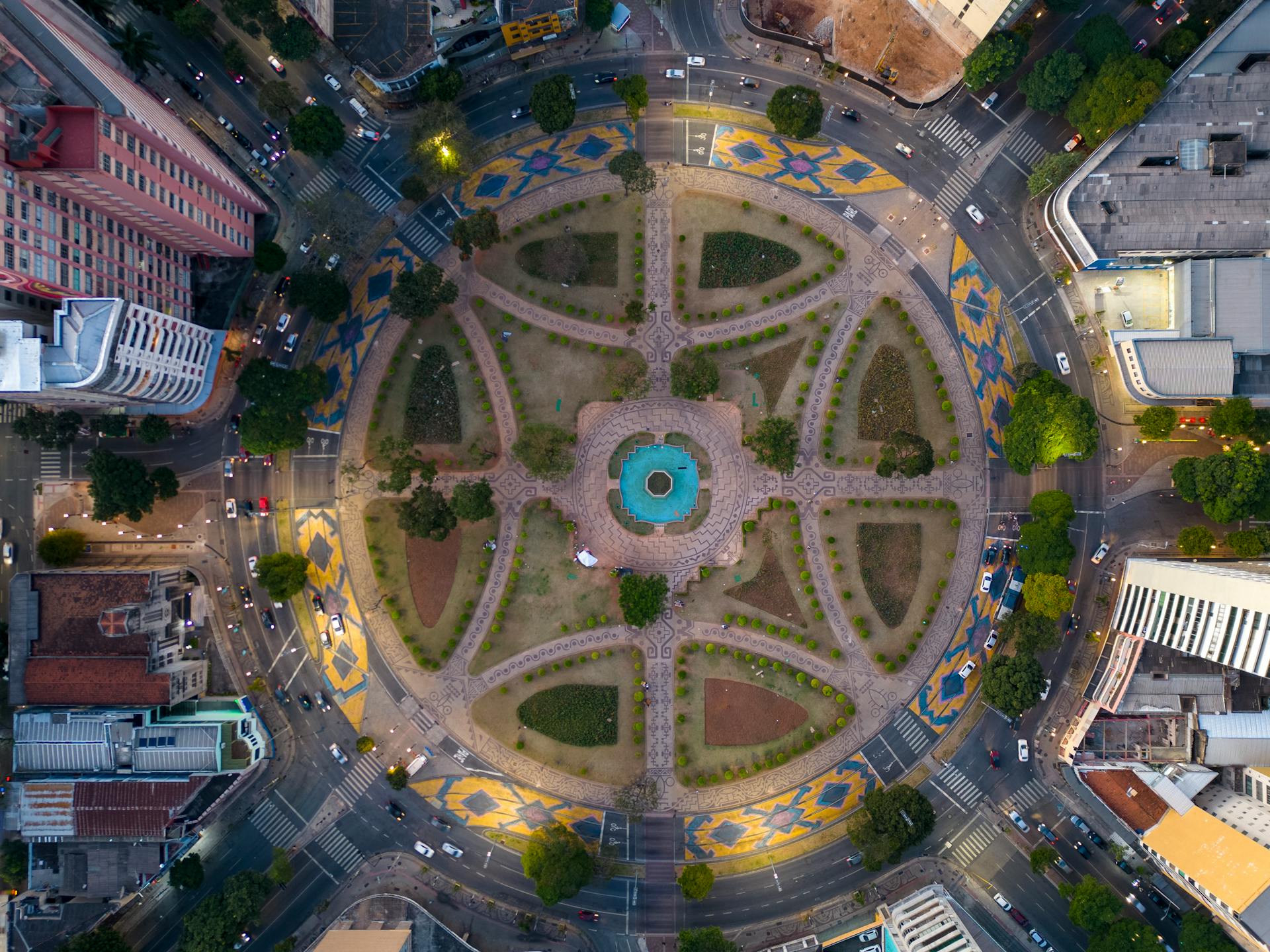

Brazil's urban population is also a key driver of the last mile delivery market, with 85% of the population living in cities. This concentration of people and demand is driving the growth of urban logistics and last mile delivery services.

A unique perspective: Ports of Brazil

Market Analysis

The Brazil last-mile delivery market is experiencing significant growth, driven by the increasing demand for e-commerce services. Brazil's retail e-commerce grew to USD 34.5 billion in 2023 from USD 12.25 Billion in 2018.

For more insights, see: Fortaleza Airport Brazil

As urbanization accelerates, consumers expect faster and more convenient delivery options. This shift in consumer behavior is driving companies to adopt innovative delivery solutions, such as same-day or next-day delivery services. The average order value in Brazil increased to 470 from 435 reais in the same period.

Logistics companies are enhancing their last-mile capabilities to meet these heightened expectations and remain competitive in the market. DHL Supply Chain launched a new service called DHL Fulfillment Network (DFN) in June 2023, which provides access to the company's e-commerce infrastructure in Brazil.

For another approach, see: Last Day to Order for Christmas Delivery

Brazil Last-Mile Delivery Market Segmentation

Brazil Last-Mile Delivery Market Segmentation is a crucial aspect of the market, and it's segmented based on several key factors.

The market is categorized into delivery mode, application, destination, service type, vehicle type, and mode of operation. This provides a comprehensive understanding of the market's dynamics.

Regular delivery and same-day or express delivery are the two primary delivery modes in the market. This is driven by the increasing demand for fast and convenient delivery options.

Take a look at this: B Pallets

E-commerce, retail and FMCG, healthcare, mails and packages, and others are the key applications of the market. This is fueled by the growing e-commerce industry in Brazil.

Domestic and international are the two primary destinations in the market. This is driven by the increasing trade and commerce between Brazil and other countries.

Business-to-business (B2B), business-to-consumer (B2C), and customer-to-customer (C2C) are the key service types in the market. This is driven by the increasing demand for efficient and effective logistics services.

Motorcycle, LCV, HCV, and drones are the primary vehicle types in the market. This is driven by the increasing adoption of technology and innovation in the logistics industry.

Non-autonomous and autonomous are the two primary modes of operation in the market. This is driven by the increasing demand for efficient and effective logistics services.

The market is also segmented by region, with the Southeast, South, Northeast, North, and Central-West being the major regional markets.

Here is a breakdown of the regional markets:

- Southeast

- South

- Northeast

- North

- Central-West

Key Highlights

The market is expected to grow at a CAGR of 12.5% from 2023 to 2028.

According to industry experts, the growth will be driven by increasing demand for digital transformation and cloud computing.

The Asia-Pacific region is expected to be the fastest-growing market, with a CAGR of 15.1% during the forecast period.

Growing adoption of e-commerce and online shopping is also expected to boost the market.

By 2025, the market is expected to reach a size of $1.2 trillion.

Competitive Landscape

The competitive landscape of the Brazil last mile delivery market is quite complex. According to the market research report, the market structure of the Brazil last mile delivery market is dominated by a few key players.

These key players have positioned themselves strategically to gain a competitive edge. Top winning strategies employed by these companies include investing in technology and expanding their delivery networks.

A competitive dashboard has been provided in the report, giving a visual representation of the market share and positioning of each company. This dashboard is a valuable tool for businesses looking to enter the market or expand their operations.

Detailed profiles of all major companies operating in the Brazil last mile delivery market have been included in the report, providing insights into their business models, strengths, and weaknesses.

Solutions and Innovations

The Brazilian last mile delivery market is rapidly evolving, driven by innovative solutions and technological advancements.

E-commerce growth in Brazil is expected to reach 15% by 2025, creating a significant demand for efficient last mile delivery services.

Companies are turning to digital platforms to streamline their delivery operations, with 70% of Brazilian e-commerce companies using digital platforms for last mile delivery.

The use of drones for last mile delivery is gaining traction in Brazil, with companies like Azul and AB InBev testing drone-based delivery services.

Brazil's vast geography and urbanization are driving the adoption of electric and hybrid vehicles for last mile delivery, with companies like Loggi and Rappi investing in electric fleets.

Investments in last mile delivery infrastructure are also on the rise, with companies like Uber and DHL opening new logistics hubs and sorting centers in major Brazilian cities.

Additional reading: International Distribution Services

Expert Insights

Brazil's vast size and diverse geography pose unique challenges for delivery companies, with the country's extensive road network often poorly maintained.

The growth of e-commerce in Brazil is driving demand for convenient and fast delivery options, with consumers expecting their purchases to be delivered quickly and efficiently.

Brazilian consumers are increasingly turning to online shopping, with e-commerce sales growing at a double-digit rate each year.

To meet this demand, retailers are investing in innovative solutions such as drone and autonomous vehicle delivery, which not only offer faster delivery times but also reduce delivery costs.

The country's high crime rates have led to security concerns, with delivery companies having to implement additional security measures to protect their drivers and packages.

Brazil's economic recovery has been uneven, with income inequality remaining a significant issue, making it essential for delivery companies to target lower-income customers with affordable delivery options.

Retailers are also investing in last-mile delivery solutions such as micro-fulfillment centers and locker pickup options to improve delivery speed and convenience.

If this caught your attention, see: Last Mile Transportation Solutions

Sources

- https://www.imarcgroup.com/brazil-last-mile-delivery-market

- https://jamaica-gleaner.com/article/business/20210911/last-mile-delivery-solution-brazilian-favela-born-pandemic

- https://www.statista.com/outlook/emo/online-food-delivery/grocery-delivery/retail-delivery/brazil

- https://www.6wresearch.com/industry-report/brazil-first-and-last-mile-delivery-market

- https://www.fmlogistic.com.br/en/solutions/transport-solutions/last-mile-delivery-solutions/

Featured Images: pexels.com